Cake DeFi is a Singapore-based staking, lending, and liquidity pool platform, enabling users to deposit and earn yield on a variety of tokens.

Despite the “DeFi” nametag, Cake DeFi is a custodial platform that offers a suite of features built around various DeFi products.

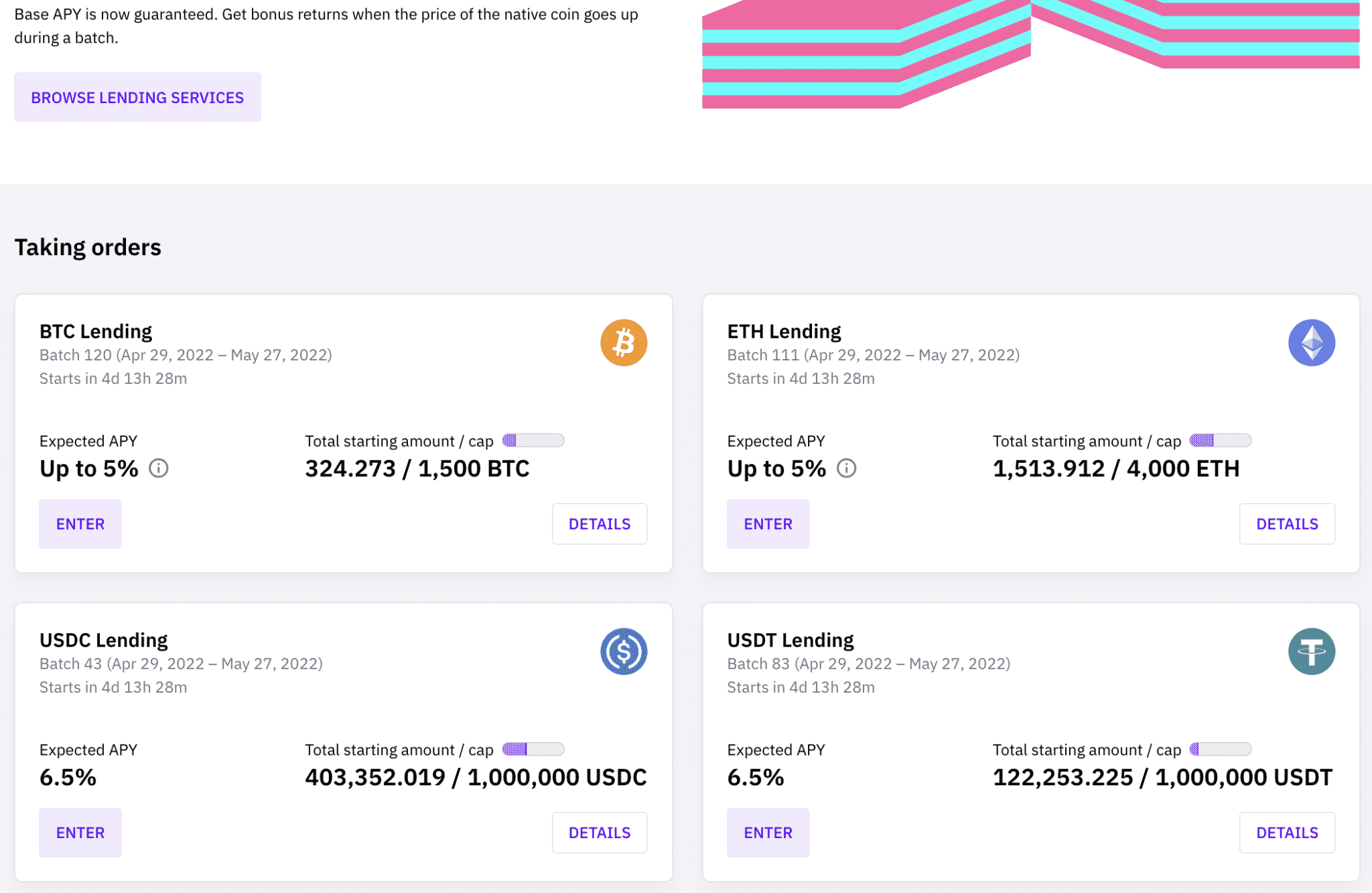

Cake DeFi offers three primary products: Lending, Liquidity Mining, and Staking– each generates different rates of yield and has different requirements. Users can earn around 6.5% lending digital assets like BTC, USDC, and ETH, or upwards of 80% by Liquidity Mining.

