The crypto market is experiencing a pullback after last week’s rally. Bitcoin has dropped nearly 5% from Tuesday’s high, slipping to around $115,000 – the lowest it’s been in over two weeks.

Major altcoins like ETH and XRP are also in the red, and market sentiment has definitely taken a hit – but it’s not all doom and gloom.

While the bigger names sell off, a few smaller tokens are still holding strong – and maybe even setting up for a rally. Let’s explore what’s going on and the top altcoins to weather the current dip.

Why Are Crypto Prices Down Today?

Bitcoin’s drop isn’t random – it’s part of a broader shift that started with some worrying whale activity. Galaxy Digital and a few other big-name funds reportedly dumped over 30,000 BTC (worth around $3.5 billion) this week.

Then some ancient whale wallets – ones that hadn’t moved in over a decade – suddenly shifted thousands of BTC to exchanges. Naturally, that spooked the market, as it suggests they are about to sell.

As a result, more than $600 million in leveraged long positions got liquidated almost immediately. That kind of forced selling also impacted altcoins, with PEPE, SOL, and DOGE all down over 4% in the past 24 hours.

On the institutional side, the vibes have flipped, too. Spot Bitcoin ETFs have seen over $280 million in outflows this week. Ethereum ETF inflows also cooled, leading investors to wonder if big money is stepping back from crypto for now.

Best Cryptos to Buy as Bitcoin Dips

But not everything is tanking. Some altcoins are still showing strength – or at least holding their position while the rest of the market panics. Here are three that might be worth keeping an eye on:

1. Snorter (SNORT)

Snorter (SNORT) might not be on everyone’s radar yet, but it should be. Built on Solana, Snorter is a Telegram-based trading bot that offers speed, sniping, and copy trading capabilities. It’s trying to help you find the next PEPE or DOGE before they explode, and it’s already raised $2.3 million in presale.

With sub-second execution and transaction fees as low as 0.85% for SNORT holders, Snorter offers a real edge over rival bots like Banana Gun. It also comes with protection tools baked in: honeypot detection, MEV resistance, and front-running defense.

For traders who don’t have time to watch every new meme coin launch, there’s even built-in copy trading so you can follow high-performing wallets on autopilot. These features help explain why YouTuber Crypto June predicted SNORT would “100x” after it lists on a DEX.

SNORT tokens are priced at just $0.0991 in presale, but that price will rise with each new tier. If you’re looking for a way to stay ahead of the next meme coin pump – or just want to own the trading tool everyone else might be using – Snorter could be worth checking out. Visit Snorter Presale.

