Q4 has a way of bringing the crypto market to life. After the slower summer stretch, speculative activity usually kicks in, new money enters the market, and sentiment starts to shift. Historically, this three-month period is Bitcoin’s best season, with average gains of above 80% since 2013.

Macro factors tend to be the reason. Things like rate cuts, softer inflation, and looser liquidity conditions prompt investors to lean toward risk assets, and stablecoin flows are already pointing in that direction. In past cycles, that mix has turned Q4 into the most bullish quarter of the year.

There are also other catalysts this year, such as compensation payouts and potential ETF approvals that could boost altcoin prices across the board. So, by the time December comes around, optimism might have snowballed into FOMO.

With macro tailwinds and sentiment lining up, we could be set for another strong finish to the year for crypto. Here are four undervalued coins that might be among the best cryptos to buy as Q4 momentum builds.

1. Maxi Doge (MAXI)

Maxi Doge (MAXI) bills itself as the “Doge for degens,” and it’s easy to see why. The token is hosted on Ethereum and is running a stage-based presale, where the MAXI price increases each round. It also offers staking (137% APY) to keep investors engaged before launch.

That formula – a rising presale price plus passive income potential – has helped Maxi Doge’s presale raise over $2.4 million so far. And that’s just the start. The team is lining up exciting features such as trading contests with crypto prizes and partnerships with leverage trading platforms to keep holders engaged.

A token generation event (TGE) is planned for sometime in Q4, and we’re already seeing hype build ahead of it. This is evidenced by YouTubers like Borch Crypto discussing Maxi Doge’s enormous price potential.

Given that it’s a meme coin with utility, MAXI going live during the crypto market’s most bullish quarter could give it a shot at producing exponential returns for investors. Visit Maxi Doge Presale.

2. Avantis (AVNT)

Avantis (AVNT) has become one of the trendiest DeFi protocols on Base. It’s a decentralized derivatives platform that aims to be the leverage layer for crypto, offering perpetual contracts not only on ERC-20 tokens but also on real-world assets.

Interest in Avantis has exploded this month due to high-profile CEX listings and a heavily hyped airdrop, which helped push 24-hour trading volumes into the billions. That buzz has cooled a bit, but with growing demand for derivatives on Base, plenty of traders still see the AVNT token as undervalued.

Avantis is the kind of project where fundamentals and momentum can line up in an explosive way if the market keeps trending. And that might make it one of the best cryptos to buy and hold in Q4.

Avantis is the kind of project where fundamentals and momentum can line up in an explosive way if the market keeps trending. And that might make it one of the best cryptos to buy and hold in Q4.

