When crypto whales start moving, retail traders pay attention and for good reason. These deep-pocketed investors don’t chase hype; they accumulate assets before the crowd catches on. While most of the spotlight remains on Bitcoin and Ethereum’s next big rally, blockchain data tells a different story.

Quietly, whales are accumulating three specific projects that look undervalued at current levels — each offering real-world utility, active development, and major upside potential in 2025.

Let’s break down the three crypto gems whales are loading up on right now: Avalanche (AVAX), Chainlink (LINK), and Digitap ($TAP). While AVAX and LINK are already trading on open markets, Digitap is a new entrant shaking up the PayFi space with the ambition to become the world’s first omni-bank.

1. Digitap ($TAP): The Rising Star With Real-World Utility

Digitap ($TAP) is the biggest surprise on the list. It is a name that has been slowly spreading across numerous crypto forums and presale trackers. In contrast to the usual DeFi or meme projects, Digitap is creating a live, working platform that aims to make crypto and fiat currency seamlessly interoperable.

Digitap ($TAP) is the biggest surprise on the list. It is a name that has been slowly spreading across numerous crypto forums and presale trackers. In contrast to the usual DeFi or meme projects, Digitap is creating a live, working platform that aims to make crypto and fiat currency seamlessly interoperable.

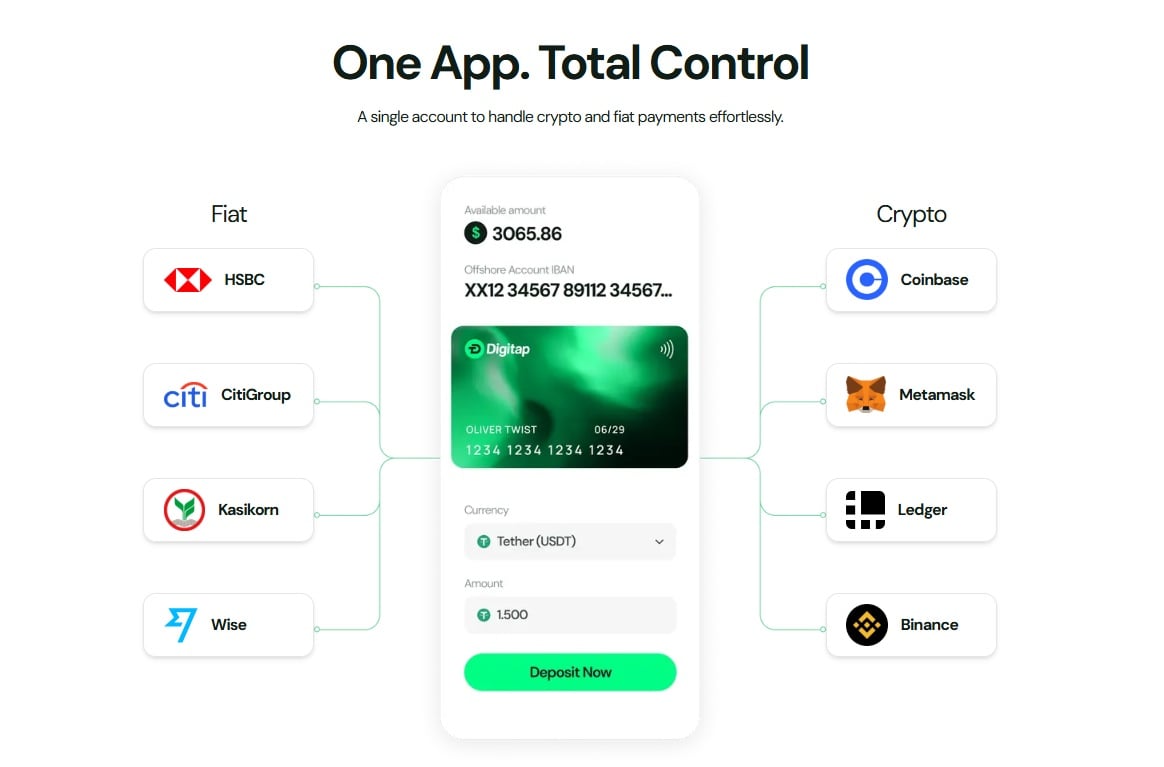

Simply put, Digitap is not a payment token. It is the first fully integrated PayFi ecosystem, combining banking, crypto wallets, and payments into a single, elegant interface.

