Bitcoin reached a new all-time high on Sunday, topping $125,500 for the first time in history. The move was driven by a combination of factors, including a surge in institutional interest and Bitcoin’s growing status as a hedge against various macroeconomic risks.

It’s currently trading at $123,500, having dipped slightly after reaching its peak yesterday. As such, many traders are seeking Bitcoin price predictions to gauge whether the bullish trend will persist and, if so, how far it may extend. JP Morgan recently stoked excitement by floating a year-end target of $165,000.

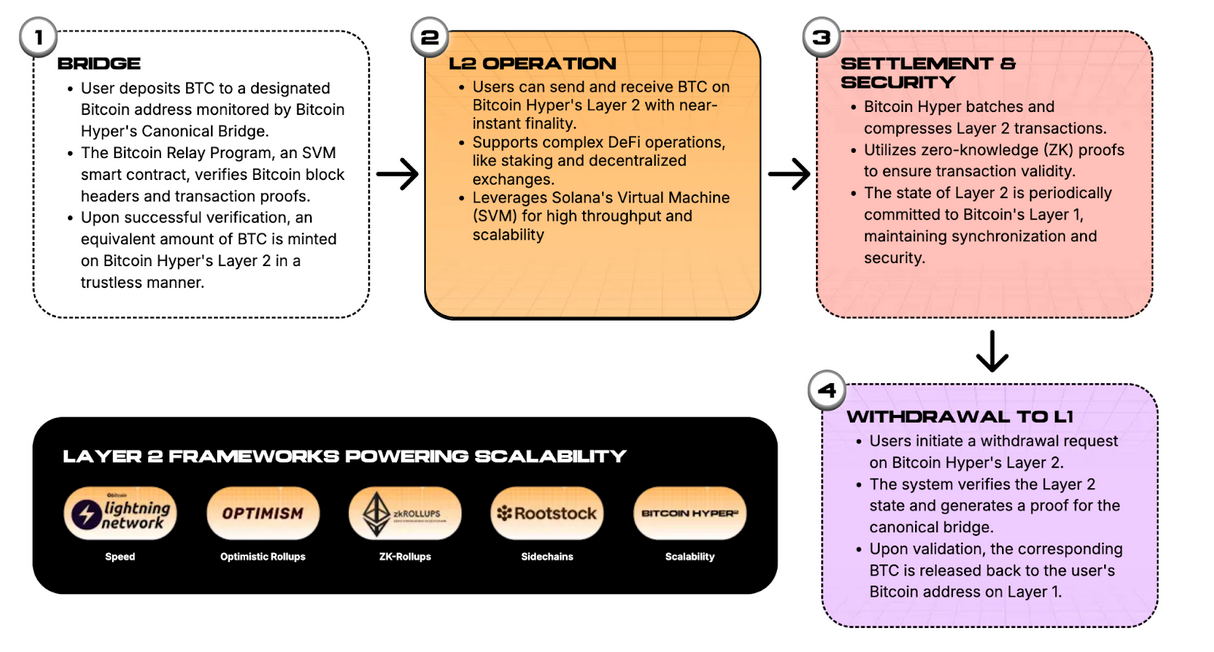

This creates a promising outlook for not only the future of Bitcoin, but also for ecosystem tokens. One project that has seen notable traction this week is a new presale called Bitcoin Hyper, which is developing the world’s first ZK-rollup-based Bitcoin Layer 2 blockchain.

Its presale shows considerable demand with over $21 million raised. So, the question becomes: Is this a better opportunity than buying Bitcoin itself? Let’s explore Bitcoin’s current setup, what JP Morgan anticipates, and how this could affect Bitcoin Hyper.

Bitcoin’s Strongest Q4 Setup Ever?

Q4 is historically Bitcoin’s strongest fiscal quarter, averaging a 79% gain, according to Coinglass data. However, this Q4 seems to have an exceptionally bullish setup.

