- Using Indacoin

- Maintaining Liquidity

- Indacoin Wallet: Reviews and Customer Support

- Indacoin Deposit and Withdrawal Fees

- Massive Fiat Withdrawal Fees

- Buy/Sell Limits

- Important Milestones and Partnerships

- Conclusion

Indacoin is aiming to become the UK’s top cryptocurrency exchange. In our Indacoin review, we look at the exchange’s mission, its fee structures as well as features like Indacoin wallet. Most importantly, we explain some of the limitations and potential obstacles to user adoption. Without further ado, here’s our Indacoin review.

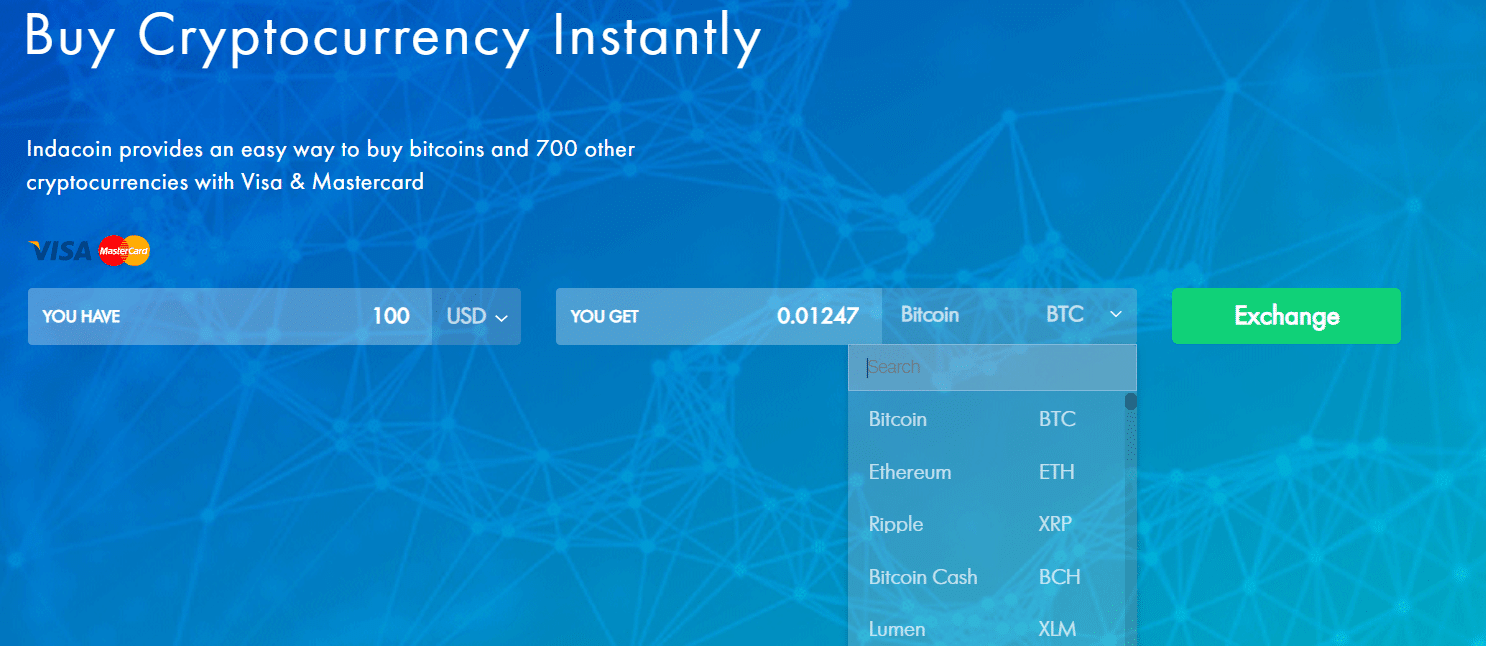

Using Indacoin

According to the FAQ section listed on the Indacoin website, the company has been working in the cryptocurrency field since 2013. Currently, the company headquarters is located in London. One of the main goals of this exchange appears to be to increase user accessibility to fiat-to-crypto trading options. While some exchanges require users to go through background checks and long registration processes, this exchange is reducing or even eliminating many of these barriers.

Users can choose to purchase a variety of cryptocurrencies via Visa or Mastercard. USD, EUR, RUB, AUD, and GBP are all accepted fiat currencies. BTC is the only accepted cryptocurrency. Then, users can enter basic information (email, mobile phone number, bank card details, and bitcoin wallet address) before converting to a given cryptocurrency.

When it comes to cryptocurrency support, the exchange accepts both popular cryptocurrencies and a number of altcoins. Over 100 cryptocurrencies can be purchased without having to go through any registration process. In total, over 700 cryptocurrencies are available for purchase on the site. As of August 2018, this exchange is available in all countries except for the United States.

Maintaining Liquidity

One of the biggest issues that many cryptocurrency exchanges face today is a lack of liquidity. Without liquidity, exchanges make it more difficult for users to trade fiat-to-crypto and crypto-to-crypto. According to Indacoin’s Crunchbase page, the exchange utilizes market-maker bots in order to maintain liquidity. By employing this type of technology, Indacoin is better able to create exchange rates that are closer to market rates. Additionally, the exchange is able to process large orders in a short amount of time without significantly impacting prices.