The platform’s Digitap Card, supported by Visa, allows users to spend crypto or fiat anytime, anywhere, and the transactions can be done online, in-store, or through Apple Pay and Google Pay. Moreover, users can create as many virtual cards as they want for online shopping purposes.

Why are big investors drawn to this project? It is not only the great functionality but also the timing. The presale price of $0.0125 per token allows Digitap to have an extremely low market cap compared to the project’s growth potential.

The project is already getting off to a good start during the presale, thus showing that investors are heavily interested in it. The ecosystem is tackling financial issues that exist in the real world, ranging from $860 billion in annual remittances to the payment sector of the $12 billion global freelance economy.

The project is endowed with huge global utility and an immense amount of room to expand. The experts are betting that it could yield 50x returns as it progresses along the adoption curve and onboards new users.

2. Avalanche (AVAX): The Smart Money Infrastructure Bet

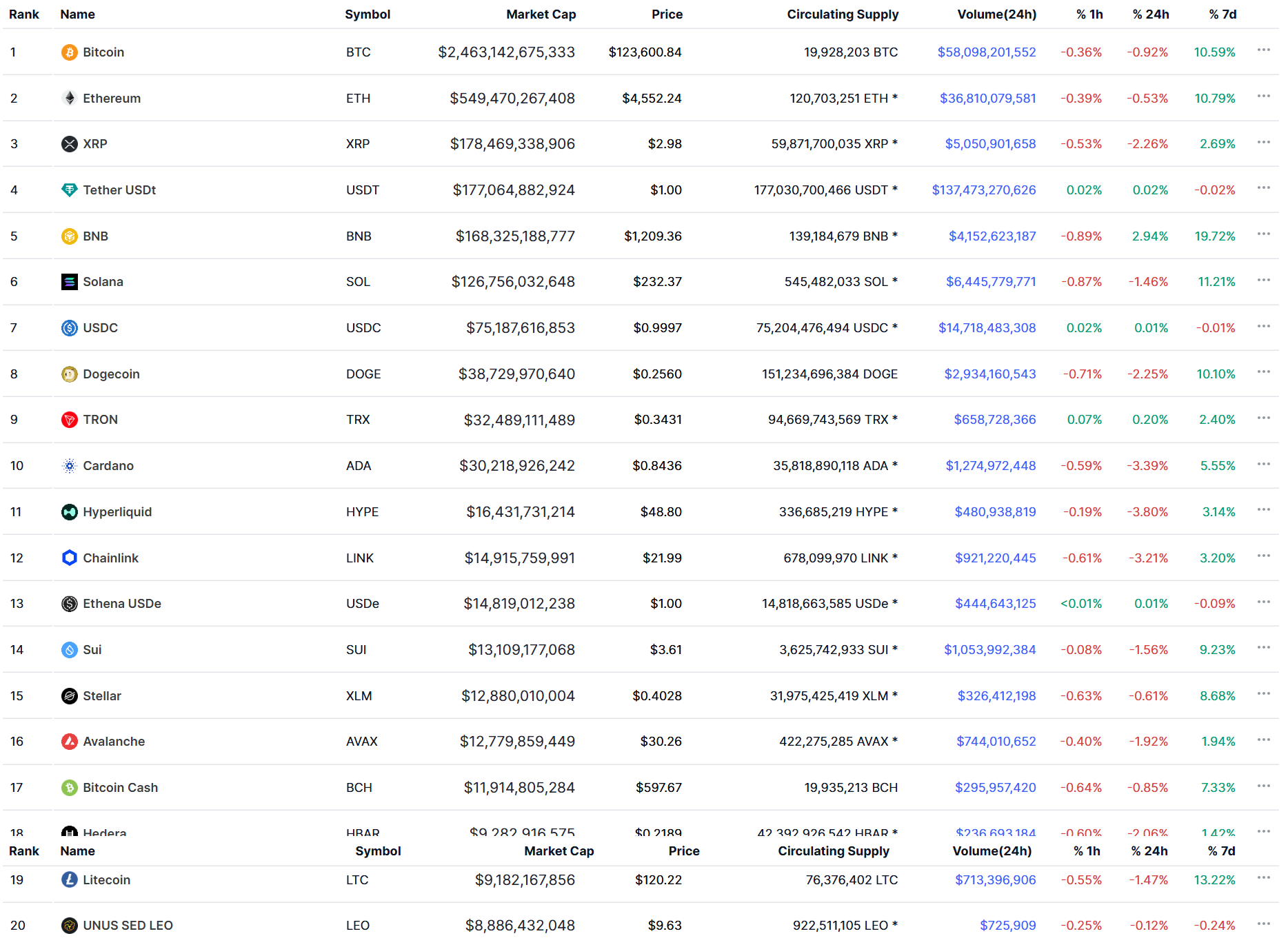

Avalanche is still a top 20 cryptocurrency and quite stable in this position, according to the rankings. However, analysts are of the opinion that it is still undervalued compared to its long-term potential.

AVAX is trading at around $30 and is going to benefit from the rising developer activity and the institutional partnerships; however, the price breakout is yet to happen as anticipated by many.

Whale wallets have quietly increased their AVAX positions over the last quarter, especially as the network expands its subnet architecture. It is a feature that allows enterprises to deploy customizable blockchains.

With stablecoins and tokenized assets gaining traction in 2025, Avalanche’s low-fee, high-throughput design gives it an edge over competitors like Ethereum for specialized DeFi and gaming applications.

AVAX is the right choice to invest in if you are a whale and looking into stable assets other than the short-term speculative ones. This is because AVAX is one of the most accumulated assets by large holders as it offers exposure to infrastructure that could support hundreds of future applications.

