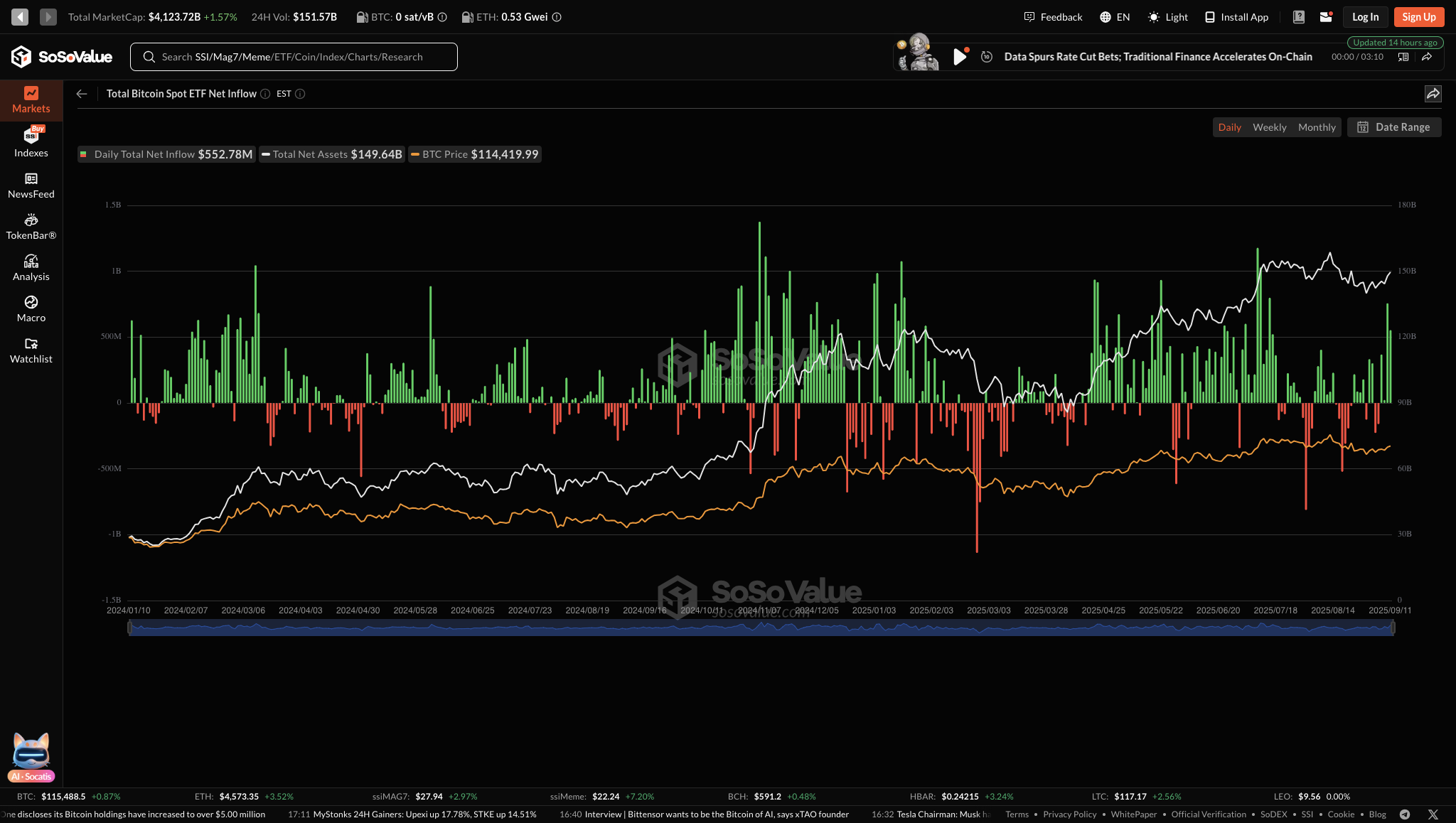

The crypto market is back to life. Spot Bitcoin ETFs have pulled in an eye-popping $1.7 billion in fresh inflows this week alone, boosting the total crypto market cap past $4 trillion for the first time in months. September 10th alone saw nearly $800 million inflow, a surge that hasn’t been matched in almost two months. Ether ETFs, after suffering nearly $800 million in outflows last week, suddenly reversed course and racked up $230 million in new demand by September 11th.

Institutional buyers are clearly back, and when deep pockets start piling into Bitcoin and Ether, smaller traders look for better opportunities. Many are crowding into DeepSnitch AI, a hot presale that capitalizes on the AI x crypto surge. Here’s why it could turn out to be the next 100x shot of this season.

