Bitcoin has shifted from a niche asset favored by speculative investors and libertarian technologists to a global hedge against macroeconomic risks within just a few years.

This shift was supported by the launch of spot Bitcoin ETFs in 2024, opening a gateway for institutional adoption. Currently trading well above $100,000, Bitcoin has reached levels that few considered possible just a decade ago.

But has it hit a ceiling for this cycle? Or will the final months of 2025 bring some of the best gains yet, potentially pushing $BTC toward $200,000? Let’s find out.

As Bitcoin solidifies its position as a world-leading asset, a new Bitcoin layer 2 called Bitcoin Hyper is gaining momentum, generating $7.5 million in capital inflows to its ongoing presale. Could this be the best crypto to buy before Bitcoin’s next big rally?

Global Liquidity Signals Bitcoin Could Reach $190,000 This September

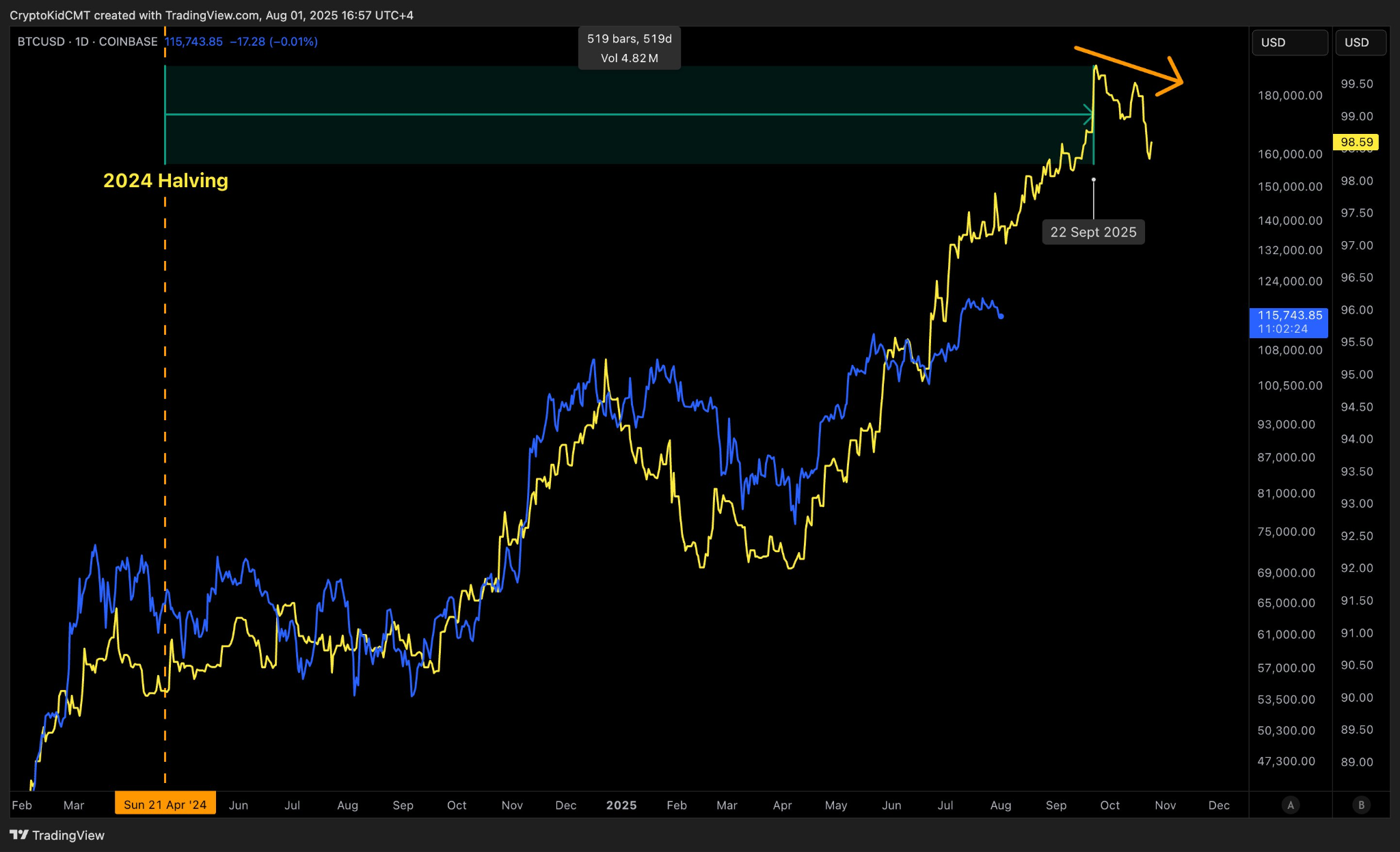

Arguably, the most important factor in predicting Bitcoin’s price trend is the M2 money supply. This measures the total amount of money in circulation globally, and Bitcoin’s price has closely correlated with it since 2024.

Bitcoin shows an 84-day delay relative to the M2 supply, according to analyst Crypto Kid. The analyst has observed that the M2 supply formed a double top after a strong uptrend starting in 2024, meaning that Bitcoin could also reach its peak price in the coming months.

This also aligns with the 4-year cycle theory, based on the Bitcoin halving. According to this theory, the Bitcoin bull market will top in Q3 or Q4 of 2025.

“The price of Bitcoin tops out 525–532 days after the halving in every cycle,” explained Crypto Kid.

The positive news is that in the weeks before the double top, the M2 supply surged rapidly, signaling that Bitcoin could do the same. Crypto Kid forecasts that Bitcoin will peak in late September, with a price between $135,000 and $190,000.

Could Bitcoin Diverge From the 4-Year Cycle?

Could Bitcoin Diverge From the 4-Year Cycle?

