The Bitcoin price has surged to an 18-day high on Thursday, hitting $14,400 for the first time since late August, after a 2.2% gain. This move was prompted by cooler-than-expected producer price inflation (PPI) data in the US on Wednesday.

Now, analysts are focusing on Thursday’s consumer price index (CPI) data, understanding that this information could influence the short-term market direction for Bitcoin and altcoins.

As evidenced by Bitcoin’s rise, an optimistic sentiment is emerging – and this is spilling over into other projects. Several Bitcoin-related projects are on form, and new Bitcoin Layer 2 blockchain Bitcoin Hyper is among the biggest winners, having recently exceeded the $15 million fundraising milestone in its presale.

That’s a significant achievement for a new project, comparable to what Ethereum raised during its ICO. So this success reflects more than just favorable market conditions – it attests to Bitcoin Hyper’s bold ambition to scale Bitcoin and unlock new use cases.

Here’s Why Bitcoin is Pumping

Bitcoin’s rally has been driven by welcomed inflation data, with Wednesday’s PPI figures at 2.6%, well below the 3.3% forecast. This means lower-than-expected inflation, increasing the likelihood of more interest rate cuts in the coming months.

The upcoming FOMC meeting on 16 September was already expected to include the first interest rate cut of 2025. However, cooling inflation combined with Tuesday’s revised job market data, which shows over 900,000 fewer jobs in the March 2025 benchmark revision, indicates that the Fed may become more aggressive in cutting rates, both in September’s FOMC and the subsequent meetings.

Generally, lowering interest rates makes risk-on assets like cryptocurrencies more attractive, leading to increased liquidity and higher prices. Last September marked the first rate cut since 2020, and Bitcoin surged from under $60,000 to over $100,000 within three months.

Thus, with the recent economic data fueling expectations of additional rate cuts, optimism around Bitcoin is rising, and that’s causing its price to climb. However, analyst Daan Crypto Trades stressed that CPI data released on Thursday will likely drive more volatility.

$BTC Took out a bunch of liquidity above $114K after this cool PPI print.

Tomorrow is CPI day which will undoubtedly cause another spike in volatility. https://t.co/6RBljOb5XG pic.twitter.com/HOi1SPEMJM

— Daan Crypto Trades (@DaanCrypto) September 10, 2025

Will Bitcoin Hit a New All-Time High This September?

From a purely price-based perspective, Bitcoin is in an advantageous position. After dropping to lows of $107,400 on September 1st, it turned what appeared to be a bearish trend into a healthy pullback after flipping a previous resistance zone into support.

After briefly falling below the previous all-time high of $111,000, Bitcoin has now regained that level and seems to be heading toward its new range high.

But considering macroeconomic factors, the outlook becomes more clouded. Kingpin Crypto predicts BTC will rally toward $118,000 after today’s CPI data, yet Ted Pillows warns that the last three CPI reports have led to selloffs.

But considering macroeconomic factors, the outlook becomes more clouded. Kingpin Crypto predicts BTC will rally toward $118,000 after today’s CPI data, yet Ted Pillows warns that the last three CPI reports have led to selloffs.

However, with the Federal Reserve expected to lower interest rates this week, any short-term volatility may quickly dissipate as we head into a period of looser monetary policy.

And with Bitcoin trading at local highs and a generally positive macroeconomic outlook supporting the rally, it’s not surprising that Bitcoin-related tokens are also performing well right now.

Bitcoin Cash is up 2.5%, Stacks has increased by 4.7%, and Bitcoin Hyper is on fire after reaching the milestone of $15 million raised in its presale.

Analyst Says HYPER Set for 100X Gains

Many experts believe that Bitcoin could reach between $150,000 and $250,000 this year – and this would unlock huge liquidity for the broader crypto ecosystem. Bitcoin Hyper is expected to be a major beneficiary, with its use case as the world’s first ZK-rollup-powered Bitcoin L2 drawing significant attention.

