Ethereum ETF inflows soared to $1 billion, as the Arbitrum price rally is drawing investors to the DeFi sector in hopes of high-growth tokens.

This has brought them to Unilabs, an emerging asset management powerhouse that has raised nearly $16 million in its ongoing ICO. Read on to see why experts say Unilabs is one of the high-potential crypto projects of 2025.

Ethereum ETF Inflows Remain High in August

Demand for Ethereum ETF assets has surged in recent weeks, showing strong institutional demand for the top cryptocurrency.

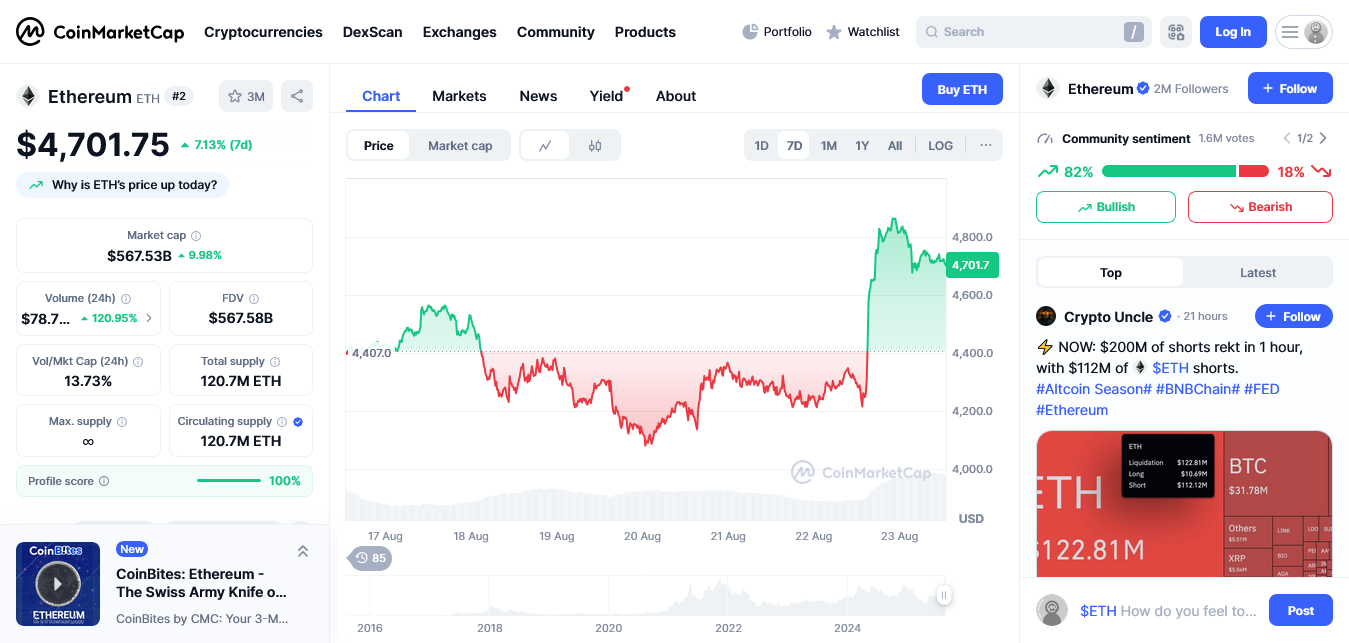

An article from Bitget showed that Ethereum ETF inflows hit a record of $1 billion in August. Additionally, a 7-day crypto chart from CoinMarketCap shows that Ethereum is trading at $4,739.92, just $100 short of its ATH reached in 2021.

Ethereum | CoinMarketCap

Some analysts believe that Ethereum is on course to set a new ATH in December if rising institutional demand for Ethereum ETF assets continues. If these Ethereum ETF predictions come true, ETH might be on course to reach $5,000.

Can the Arbitrum Price Stay Bullish?

Arbitrum price gains in recent weeks have made it one of the top altcoins in the market. Despite recent market volatility, the Arbitrum price has maintained its double-digit increase.