Indacoin Wallet: Reviews and Customer Support

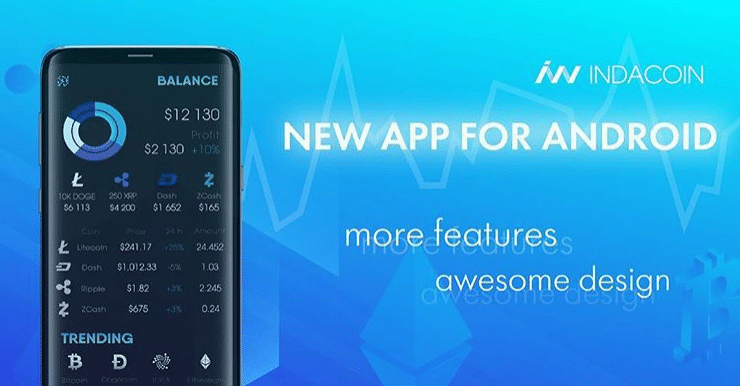

Indacoin Wallet is available across all major platforms. This includes mobile (iOS and Android) and desktop wallets. Indacoin wallet not only allows users to store various cryptocurrencies but also easily send P2P transfers. According to the exchange website, using Indacoin wallet is as simple as sending a message to a friend.

The reviews of this app are highly positive. As of September 17, 2018, the Indacoin wallet application for Android boasts 10,000 installs and an average rating of 4.8 stars with 2,980 reviews. The iOS app also has an average rating of 4.8 stars with 27 reviews. For those looking for a regularly-updated application, the development team provides this. For instance, looking at the version history of the iOS app, the project is committed to releasing frequent updates. These include bug fixes, performance improvements, and more.

Despite these stellar reviews, it’s important to note that some reviewers have claimed that transactions weren’t completed. Some people found that customer support was either unresponsive or not helpful in solving their issues. As we have seen in other cryptocurrency exchange reviews, customer support is unfortunately often a major issue with exchanges.

Indacoin Deposit and Withdrawal Fees

In order to buy cryptocurrencies, users have two main options. The first method is to use a debit/credit card (i.e. Visa or Mastercard), which includes a 4% fee. The second method is to use Payza, which includes a 2.9% + $0.30 fee. There is a 3% transaction charge for both buyers and sellers on every transaction made on Indacoin. Even though there isn’t a deposit fee for Bitcoin, there is a withdrawal fee of 0.0001 BTC.

Massive Fiat Withdrawal Fees

Looking at almost every Indacoin review available online, we see one common complaint: users can’t directly withdraw fiat in a convenient manner. Withdrawal fees for cryptocurrency to fiat conversions are 12% by using the exchange directly. This is especially high when considering other available options on the market like GDAX or Changelly provide much lower fees.

Fortunately, the exchange does offer an alternative. Users can utilize an online payment platform called Payza to significantly reduce withdrawal fees. For example, withdrawing funds via bank transfer with Payza costs only $0.50. Withdrawing funds to a credit card costs a standard fee of $8 for any amount less than $5,000. Reliance upon a separate, third-party processor isn’t optimal. However, in some circumstances, it provides a more convenient solution.

The bad news is that Payza takes around 20 business days to send fiat withdrawals. When considering that there are numerous Fintech platforms capable of achieving faster transfers, this could dissuade some users. In essence, users have to choose between faster withdrawal completion times with much higher fees (Indacoin) or slower withdrawal completion times with lower fees (Payza).

Buy/Sell Limits

For Indacoin users, buy and sell limits are restrictive. For example, for a first-time buy/sell the minimum amount is $15. The maximum amount is $50. The second transaction can be up to $200 but can’t be done until at least four days after the first purchase. The third transaction is limited at $500 and can only be done seven days after the first purchase. There is also a first-month buy limit of $5,000. After this, there aren’t any limitations. While the ability to easily buy a variety of cryptocurrencies directly with fiat is enticing, these unexplained buy/sell limitations do seem to present a major obstacle to new user adoption.

Important Milestones and Partnerships

In March 2018, the team announced that users could directly sell cryptocurrencies for fiat within the Android mobile app. Fees on these transactions were set at 7%. In August 2018, Indacoin released a new app for Android as well as the addition of coin swap functionality. In addition, Indacoin has partnered with projects like ZenCash, Alt.Estate, and Coinranking.

Indacoin also offers companies partnership opportunities via API integration. Both light and standard integrations can be used to enable any company’s service to run the cryptocurrency exchange features (i.e. payment processing via credit/debit cards).

Conclusion

In our Indacoin review, we found several, significant obstacles to user adoption. Even though this exchange does offer innovative features like Indacoin wallet, potential users should also consider Indacoin’s high fees and buy/sell limits.

Improvements to fee structures, withdrawal processes, and buy/sell limits could propel Indacoin to become a top exchange. It will be interesting to see how Indacoin continues to innovate in these areas and what role the company will serve in the increasingly competitive cryptocurrency exchange market.

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.