About Cake DeFi

Cake DeFi was founded in 2019 by Dr. Julian Hosp (CEO) and U-Zyn Chua (CTO).

The company is based in Singapore.

Julian Hosp M.D., has a wide variety of experiences, ranging from being a Trauma Surgeon in Residence to a Professional Kite Surfer. In 2015, Hosp Cofounded TenX, a cryptocurrency-enabled Visa card, and mobile wallet.

Hosp and Chua worked together on the TenX token sale, helping the project raise $80M in June 2017; it was one of the largest ICOs at the time. The project, however, faced enormous difficulty in the trials and tribulations of the 2018 cryptocurrency market crash.

Hosp parted ways with the project in 2019 raising various controversies– addressed in his blog post here.

TenX rebranded to Mimo, which appeared to be a staking and liquidity pool platform for a EUR stable token called Parallel, before shutting down completely in 2021.

U-Zyn Chua has been a Chief Researcher for the DeFiChain project since January 2019, which plays an integral role in the Cake DeFi ecosystem.

The DeFiChain DFI Token

Cake DeFi built many of its services around the DeFiChain (DFI) token.

DeFiChain is a non-Turing complete blockchain that aims to enable decentralized finance on Bitcoin. DeFiChain runs on a PoS consensus mechanism, and it anchors its most recent Merkle root to the BTC blockchain.

DFI went live in August 2020; its price peaked with a market cap of $2.34B in April 2022.

The project is operated by the Singapore-based DeFi Foundation, and the foundation is led by Cake Founders Dr. Julian Hosp (chairman), and U-zyn Chua (CTO).

Cake DeFi Lending

Cake DeFi’s rates for lending are competitive with their true DeFi counterparts. It advertises a “guaranteed” Base APY– with bonus returns if the price of the native coin goes up during the lending period.

Deposits are lent in “batches” where users deposit digital assets (BTC, ETH, USDC, or USDT) and the coins are locked in options contracts for four weeks. The batch lasts for 28 days, and starting and ending on a Friday.

After the four-week period, users can automatically roll over into the next batch, withdraw their entire principal and return to their Cake Wallet, or withdraw only the proceeds.

Cake doesn’t charge its users fees; it receives commissions directly from its partners.

Bonuses occur if the spot price of the asset ends in a specific range. For example, let’s assume the following:

- BTC’s spot price at the start date is $10,000.

- A Lending Batch offers 5% APY on BTC, and a bonus BTC return of 2.5% APY if BTC’s spot price is at least $12,500 at the end of the 28-day period.

- We enter the Batch with 10 BTC.

Situation #1: BTC’s spot price at expiration is $10,500.

We would get 5% APY on our 10 BTC, or 0.0375 BTC– 5% APY for the 28 days of the batch. We would have about 10.0375 BTC in our account, which we can elect to roll over into the next batch or withdraw completely.

Situation #2: BTC’s price at expiration is $2,500. (ouch)

We would still get our 5% APY. Same as the example above, we’d receive about 10.0375 BTC in return.

Situation #3: BTC’s price at expiration is $13,000.

We would get our 5% APY, and an additional 2.5% APY bonus, putting our total APY at 7.5%. At the end of the batch, we would get a total 10.0565 BTC :

- Our principal (10 BTC)

- Our 5% APY (0.0375 BTC)

- Our Bonus 2.5% APY (0.01896)

Although Cake claims that the principal and returns are both fully guaranteed and risk-free with “potential bonuses,” they don’t really explain how– their team did not provide a comment when contacted.

