Bitcoin’s hashrate has reached new levels after a continued upward trend over recent months. Network data shows capacity now exceeding 1 billion terahashes per second. As Bitcoin’s hashrate pushes higher, Bitfrac is offering a new market opportunity. The project combines traditional bond investing with crypto mining to make institutional-scale operations accessible to individuals. Its ongoing crypto presale provides asset-backed tokens that connect investors directly to mining revenues. With over $4 million already raised, the Bitfrac project is positioning itself within an expanding sector driven by rising network activity.

Bitcoin Price Holds Above $113K as Hashrate Nears 1 Billion TH/s

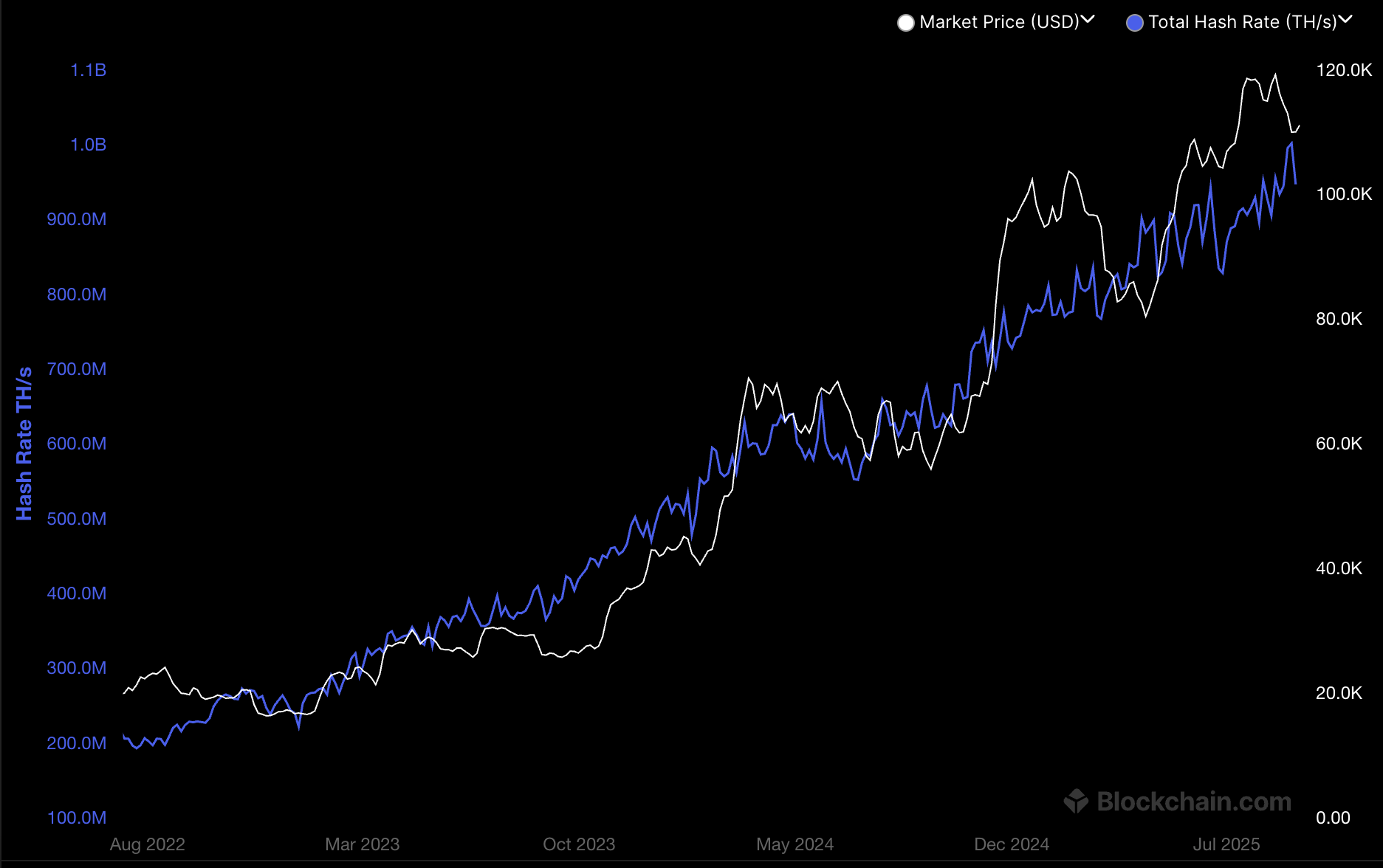

According to recent data, Bitcoin has recorded significant price movement over the past six months. It has risen from around $80,000-$85,000 at the start of that period to approximately $114,000, with current trading hovering near $114,000.

Source: Blockchain.com (Bitcoin Hashrate)

In addition to a continued price trend, the total hash rate showed frequent changes but followed an overall upward path. Levels ranged between 750 million terahashes per second and nearly 1 billion.

Price and hash rate displayed coordinated upward trajectories with phases of volatility. Despite periodic corrections, the chart reflects sustained increases in network participation alongside valuation changes across the observed six-month span.