ETF inflows create renewed risk appetite

Data compiled by ETF trackers showed that spot Bitcoin exchange-traded funds pulled in about $1.7 billion in net inflows on September 11th, making it the largest weekly total in nearly two months. The largest single-day contribution came midweek, when inflows approached $800 million, a number that drew attention from portfolio managers watching liquidity rotate into crypto.

Ether funds recovered after a brutal week of outflows. Spot Ether ETFs that had registered nearly $800 million in net redemptions last week recorded about $230 million of inflows this week. The speed of the rebound in Ether funds matters because ETH often leads or increases risk-on moves across the altcoin market.

Institutional flows often behave like a rising tide. When large pools of capital re-enter the market, they lift price discovery for large-cap altcoins. XRP has been among the better performers during the early phase of the rebound, and its liquidity profile makes it a natural beneficiary of renewed institutional demand.

Institutional flows often behave like a rising tide. When large pools of capital re-enter the market, they lift price discovery for large-cap altcoins. XRP has been among the better performers during the early phase of the rebound, and its liquidity profile makes it a natural beneficiary of renewed institutional demand.

However, there’s a new kid on the block.

DeepSnitch AI tops $200k: Is it too late to buy DSNT?

DeepSnitch isn’t another vague “AI-for-blockchain” pitch. It is being developed to be a trader’s weapon, an AI engine analyzing on-chain flows, Telegram chatter, and shadow-wallet activity to provide the kind of intel whales pay entire teams to uncover. An interesting aspect of DeepSnitch is its positioning.

The AI sector’s valuation is expected to increase by more than 3 times before 2030. In essence, the adoption that might flow into tokens like DeepSnitch AI will hit like a crack. Many believe it will give users a strategic edge in the crypto market, and its presale is moving like a lit fuse.

DeepSnitch AI is already positioned for this. By integrating into Telegram’s 1 billion active users, the project has the kind of distribution channel only a few can match.

The presale opened at $0.0151 and has sprinted to roughly $0.0163 in a flash, an 8% jump before most people even heard the name. A $100 today still buys more than 6,000 DSNT tokens, but every stage means a greater price jump.

Simply put, if DeepSnitch reaches even a conservative $1, that same $100 could turn into $6k.

The people who turned a few hundred dollars into life-changing wealth with PEPE, SHIB, or early-stage Solana didn’t wait for CNBC to confirm the trend. And with nearly $200k raised in DeepSnitch AI’s presale at only $0.01634, this could be the asymmetric trade of this cycle.

XRP price prediction

On Sept. 12, XRP traded around $3.04, after the token outperformed the market by more than 5% in the past week. Technical indicators support a bullish view: the 50-day simple moving average stood close to $3.01, and the 14-day RSI read about 56.66.

Furthermore, XRP price prediction points to a near-term target of roughly $3.51 by December. This could be a nearly 15 percent increase if it happens. And in 2026, XRP could see a trading band between about $3.10 and $4.96.

Furthermore, XRP price prediction points to a near-term target of roughly $3.51 by December. This could be a nearly 15 percent increase if it happens. And in 2026, XRP could see a trading band between about $3.10 and $4.96.

Avalanche price prediction

On Sept. 12, Avalanche traded around $28.40 after a week of strong performance that saw AVAX gain over 10%. Moreover, Avalanche’s TVL has doubled to roughly $2.1 billion over recent quarters, driven by gaming ecosystem expansion. Also, its on-chain transaction volume has surpassed 1.4 billion.

Technicals show a 14-day RSI near 68.49 and a 50-day SMA around $24.00. Price forecasts place AVAX near $30.61 by October.

The bottom line

If you believe the next crypto mania is underway, waiting could be the most expensive decision you make this year. Large caps do provide respectable gains, but DeepSnitch AI’s presale is one of the purest 100x play on the board right now.

It is low enough to deliver massive returns, visible enough that serious traders are already piling in.

Pricing will increase with each stage; now still in stage 1, but not for long. For those on the hunt for the next 100x shot, this presale could be it.

Visit the DeepSnitch AI presale website today.

FAQs

FAQs

What is the short-term XRP price prediction?

XRP price predictions point toward roughly $3.51 by December if ETF flows continue.

How does DeepSnitch AI compare to buying XRP now?

XRP will likely benefit from ETF liquidity and offer steady gains. But DeepSnitch AI will be positioned as an early-stage, asymmetric bet that could deliver massive returns if adoption increases.

Is it too late to buy DeepSnitch AI?

No, but the presale will progress through stages that will raise the price. Early-stage allocations will be cheaper, so acting sooner will reduce entry cost.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.