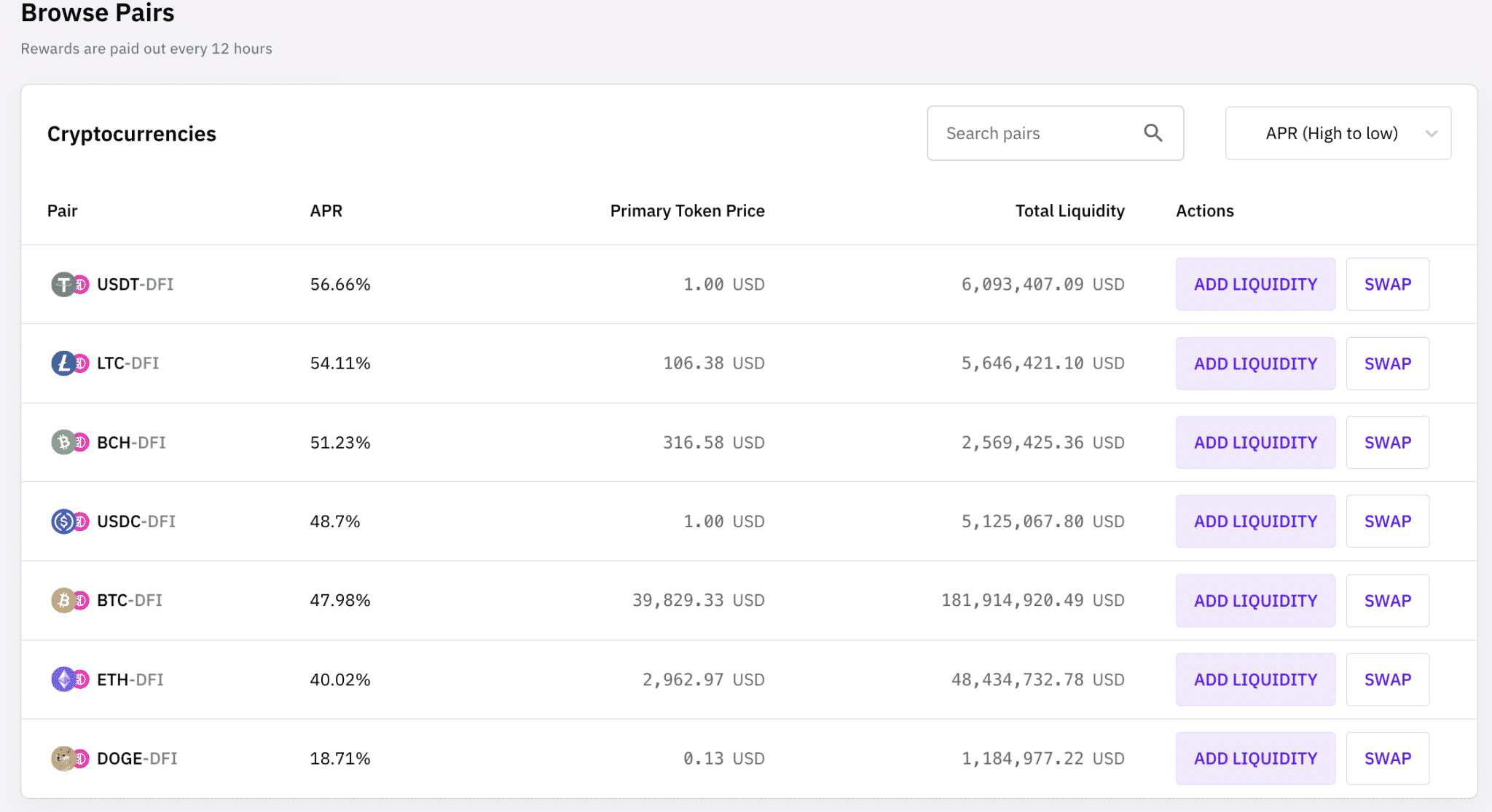

Liquidity Pools

Cake DeFi offers shared liquidity mining pools where users can earn yield in pairs between popular coins and the DFI token.

These liquidity pools pay a yield upwards of 68% (subject to change). Cake takes 15% as a fee on all rewards.

Rewards are paid out every 12 hours directly into your wallet on the Cake platform; it may take up to 24 hours for the first rewards.

These rewards are paid in both pairs, so if you are adding liquidity to a BTC-DFI pool, you’ll be paid in equal amounts BTC and DFI.

Users can take their coins out of liquidity mining pools at any time.