If this were previous cycles, we’d have to wait another 3-4 years before Bitcoin creates its next all-time high (ATH) after September, and we’d have to endure nauseating drawdowns in between.

But with Bitcoin ETF flows now exceeding $53 billion, and corporate treasuries holding billions more with plans to keep accumulating $BTC in the coming years, there’s a possibility that the 4-year cycle as we know it may fade away. Bloomberg’s ETF analyst Eric Blachunas made this case in a recent tweet:

“Since BlackRock’s filing, Bitcoin is up 250% with much less volatility and no vomit-inducing drawdowns,” he noted, adding, “This has helped it attract even bigger investors and gives it a real chance to be adopted as currency. The downside is that there are probably no more God Candles. Can’t have it all!”

Balchunas cited a Bitcoin price chart that illustrates Bitcoin’s tapering volatility ever since institutional capital began flooding the asset.

So what does this mean? We could see a peak in September between $130,000 and $190,000, due to the resistance of the M2 money supply – but this might not be the cycle top that you’re used to seeing.

So what does this mean? We could see a peak in September between $130,000 and $190,000, due to the resistance of the M2 money supply – but this might not be the cycle top that you’re used to seeing.

Instead, Bitcoin may consolidate, potentially above $100,000, before gradually rising again in line with the M2 supply, much like traditional assets such as gold and stocks. Therefore, depending on how M2 moves in the coming weeks, there’s even a chance that Bitcoin hits another ATH in late December or early 2026, finally surpassing $200,000.

Fueled by institutional capital, Bitcoin is becoming a stable, long-term asset. However, traders are taking advantage of this through related altcoins with more upside potential

Bitcoin Hyper Presale Sees $7.5M Inflows

Although Bitcoin still holds the potential for significant gains, especially compared to traditional assets, it’s unlikely to deliver the same impressive returns investors have seen in earlier cycles.

