The Ethereum price is trading between $4,200 and $4,400 as the ETH price struggles to reclaim the key $4,500 resistance level. Despite strong fundamentals, including its dominance in DeFi and stablecoin transactions, buyers remain cautious at higher ranges. While Ethereum consolidates, attention is shifting to new opportunities, with Layer Brett raising over $3 million as crypto holders massively invest in its project.

Ethereum price struggles to regain $4,500

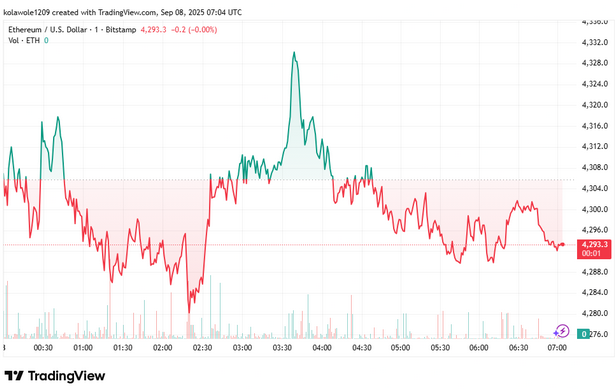

The Ethereum price has been attempting to head back to $4,500 but has encountered multiple rejections. ETH recently reached highs near $4,956, but has been trading laterally in the 4,300 zone. This shows that while Ethereum has strong demand, buyers are cautious at higher levels.

One of Ethereum’s major strengths is its role as a settlement layer, now processing nearly 70% of all blockchain flows. This dominance makes it the backbone of decentralized finance. Recent integration with Codex has further boosted stablecoin efficiency, helping to cut transaction costs and attract more activity across DeFi platforms. With such developments, the fundamentals remain strong even as short-term price movement appears stuck.

At the moment, the Ethereum price needs solid buying momentum to break past $4,500. If the market continues to see growth in DeFi and stablecoin adoption, Ethereum could retest $4,800 in the near term.

Layer Brett emerges as the best crypto presale for Q4 2025

Layer Brett (LBRETT) is quickly shaping up to be the standout presale of Q4 2025, setting itself apart in a crowded market. While many projects rely on hype alone, Layer Brett is pairing Ethereum Layer 2 innovation with features that strengthen real adoption. Having already raised more than $3 million, the presale is building momentum with a roadmap that emphasizes long-term value over short-lived speculation.

One of the biggest reasons traders are drawn to Layer Brett is its efficiency. By reducing gas fees and accelerating transactions, the project makes cryptocurrency use more practical for everyday payments and interactions. This gives LBRETT a utility edge over meme tokens that thrive only on attention. Add to this a gamified staking system that rewards community members for staying active, and the project builds a cycle of engagement that feels both rewarding and sustainable.

The presale also benefits from strong support mechanisms, including a $1 million liquidity pool and seamless integration with NFTs—one of the fastest-growing segments of digital assets.

Here are the features driving the LBRETT hype in the crypto presale space:

- Gamified staking rewards that encourage active community participation.

- Seamless NFT integration to capture value from digital collectibles and markets.

- $1 million liquidity program providing trading depth and investor confidence.

- Cross-chain utility ensures accessibility and adoption across multiple blockchains.

With cross-chain accessibility in play, Layer Brett is poised to grow far beyond its early stage. As Q4 unfolds, it stands out as the presale to watch for lasting impact.

Layer Brett outshines Ethereum as the smarter bet

Layer Brett (LBRETT) at just $0.0055 offers massive upside compared to Ethereum’s higher entry point. With its Layer 2 speed, low fees, NFT integration, and gamified staking, it combines utility with growth potential. For investors seeking affordable exposure and strong returns, LBRETT looks like the smarter bet.

Visit the website before this opportunity passes you by.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.