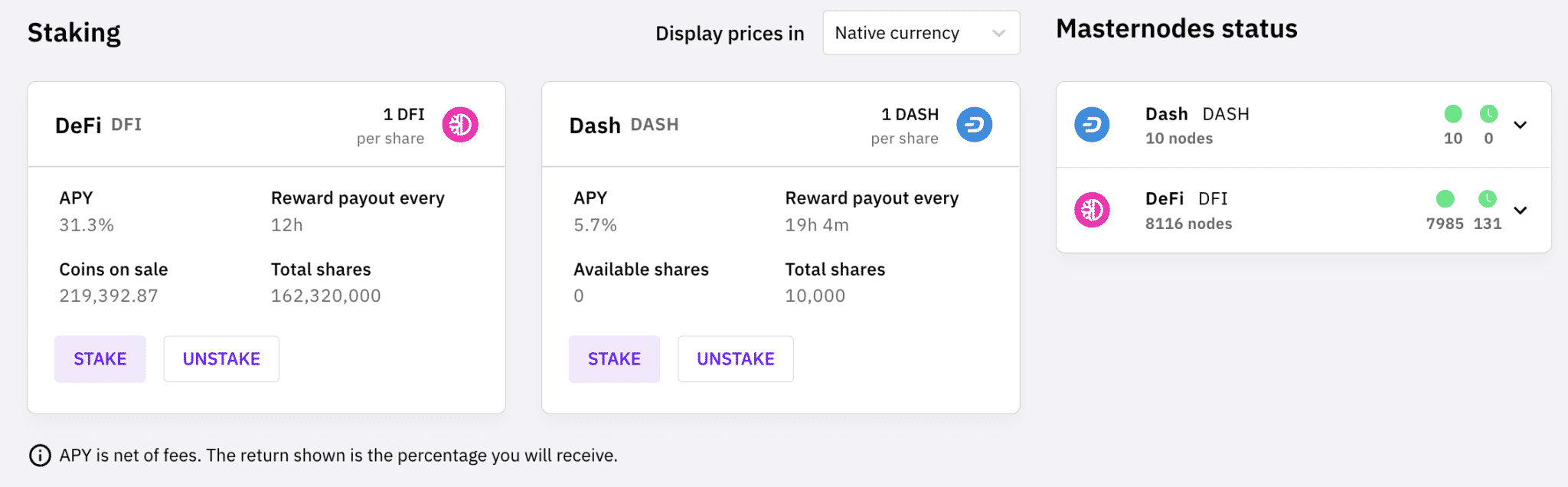

Staking

Users can stake (“bake” masternodes) and earn staking rewards in real-time. Cake currently offers two masternodes– DFI (up to 31.7% APY) and Dash (5.7%).

The Cake Freezer ????

The more hardcore Cake users can elect to “freeze” or lock up their DFI for up to ten years. In return, they get daily cash flow on their locked-up funds and an 85% rebate on staking fees.

To use the Cake Freezer, you simply elect to lock up your DFI for a minimum of a month (or a max of a decade). Your funds will be automatically allocated to liquidity mining pools; bonuses are staggered based on the duration of your lock-up.

For example, let’s say we freeze 10,000 DFI for 1 month. We’d get a Base APY of 89%, and our Freezer APY would be about 92%. For the 1 month, we’d receive about 500 DFI in rewards.

Alternatively, let’s see what happens if we do a full send on our DFI. Let’s assume we’re super bullish on the Cake platform, DFI token, and see both existing in 10 years.

Over this 10-year period, our Freezer APY would jump to about 108%. At the end of this period, our 10,000 DFI would have turned into about 42,000 DFI.

Final Thoughts: Is Cake DeFi Legit?

Cake DeFi is a fairly unique offering compared to its crypto yield kin. Cake DeFi is a centralized company like BlockFi and Celsius; by using the service, you’re trusting it to keep your funds safe throughout the various yield-generation activities. It does offer some guarantees, but there is nothing of substance to back the guarantee, which comes off as marketing-speak.

However, it differs in the opportunities available. Whereas most crypto interest accounts only offer yield on lending your assets, Cake enables users to access much higher returns through liquidity mining and staking– activities generally reserved for the DeFi-savvy crowds.

How is Cake able to offer 80% APY? Well, like most other liquidity mining and staking opportunities, the yield is paid out in DFI that the Cake DeFi team controls. So, the actual “yield” you get is dependent on DFI maintaining its price, as well as your ability to sell it (its most popular exchanges are on Kucoin and Binance, with limited support elsewhere).

These tokenomics don’t work well in DFI’s long-term favor, so the “freezer” product of locking DFI up for 10 years seems like a risky proposition.

The controversies with TenX shouldn’t be ignored, but it doesn’t seem that this product was created out of malicious intent. The company itself is based in Singapore, which adheres to different regulating authorities than U.S-based companies.

However, despite dubious claims of guaranteed returns and a lack of company response to clarify, it doesn’t seem like the product is illegitimate. The token itself has surprisingly held its value up well in recent times.

As always, this guide isn’t financial advice or an endorsement. Digital assets are risky, and platforms that take custody of your assets to introduce another risk.