TLDR

- Swiss banks UBS, PostFinance, and Sygnum have completed the first legally binding payment using a public blockchain.

- The proof-of-concept test showcased blockchain’s potential for interbank payments and smart contract applications.

- The payment process involved tokenized deposit tokens used for fiat money transfers between bank customers.

- The Swiss Bankers Association confirmed that the test proved the feasibility of blockchain technology for institutional payments.

- The successful test highlights the growing interoperability between traditional banking systems and blockchain infrastructure.

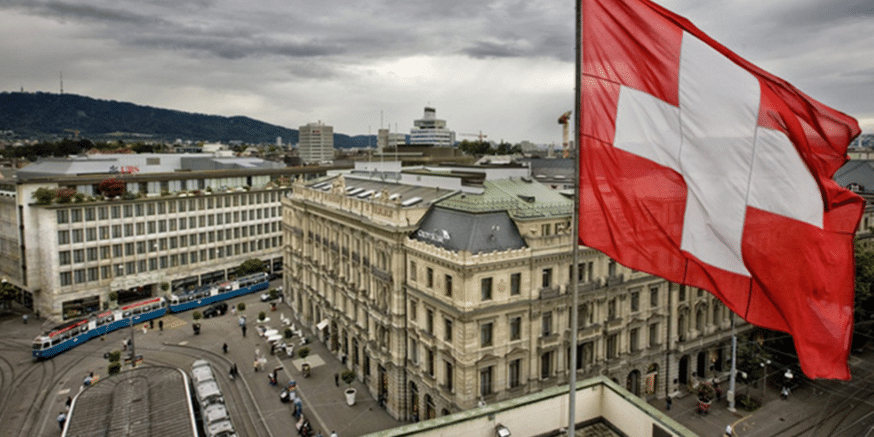

Swiss banks have completed the first legally binding payment via a public blockchain, marking a major milestone. UBS, PostFinance, and Sygnum Bank participated in a proof-of-concept (PoC) that tested blockchain technology and smart contracts for interbank payments. The project, coordinated by the Swiss Bankers Association (SBA), demonstrates the potential of blockchain for future banking infrastructure.

Blockchain-Based Payment System Successfully Tested

The PoC involved blockchain-based deposit tokens used for interbank payments. The system tokenized fiat money transfer instructions on the blockchain as “deposit tokens.” The test demonstrated a payment between bank customers of the participating Swiss banks, and also tested an escrow-like process involving tokenized real-world assets.

This marks the first time banks have used a public blockchain for legally binding transactions. According to the SBA, the test proves the feasibility of institutional payments using blockchain technology.

“Public blockchains with permissioned applications can trigger legally binding payments,” the SBA stated.

Interoperability with Traditional Bank Deposits

The successful test of blockchain payments signals growing interoperability between traditional banking systems and blockchain. Christoph Puhr, UBS Group’s digital assets lead, noted that the PoC proves that “interoperability of bank money via public blockchains can become a reality.” He added that this innovation could accelerate developments in tokenized assets and reshape financial systems globally.

The test also showed the potential for increased cooperation among banks, infrastructure providers, and regulators to address scalability challenges. The SBA confirmed that scalability would require “additional design adjustments” to meet the needs of larger, more complex financial systems.

This development could pave the way for a new era in financial transactions, bringing decentralized finance (DeFi) closer to mainstream adoption. With Switzerland leading the way, other nations may soon follow suit, further integrating blockchain into the financial landscape.

Swiss Banks Set Stage for Future Innovations

Swiss banks’ success in testing blockchain-based payments may prompt more financial institutions to explore similar technologies. The experiment demonstrates how blockchain can be used in regulated, legally binding ways to process payments. The SBA highlighted that this proof of concept “accelerates innovation in tokenized assets,” which could revolutionize the future of global finance.

As global banks and central banks experiment with blockchain, Switzerland is positioning itself at the forefront of this innovation. The successful PoC adds to Switzerland’s reputation as a leader in financial technology. The development signals an important step toward integrating traditional banking with blockchain’s decentralized features, marking the future of financial services.