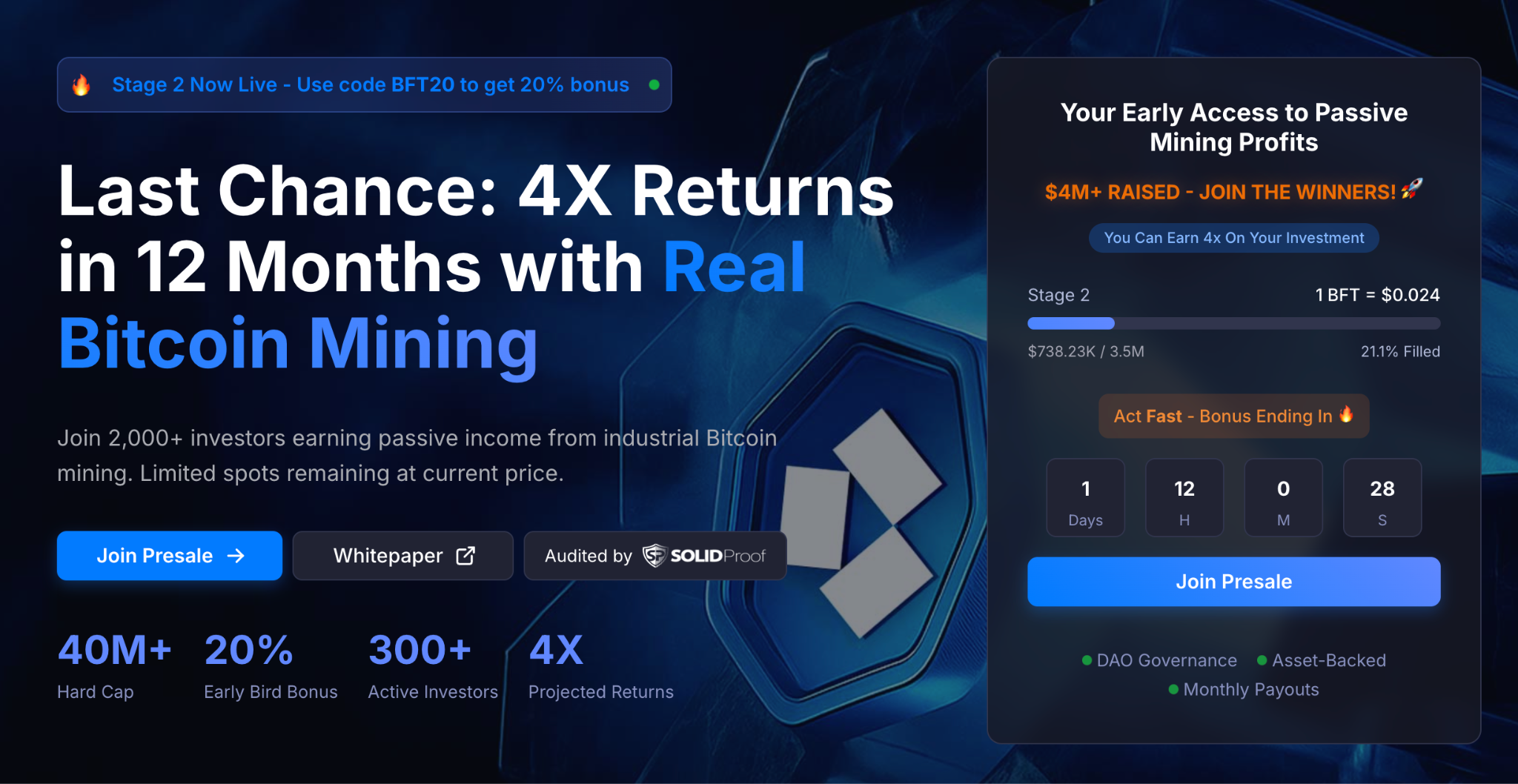

Bitfrac Crypto Presale Stage 2 is Live

Amid these industry gains, Bitfrac has advanced its crypto presale to Stage 2. The token, BFT, is priced at $0.024. Stage 2 is already 21% filled, with $738K raised out of the $3.5 million target. The round offers investors a 20% bonus when using the code BFT20. More than 2,000 participants have already joined the presale, which is expected to close in four days.

Source: Bitfrac

In Stage 1, the token launched at $0.017 before advancing to the current level. Bitfrac positions its crypto presale as distinct through its legally backed assets. The model combines fractional ownership of mining equipment and commercial facilities. Investors gain exposure to monthly Bitcoin distributions starting in November 2025.

Mining operations deploy Bitmain Antminer S19 XP and Whatsminer M50S machines, targeting 2.5 EH/s capacity. The infrastructure consumes 75 MW of power, producing approximately 8.2 BTC daily. Monthly net profits are projected at $14.2 million, supplemented by $892,000 from hosting services.

Token Utility and Governance Structure

The Bitfrac Token carries multiple functions within its ecosystem. Each BFT represents ownership rights, profit distribution claims, and DAO governance voting. Holders also access facility hosting services and site visits. A monthly buyback and burn mechanism reduces circulating supply, funded by 5% of profits. Importantly, all equipment records are stored on-chain with verified custodians.

Legal frameworks include SEC compliance and KYC/AML checks for presale participants. The global mining market is forecast to reach $7 billion by 2027. Barriers such as hardware costs and lack of transparency limit individuals’ access. Bitfrac addresses these gaps with tokenized ownership and transparent revenue sharing. The roadmap includes facility expansion, a CertiK audit, and exchange listings. Applications for Binance and Coinbase are already planned.

Bitcoin’s record hashrate confirms strong industry growth, while Bitfrac’s crypto presale introduces asset-backed mining access. With Stage 2 underway, $4 million raised, and a capped supply, the project positions itself within a sector seeking transparency and sustainability. Investors in the ongoing crypto presale face a limited time before the 20% bonus closes.

More Details:

Website: https://bitfrac.com/

Telegram: t.me/BitFracCommunity

X: https://x.com/BitFracProtocol

WhitePaper: https://bitfrac.com/docs/bitfrac-whitepaper.pdf

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.