TLDR

- Broadcom secured a $10 billion customer deal and expects AI revenue to reach $45 billion in fiscal 2026

- Zscaler delivered strong Q4 results with 31% growth in remaining performance obligations for fourth consecutive quarter

- Oracle reported 359% year-over-year growth in remaining performance obligations to $455 billion

- JPMorgan raised Broadcom’s price target to $400, Stifel boosted Zscaler to $330, and Jefferies increased Oracle to $360

- All three companies show strong AI-driven growth with analysts maintaining buy ratings

Wall Street’s top analysts are betting on three technology companies positioned to benefit from artificial intelligence growth. Broadcom, Zscaler, and Oracle all received upgraded price targets from leading analysts following strong earnings results.

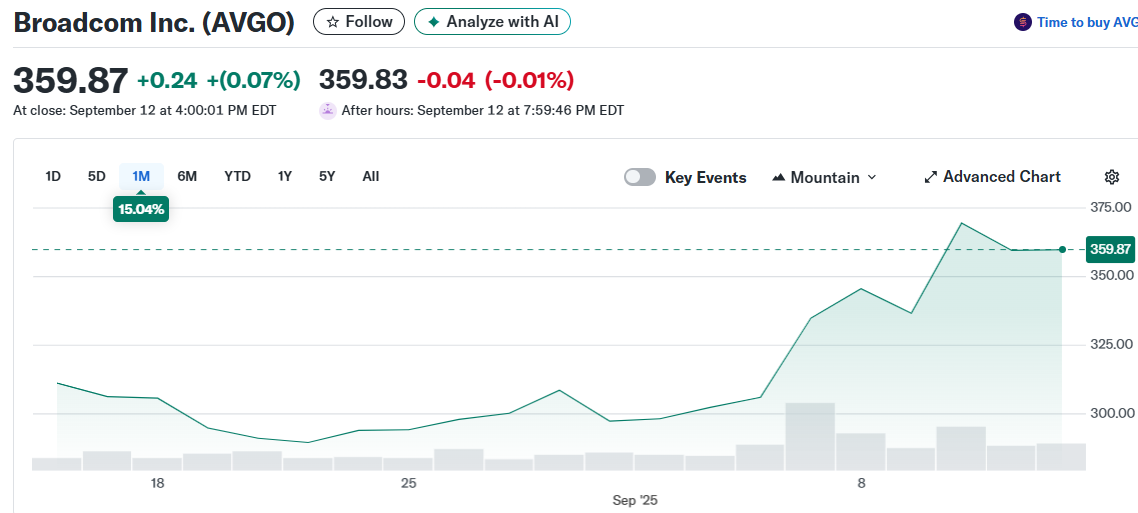

Broadcom reported impressive third-quarter results and secured a new $10 billion customer deal. The semiconductor company’s AI revenue grew 18% sequentially in Q3 and is expected to reach $6.2 billion in the fourth quarter.

JPMorgan analyst Harlan Sur raised his price target for Broadcom to $400 from $325. Sur believes the company will deliver about $20 billion in AI revenue for fiscal 2025.

The analyst expects AI revenue to jump 125% to $45 billion in fiscal 2026. This growth comes from Broadcom’s custom AI chips that offer better efficiency and economics than competitors.

