Cardano (ADA) is back in the spotlight as its latest breakthrough, the launch of the Cardinal Protocol, sparks renewed optimism across the crypto market. By enabling non-custodial Bitcoin-based DeFi on Cardano, this development could dramatically expand the network’s utility and liquidity. Investors are now asking the big question: Does this signal a path to new all-time highs for Cardano? With bullish sentiment growing and technicals aligning, the latest move might be the catalyst Cardano needed to reclaim momentum.

ADA price prediction: Cardano ignites price momentum as Cardinal Protocol bridges Bitcoin to DeFi

Cardano is regaining market momentum with the launch of the Cardinal Protocol, a groundbreaking DeFi bridge that now brings Bitcoin liquidity into the ADA ecosystem. This trust-minimized protocol allows BTC holders to stake, lend, and borrow without relying on custodians—a massive step forward for cross-chain DeFi. Following the unveiling, the ADA price surged, driven by whale accumulation and renewed market confidence.

The Cardinal integration enables native Bitcoin UTXOs to power activity on Cardano, introducing a new dynamic to yield generation and staking. Analysts believe this lowered friction, paired with non-custodial access and seamless cross-chain movement, could lift ADA price predictions even higher in the coming months.

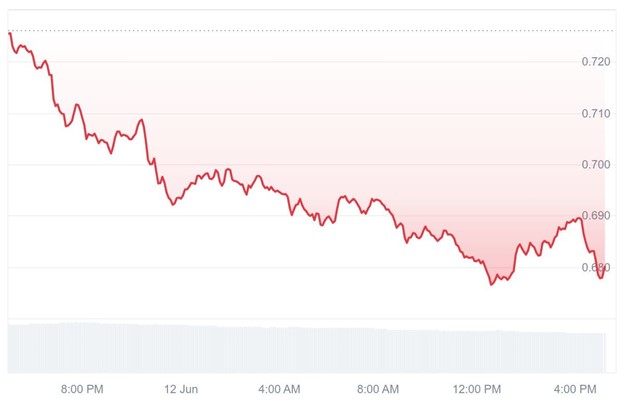

Speculation that Cardano will reach the $10 mark has sparked renewed debate across the crypto space. The token, currently hovering near $0.70, has drawn fresh attention following its inclusion in the NASDAQ Crypto Index and the reopening of ADA trading on Binance US after an SEC-related pause. These developments have reignited hope for a long-term ADA rally, with some analysts forecasting a cycle top between $10 and $15.

Still, the path is far from smooth. Many observers argue that Cardano must reclaim $1.10 to establish the momentum needed for such a breakout. While conservative forecasts point to a more realistic range of $1–$2 in the near term, on-chain metrics and ecosystem upgrades fuel a slow but steady climb.

Ultimately, Cardano’s ability to align macro adoption trends, consistent development, and investor confidence will determine its trajectory. The $10 dream isn’t guaranteed, but it’s far from dead.

This PayFi altcoin rises as utility-focused investors look beyond ADA’s 10x hype

As excitement builds around the possibility of Cardano (ADA) achieving a 10x price surge, savvy investors are widening their focus. Utility-based projects like Remittix are increasingly attractive to those seeking meaningful long-term returns. Unlike speculative assets, Remittix brings real-world value through its PayFi protocol—a simple, fast, and cost-effective way to send crypto directly into over 30 fiat currencies.

Remittix enables users to transfer Bitcoin, Ethereum, or XRP to someone’s bank account in minutes, bypassing the delays and fees of traditional banking. With global remittance flows expected to exceed $250 trillion by 2027, the timing couldn’t be better.

What makes Remittix different is its focus on small businesses and everyday users. Its easy-to-use wallet and seamless crypto-to-fiat pipeline are designed for accessibility, not complexity. Analysts see strong adoption potential as Remittix bridges the gap between blockchain innovation and mainstream financial systems.

At just $0.0781, RTX offers early investors a high-upside entry point. With over $15.7 million already raised in its presale, this token is quickly becoming the top pick for those who believe real utility, not just hype, will drive the next wave of crypto growth.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.