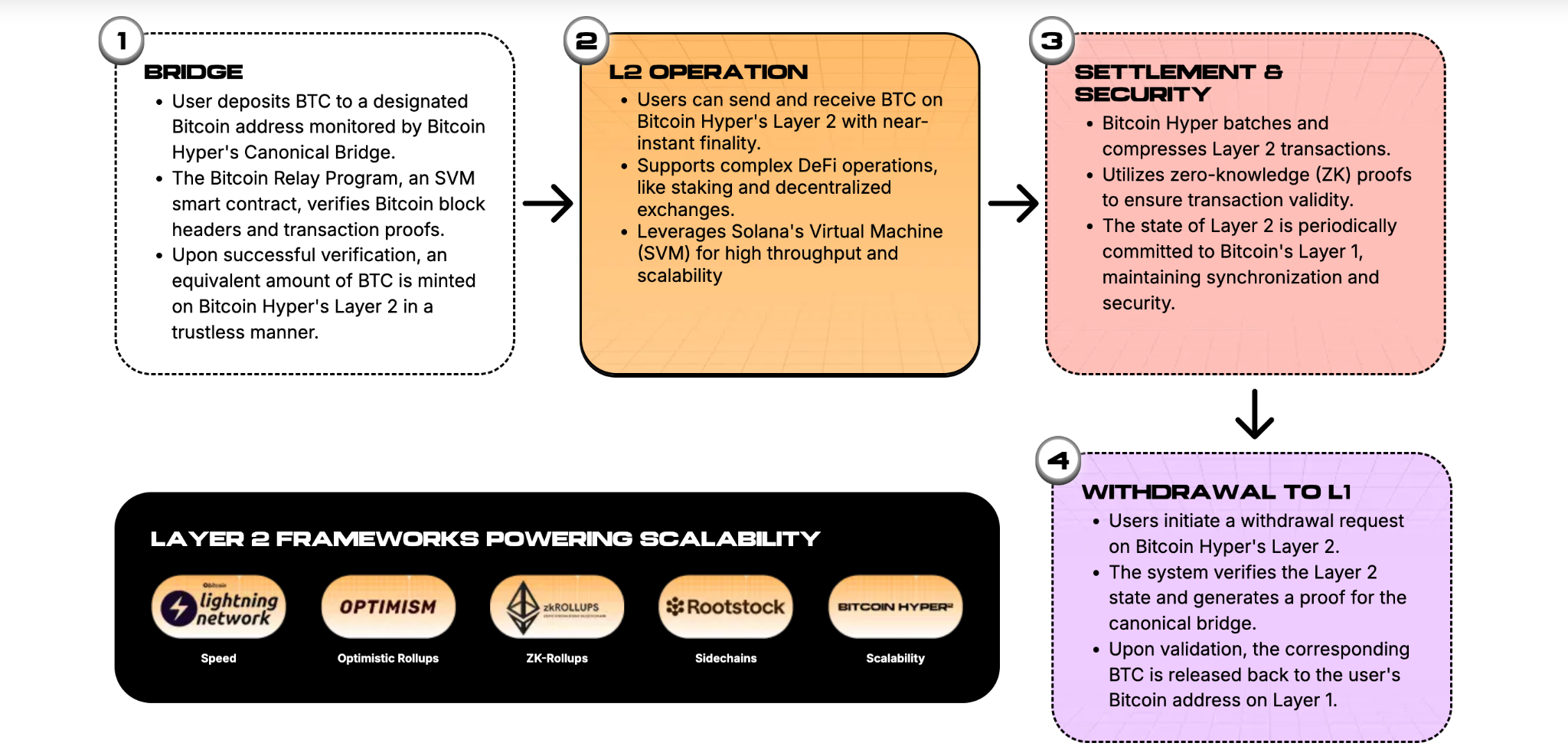

For crypto investors seeking multiple X gains, analysts recommend considering Bitcoin Hyper as an alternative. It’s the first genuine Bitcoin layer 2 blockchain, using ZK-rollups and Solana Virtual Machine execution to bring DeFi, staking, meme coins, and payments to the Bitcoin ecosystem.

Bitcoin Hyper is expected to process thousands of transactions per second without compromising security or decentralization. The HYPER token is used for governance and transactions.

The project is gaining rapid attention in its ongoing presale, with an astonishing $7.5 million raised and hundreds of thousands of dollars more flowing in daily, showing huge investor confidence in HYPER’s potential.

Analysts believe this presale could be one of the most rewarding opportunities out there right now. For example, popular commentator Umar Khan from 99Bitcoins even says it could deliver 40x gains this year.

Bitcoin Hyper offers something rare – a use case that could significantly expand Bitcoin’s user base and thereby strengthen its core value as a decentralized digital currency, making it more versatile and accessible.

And adding to that, it’s available to buy at a ground-floor price. That’s why Umar Khan says it has 40x price gain potential.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.