Zscaler Shows Strong Zero Trust Demand

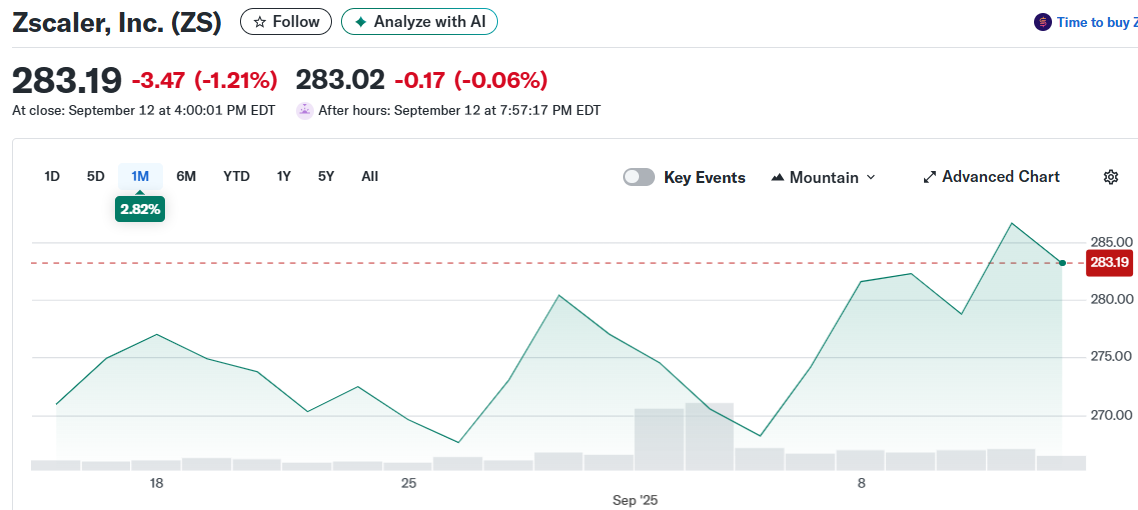

Zscaler delivered solid fourth-quarter results driven by demand for Zero Trust and AI security solutions. The cybersecurity company’s remaining performance obligations grew 31% for the fourth consecutive quarter.

Stifel analyst Adam Borg increased his price target to $330 from $295. Borg praised the company’s strong execution across key metrics including billings growth.

The analyst remains positive about Zscaler’s newer solutions like Z-Flex. He believes the company’s portfolio helps organizations improve security while reducing costs through vendor consolidation.

Borg expects Zscaler to maintain high-teens revenue growth in coming years. The company continues expanding its Zero Trust offerings into emerging areas like AI security.

Oracle’s Cloud Contracts Drive Massive Growth

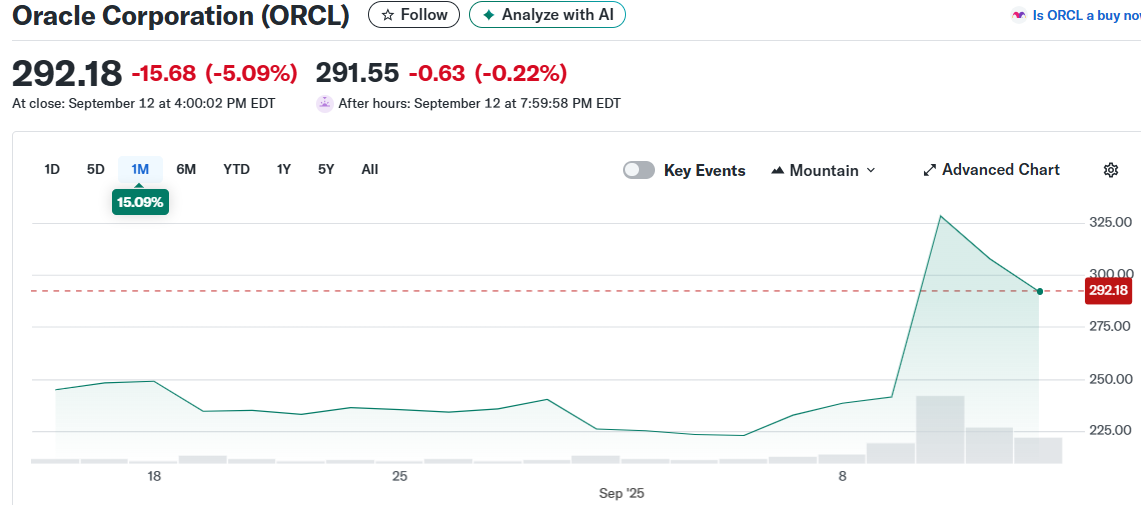

Oracle saw its stock surge after reporting 359% year-over-year growth in remaining performance obligations. The database company reached $455 billion in contracted revenue despite missing Q1 earnings estimates.

Jefferies analyst Brent Thill boosted his price target to $360 from $270. Thill called the RPO results the highlight of Oracle’s quarter.

Oracle added $317 billion in RPO during the quarter from four multi-billion-dollar contracts. This represents nearly five times the company’s estimated fiscal 2026 total revenue of $67 billion.

The Oracle Cloud Infrastructure business is expected to grow 77% to $18 billion in fiscal 2026. Management projects this will jump to $144 billion by fiscal 2030.

Oracle plans to expand to 71 data centers across cloud providers. The company expects multicloud database revenue to grow every quarter for several years.

All three analysts maintain buy ratings on their respective stocks. Sur ranks 39th among over 10,000 analysts tracked by TipRanks with a 67% success rate and 26.1% average return.