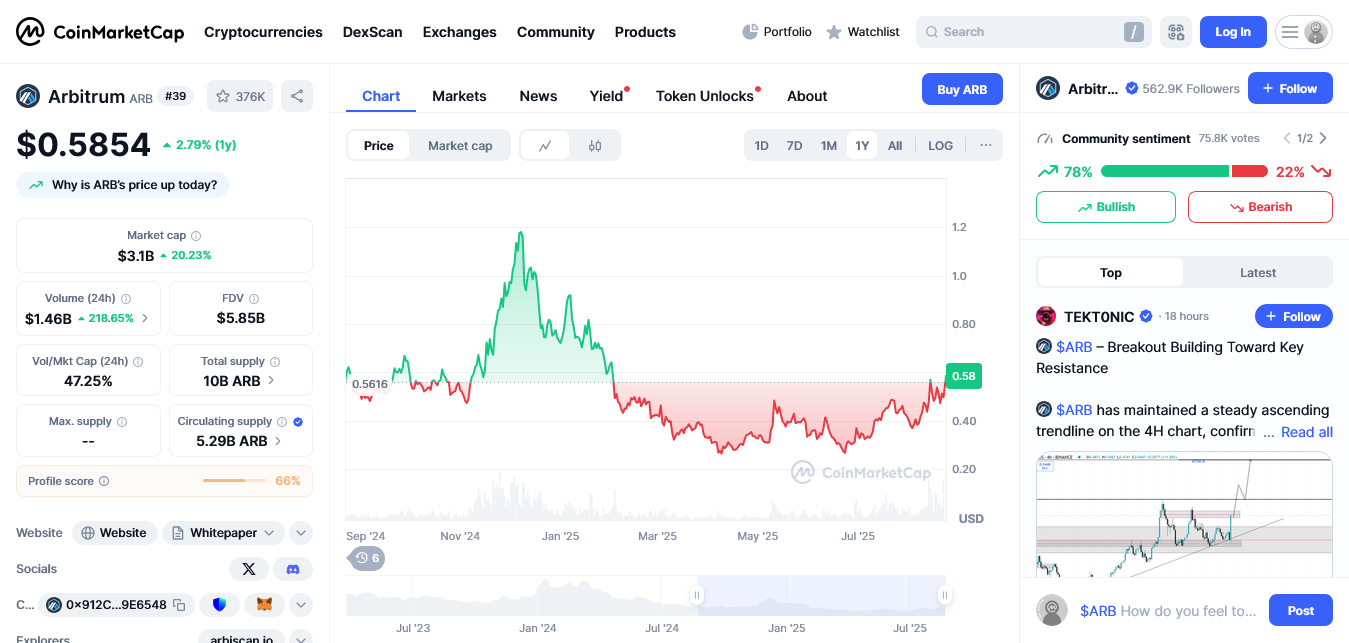

Arbitrum | CoinMarketCap

Arbitrum | CoinMarketCap

According to CoinMarketCap, the Arbitrum price is up by 23.67% in the past week. Additionally, experts say the Arbitrum price gains are due to its high DeFi activity. If things stay the same, the Arbitrum price might return to $1.

Unilabs: Powering the Web3 Asset Management Revolution

Built on Ethereum, Unilabs is creating an asset management ecosystem where investors can enjoy unmatched speed, flexibility, and access to diverse market segments with ease.

Unilabs’ decentralized ecosystem features four central funds, each targeted at AI assets, BTC-related derivative products, tokenized RWA assets, and PoW mining.

It’s not just about getting into different markets. Traders also get handy extras like custom reports, expert takes, market insights, and risk management tips. Basically, all the stuff that makes decision-making easier and keeps you investing with solid info.

Additionally, Unilabs also offers automated portfolio management. Here, it conducts risk profiling and customizes investment strategies. It also allocates assets dynamically, monitoring the market to ensure optimal returns and reduced risk.

Why Experts Say Unilabs Could Become one of the Top DeFi Tokens of 2025

One of the most attractive aspects of the Unilabs ecosystem is its UNIL token. Investors who hold UNIL will enjoy access to coin staking services, which could offer up to 122% APY.

Aside from staking benefits, token holders also enjoy governance benefits and exclusive access to new launches. This allows you to get ahead of the market and find the next big crypto before it goes mainstream.

Comparison Between Ethereum and Unilabs

|

Features |

Ethereum |

Unilabs |

|

Unique Selling Point |

Offering blockchain technology to developers and businesses |

Offering DeFi-powered asset management services to investors |

|

Price |

$4,739 |

$0.0108 |

|

Appeal |

Second-largest cryptocurrency |

New token with immense growth potential |

|

Growth potential |

76% in the past 12 months |

170% ROI since the start of its presale and up to 362% by the end of its presale |

Unilabs’ Presale Revenue Nears $16 Million

Now in stage 7 of its ICO, Unilabs has become one of the top tokens on crypto news sites. Over 2.1 billion UNIL tokens have been sold as investors have earned a 170% ROI increase since the start of its presale.

One UNIL token now costs $0.0108. However, current buyers stand the chance to earn up to 362% by the time of its official launch by joining Unilabs’ presale today.

Discover the Unilabs Finance (UNIL) presale:

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.