The altcoin market has roared back to life this week, with XRP, Ethereum (ETH), and Solana (SOL) breaking away from the pack. ETF headlines, strong institutional inflows, and bullish technical setups are combining to give these tokens an edge, earning them top spots on analysts’ buy lists for September.

XRP’s first U.S. spot ETF, Ethereum’s flood of inflows, and Solana’s institutional momentum are making them the stars of the week. Yet beneath the surface, retail traders and whisper networks are spreading talk of an unexpected play: MAGACOIN FINANCE, an emerging high-upside token positioning itself as the “off-ETF bet” for those chasing asymmetric gains.

XRP: ETF Milestone and Regulatory Progress

XRP is entering a new chapter in its long history. On September 18, the first-ever U.S. spot XRP ETF is set to launch, a milestone that finally places the asset alongside Bitcoin and Ethereum in the regulated fund space. For years, XRP’s regulatory status clouded its adoption prospects. Now, with ETF approval in hand, XRP has institutional access on its side.

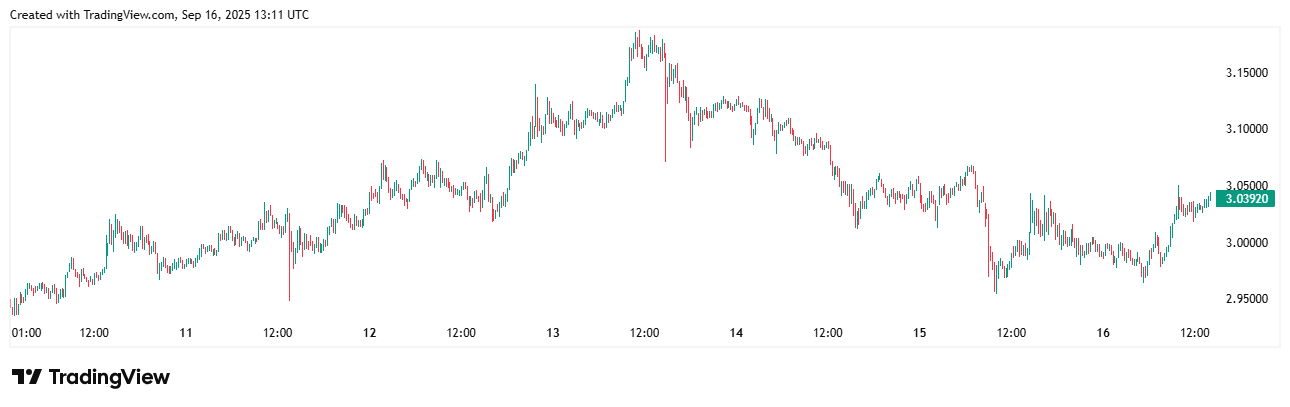

Prices have held firm near $3.10, showing resilience after nearly a 10% gain over the week. Analysts point to $3.10 as a key support level and highlight $4.50–$5.00 as realistic high-end targets into 2025 if inflows remain steady. Whale accumulation adds another layer of optimism, with big holders positioning ahead of the ETF debut. Analysts are increasingly confident that this structural demand—backed by clarity on adoption and regulation—will underpin XRP’s next major push.

Ethereum (ETH): Inflows Drive Renewed Confidence

Ethereum has staged a notable rebound after its August correction. Trading in the $4,700–$4,750 range, ETH has regained momentum thanks to $44 million in ETF inflows, increased network activity, and renewed institutional demand. The support level at $4,015 has proven reliable, while resistance around $4,530 and $4,800 is in focus as the next breakout zone.

Citi and other major banks maintain a year-end target of $4,300, but with ETFs soaking up supply and 29% of ETH already staked, analysts believe the real upside may extend further. Ethereum’s liquidity crunch is tightening as Layer 2 solutions cut costs and expand adoption, creating a structural foundation for higher valuations. With smart money rotating into ETH and retail participation increasing, Ethereum is once again proving its role as the market’s innovation engine.

Solana (SOL): Institutional Flows Set the Stage

Among the majors, Solana (SOL) has been the standout story. At $233, SOL is consolidating near recent highs, with analysts eyeing $250 as the breakout trigger. If that barrier falls, the stage is set for a larger bull run into 2026. Pantera Capital’s $1.1 billion investment and record open interest on CME futures reflect how deep institutional confidence has grown.

For 21 consecutive weeks, Solana-linked ETPs have posted net inflows, highlighting consistent institutional appetite. Staking growth and a robust technical setup reinforce its momentum. Analysts are eyeing $280 short-term and $1,250 over the cycle if current trends persist. Solana has become more than a fast blockchain; it’s now a core institutional play, with whales and funds treating it as the third heavyweight alongside Bitcoin and Ethereum.

Retail Angle: MAGACOIN FINANCE and the “Off-ETF Bet”

While institutions pour capital into XRP, ETH, and SOL ETFs, retail traders are chasing a different narrative. MAGACOIN FINANCE has emerged as the “unexpected side bet” of the cycle—an altcoin story divorced from ETF headlines but buzzing with momentum. Early backers frame it as the off-ETF play, an opportunity with a completely different growth profile than established tokens.

Its rise isn’t about corporate balance sheets or regulated funds. Instead, MAGACOIN FINANCE is built on scarcity, cultural branding, and community-driven hype, drawing investors who crave outsized returns beyond what ETF-backed majors might deliver. In a cycle dominated by institutional flows, MAGACOIN FINANCE has carved its identity as the counterweight—a speculative bet for those willing to move outside the mainstream spotlight.

Conclusion: Three Pillars and a Hidden Fourth

XRP, Ethereum, and Solana are dominating the analyst buy lists this week. ETF momentum, whale accumulation, and institutional inflows have positioned them as the leading altcoins heading into Q4. XRP’s landmark ETF launch, Ethereum’s structural liquidity tightening, and Solana’s unprecedented institutional streak all point toward strong breakout potential.

Yet, the crypto market has always rewarded diversity of approach. Beyond the ETF headlines, MAGACOIN FINANCE is gaining traction among retail investors as a bold, high-upside alternative.

For those balancing stability with speculation, this week’s message is clear: institutional giants like XRP, ETH, and SOL may define the cycle, but the stealth stories—like MAGACOIN FINANCE—could define its surprises.

Visit MAGACOIN FINANCE today to explore before the next move.

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.