3. Best Wallet Token (BEST)

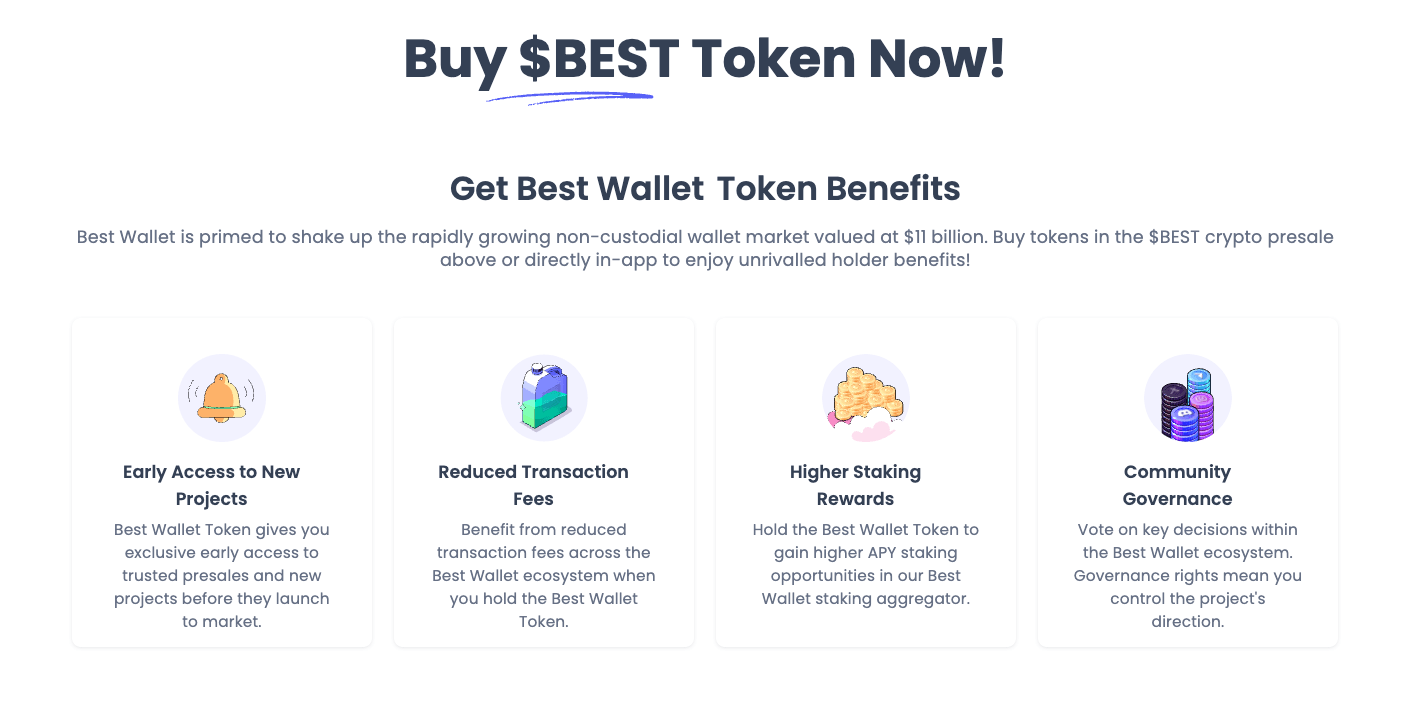

Following its launch later this year, Best Wallet Token (BEST) will be what makes the Best Wallet app tick. Best Wallet is a non-custodial, no-KYC crypto wallet that integrates swaps, staking, dApps, and a presale launchpad – and BEST will tie it all together.

Holding the BEST token will cut your swap fees, unlock early access to vetted presales through the “Upcoming Tokens” portal, boost staking yields, and will eventually plug into new features like a crypto debit card for everyday spending. It’s basically an all-access pass.

Best Wallet Token’s ongoing presale has raised more than $16 million so far, with each presale stage bumping the price a little higher. Currently, tokens are priced at just $0.025675 each.

Best Wallet Token’s ongoing presale has raised more than $16 million so far, with each presale stage bumping the price a little higher. Currently, tokens are priced at just $0.025675 each.

With a roadmap that includes features like derivatives trading, along with planned DEX/CEX listings, BEST has an exciting set of catalysts ahead. That’s why it’s one to keep tabs on as we look ahead to Q4. Visit Best Wallet Token Presale.

4. Merlin Chain (MERL)

Merlin Chain (MERL) is one of the newer Bitcoin Layer-2 solutions. It’s EVM-compatible, batches transactions with ZK-rollups, and supports BTC-native assets like BRC-20 tokens and Atomicals.

In practice, that means faster, cheaper transactions with Ethereum-style smart contracts – all tied to Bitcoin security. The native MERL token covers fees, staking, and governance, with its capped supply rolling out gradually over four years.

The project’s been getting lots of attention thanks to the “Merlin 2.0” upgrade, which helped push MERL onto CoinMarketCap’s trending cryptos list. So, with Bitcoin Layer-2s yet to really take off, Merlin Chain’s positioning looks timely – giving it a shot to capture early developer interest.

The project’s been getting lots of attention thanks to the “Merlin 2.0” upgrade, which helped push MERL onto CoinMarketCap’s trending cryptos list. So, with Bitcoin Layer-2s yet to really take off, Merlin Chain’s positioning looks timely – giving it a shot to capture early developer interest.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.