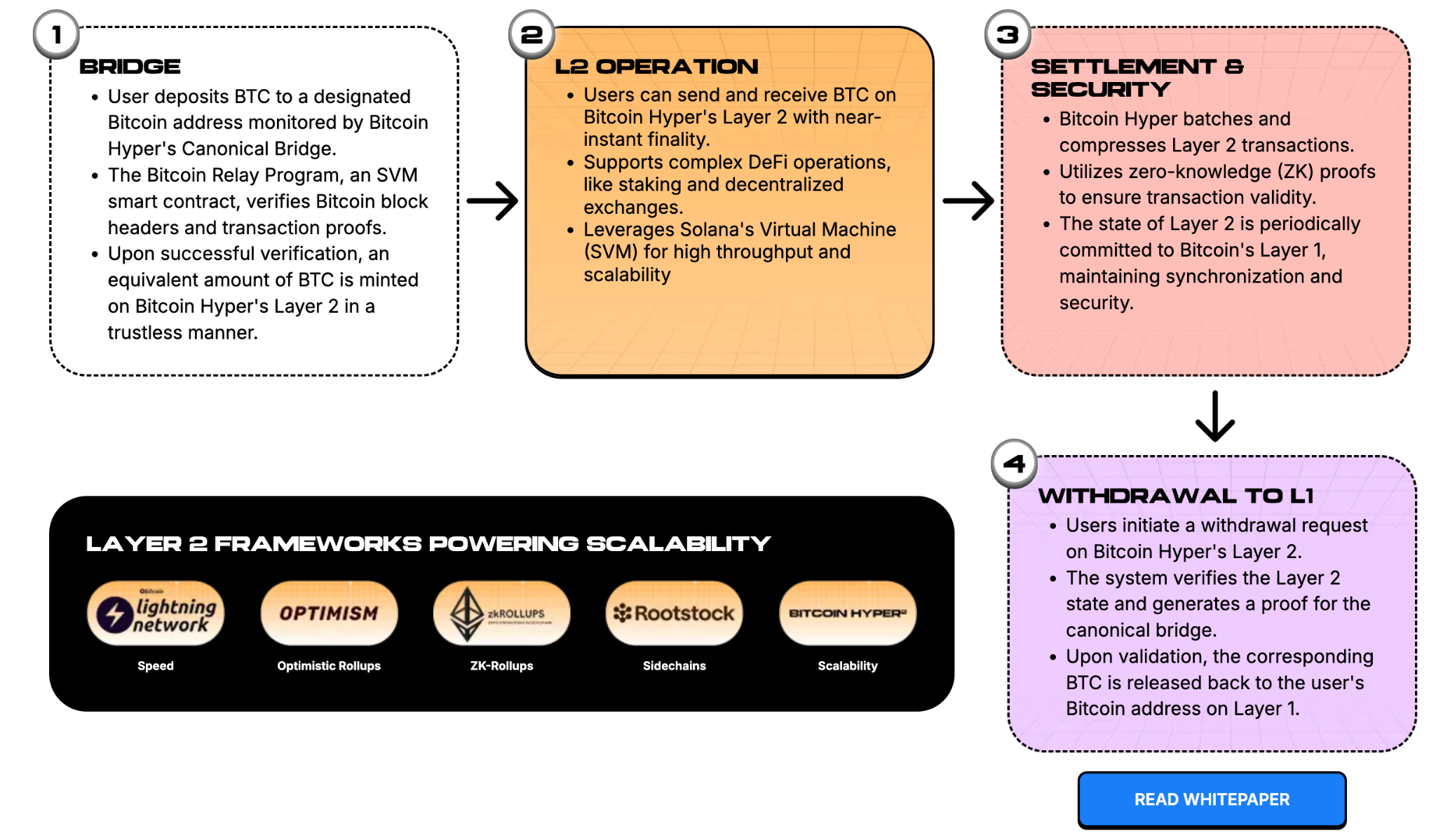

The project will periodically anchor its state to the Bitcoin L1, inheriting its neutrality and immutability. It will also perform periodic fraud proofs to maintain network security while keeping costs low.

The Bitcoin Hyper L2 uses Solana Virtual Machine (SVM) execution, which offers extremely fast transaction speeds, smart contract support, and interoperability with Solana. This setup could open up a new realm of possibilities for Bitcoin – including DeFi, AI, gaming, payments, meme coins, and much more.

Unsurprisingly, capital is flowing into the presale as investors rush to secure early investments. Recently, one whale purchased $16K worth of HYPER. Meanwhile, leading industry analysts are taking notice, with Umar Khan from 99Bitcoins suggesting it has 100x potential.

Unsurprisingly, capital is flowing into the presale as investors rush to secure early investments. Recently, one whale purchased $16K worth of HYPER. Meanwhile, leading industry analysts are taking notice, with Umar Khan from 99Bitcoins suggesting it has 100x potential.

Although no one knows for sure whether Bitcoin will reach new highs this month, the fact that it has reclaimed its previous ATH and is back in its highest trading range – especially as interest rate cuts are approaching – creates a very optimistic outlook.

But Bitcoin Hyper’s early-stage, innovative use case and community support suggest this could be one of the best ways to capitalize on Bitcoin’s future growth, with considerably more upside potential.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.