It all begins with ETF demand. Bitcoin ETFs recorded the second-highest week of inflows last week, attracting $3.24 billion in new capital. This indicates that institutional players are optimistic about the upcoming outlook and expect a surge.

Other bullish catalysts include the anticipated interest rate cuts in the October and December FOMC meetings, along with regulatory tailwinds from the Crypto Market Structure Bill, which is expected to be approved this quarter, providing greater regulatory clarity and potentially attracting more institutional capital.

Analyst Cas Abbe also emphasized another key point: the stablecoin market capitalization is at a record high of $309 billion. Abbe says a portion of this could rotate into risk-on tokens and take the market to “another level.”

And then there’s stablecoins.

Supply is now at a record $309B.

That’s over 8% of total crypto market cap just sitting as cash.Even if only 10% of that rotates into BTC and alts, that’s more than $30B of buying power.

Enough to move markets to another level.

— Cas Abbé (@cas_abbe) October 5, 2025

But here’s where it gets really interesting. Bitcoin appears to finally be realizing its primary intent as a hedge against macroeconomic risk. Abbe underlined that it rallied on the recent partial US government shutdown, signifying that “political dysfunction in the U.S. may actually send more people into Bitcoin.”

Bitcoin’s safe-haven properties are also why JP Morgan predicts it could reach $165,000 by the end of 2025. Let’s take a closer look at its forecast.

JP Morgan Eyes $165K BTC on “Debasement Trade” Narrative

Analysts from JPMorgan, a leading banking institution, forecast that Bitcoin could reach $165,000 when adjusting for volatility relative to gold. Under the guidance of Nikolaos Panigirtzoglou, their team developed a model that found Bitcoin would need to grow by 42% to match private gold holdings, taking into account risk factors.

This prediction is rooted in the idea that both Bitcoin and gold function as safeguards against fiat currency devaluation, which is driven by inflation and declining purchasing power. Both assets hit new all-time highs in the past 48 hours, underscoring their correlation.

GOLD JUST HIT A NEW ATH OF $3,915

BITCOIN AND ETH WILL FOLLOW 🚀 pic.twitter.com/Ki6yggOfbB

— Ash Crypto (@Ashcryptoreal) October 6, 2025

Furthermore, Bitcoin’s role as a hedge against currency debasement enhances the prospects for ecosystem projects such as Bitcoin Hyper. As Bitcoin liquidity increases, so does demand for related ecosystem plays.

Bitcoin Hyper aims to capitalize on this trend by addressing critical issues, such as slow transaction speeds and limited features – reasons some analysts believe HYPER’s future returns could significantly surpass those of Bitcoin itself.

Bitcoin Hyper Tipped for 100x as Presale Raise Nears $22M

The Bitcoin Hyper presale momentum is skyrocketing as the Bitcoin price surges. On Friday, the asset experienced a record-breaking influx of over $1 million worth of buys, contributing to its total raise that sits well above $21 million at press time.

For a new project that has yet to list on exchanges or have a live product, inflows of this magnitude are truly unprecedented. This not only indicates that sophisticated investors are backing HYPER, but it also sets an optimistic tone for when the project launches on exchanges.

Bitcoin Hyper is developing a Layer 2 blockchain, aiming to transform Bitcoin from a primarily store-of-value Layer 1 into a vibrant ecosystem where users can trade, earn yields, hold meme coins, and more.

Built using Solana Virtual Machine tools and ZK-rollups, Bitcoin Hyper can process thousands of transactions per second while upholding Bitcoin’s guarantees of immutability and neutrality. Imagine an ecosystem that combines Bitcoin’s security and inflation protection with the utility of a next-generation blockchain – that’s what Bitcoin Hyper aims to create.

Consequently, analysts see massive potential for HYPER, with 99Bitcoins recently naming it the next 100x crypto.

Following HYPER’s $1 million raise on Friday, it’s evident that Bitcoin’s growth is positively impacting the project.

As such, JP Morgan’s $165,000 forecast hints at a promising future and might just fuel the 100x HYPER rally predicted by 99Bitcoins.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.