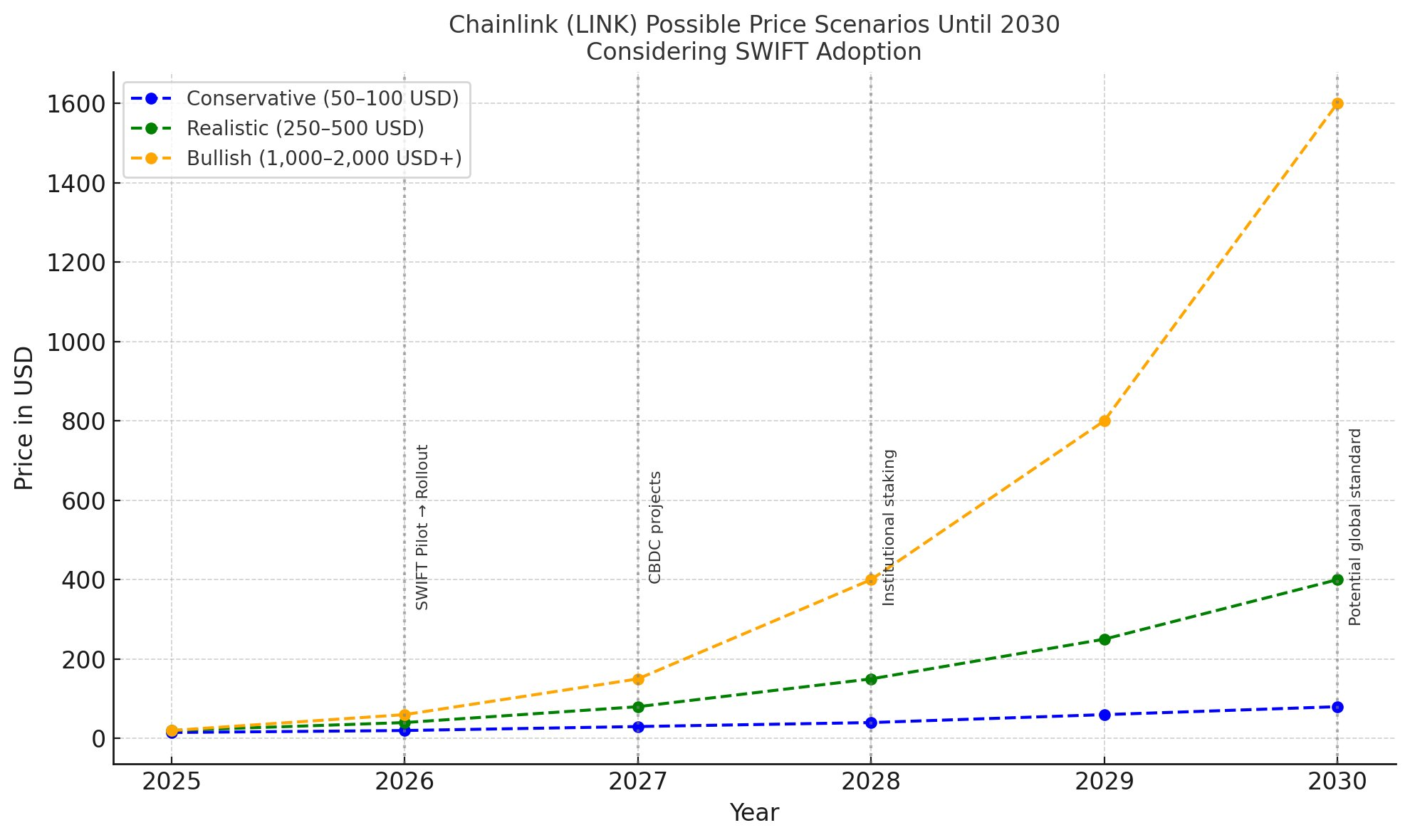

3. Chainlink (LINK): Data Infrastructure for the Next Cycle

If AVAX is the blockchain backbone, Chainlink is the connective tissue of the crypto world. The project powers data transfer between smart contracts and real-world systems through decentralized oracles.

It is trading at about $21.90, which is significantly higher than the beginning of 2024 but is still much lower than its all-time highs of over $50. A large number of transactions involving big players occurred according to the on-chain data, with large players buying the dip.

CCIP is crucial to the future DeFi model. It allows two or more chains to communicate with each other as well as traditional finance networks. As the tokenization process extends, Chainlink’s technology will probably be just as necessary as TCP/IP was during the inception of the internet.

Why These Three Stand Out

One common feature that these three assets have is that they address issues that end-users find important. AVAX supports scalable application infrastructures, LINK provides real-world data access for crypto, and Digitap enables instant cross-border money transfers. In a market that is largely driven by speculation, these projects are highlighted by their actual functionality.

As Bitcoin nears new highs and liquidity returns to altcoins, the next breakout will likely be driven by usability. The message for smart investors who are watching the big wallet moves is: follow utility, not noise.

$TAP vs. AVAX vs. LINK: Which Crypto to Buy Right Now?

Whales are mature market operators, and currently, they are loading up on AVAX, LINK, and, above all, Digitap ($TAP). The integration of Digitap into the real world, along with the 50x upside potential, makes it the standout of the trio.

While retail investors chase the next viral token, whales have already positioned themselves for the next real boom: real-world adoption and the PayFi revolution.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.