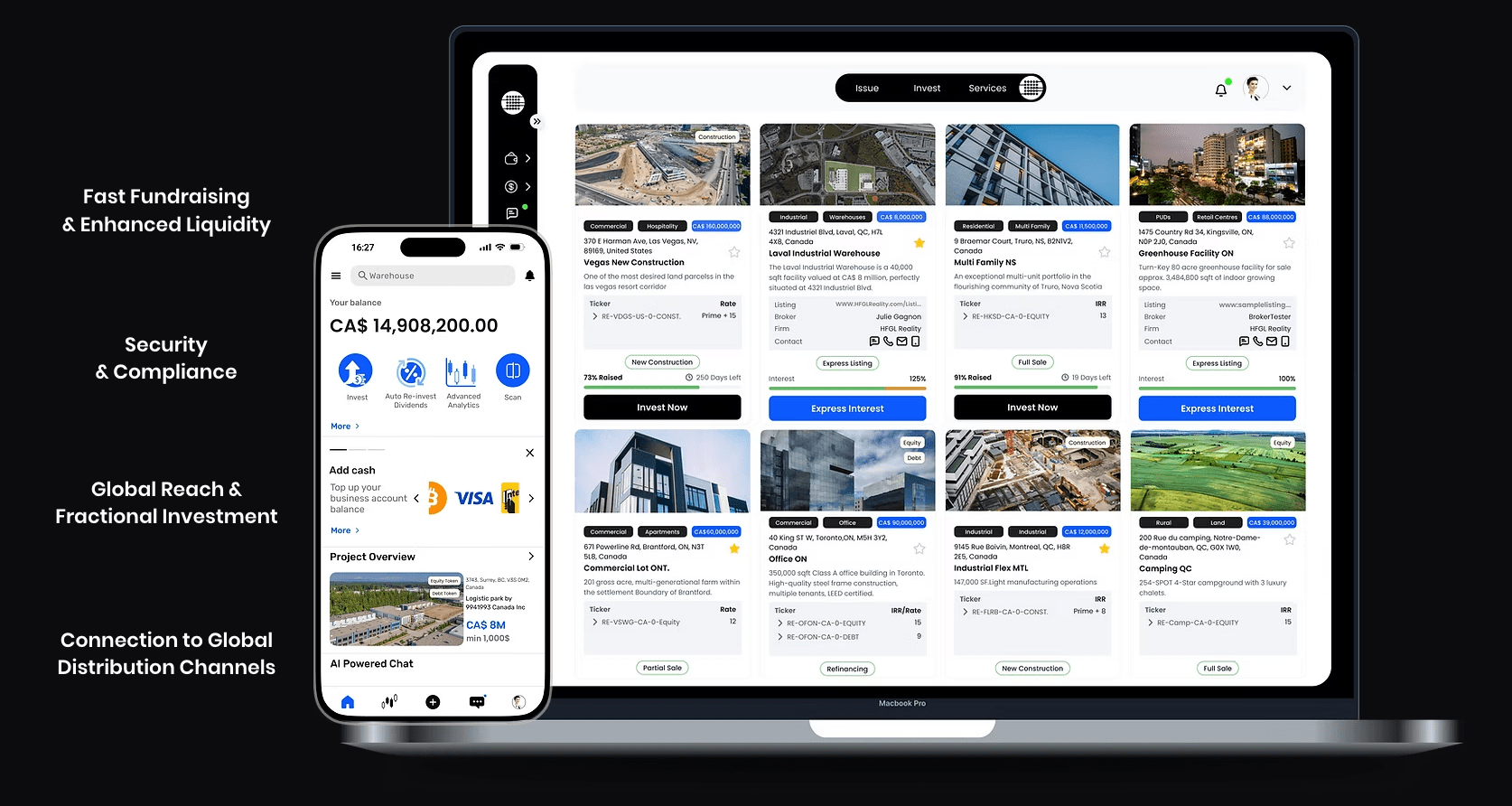

2. Rize (RIZE)

Rize (RIZE) is targeting a huge market: real-world asset (RWA) tokenization for institutional clients. It’s a DeFi platform that lets you invest fractionally in things like real estate or infrastructure – assets that usually require lots of capital. Everything’s managed on-chain, from due diligence to trading.

The platform uses AI to simplify risk assessments and taps into a unique “Liquidity Diffusion Network” that allows users to earn yield on ETH and stablecoins easily. And with over $23 million in value already locked, Rize is gaining legit momentum.

If RWAs are one of crypto’s strongest long-term narratives – and many top analysts believe they are – then RIZE is a project to keep tabs on, especially while Bitcoin and other top altcoins dip.

3. Centrifuge (CFG)

Centrifuge (CFG) isn’t new to the RWA game – they’ve been building infrastructure between TradFi and DeFi since before it was trendy. Their protocol lets businesses tokenize things like invoices or real estate and use them as collateral in DeFi, mainly through their Tinlake platform.

The CFG token runs everything, handling governance, staking, and gas fees. It’s also now bridged to Ethereum and Base, making it easier for capital to flow in. Yields come from off-chain repayments – not token inflation – so they’re as stable as possible.

With over $447 million in TVL and big-name partnerships like MakerDAO and Aave on board, Centrifuge is making a name for itself. If you’re into projects with actual fundamentals, this is one worth adding to your watchlist.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.