GDAX Review

Global Digital Asset Exchange, most often referred to as GDAX, is one of the world’s most popular places for the exchange of cryptocurrencies.

GDAX is run by the same company that owns Coinbase, arguably the more popular cryptocurrency exchange platform of the two.

While both provide the same functionality, many advanced investors inevitably make GDAX their primary form of crypto trading.

| Key Information |  |

|---|---|

| Site Type | Cryptocurrency Exchange |

| Beginner Friendly | |

| Mobile App | |

| Company Location | San Francisco, CA, USA |

| Company Launch | 2012 |

| Fiat Deposit Methods | Bank Transfer |

| Fiat Withdrawal Methods | Bank Transfer |

| Available Cryptocurrencies | Bitcoin, Ethereum, Litecoin |

| Community Trust | Great |

| Security | Great |

| Fees | Very Low |

| Customer Support | Good |

| Site |

Who Should Use GDAX?

The GDAX platform is better suited for people with an intermediate understanding of crypto trading, institutional investors, and professional investors. GDAX may look slightly daunting for beginners, but it’s fairly easy to understand once you get the hang of it.

Customer USD funds in GDAX are FDIC insured, meaning your balance up to $250,000 is protected.

The exchange has a variety of digital currency pairs like Bitcoin, Ethereum, Litecoin, as well as fiat currencies such as USD and EUR.

Origins of GDAX

GDAX and Coinbase are owned by the same parent company, and each exchange is geared towards different purposes.

Coinbase as we know it today is very easy to use, and this is largely why so many first-time Bitcoin buyers start out with Coinbase.

Adam White, the Vice President of Coinbase, noted “We believe exchanges that provide advanced trading features and meet regulatory requirements are most likely to succeed long term.”

Chances are if it’s your first time buying a cryptocurrency, you want the process to be as simple as possible. Coinbase recognized the gap between mass user adoption and robust functionality, and decided to split into two different business models. Coinbase aims to on-board as many new traders as possible, and GDAX aims to provide more educated investors the functionality they need.

In White’s words, “Coinbase is designed for retail customers while GDAX is focused on serving sophisticated and professional traders.”

It’s important to note how the Coinbase team handled a flash-crash in June. Ethereum prices on GDAX took a nosedive from $317 to as low as 10 cents due to a multimillion-dollar market sell order. This gigantic sell order triggered an avalanche of around 800 automated stop-loss orders and margin-funding liquidations.

The fall caused quite the commotion among traders who woke up to chunks or all of their Ethereum gone due to the GDAX crash, but the Coinbase team handled it fairly well. Trading of ETH-USD was temporarily halted, but then restored after the Coinbase team ensured there weren’t any problems with the GDAX systems.

GDAX honored every single transaction using company funds and took responsibility for the flash crash. While the financial damage was mitigated, users still noted that the lack of accessibility to the platform during the crash was aggravating.

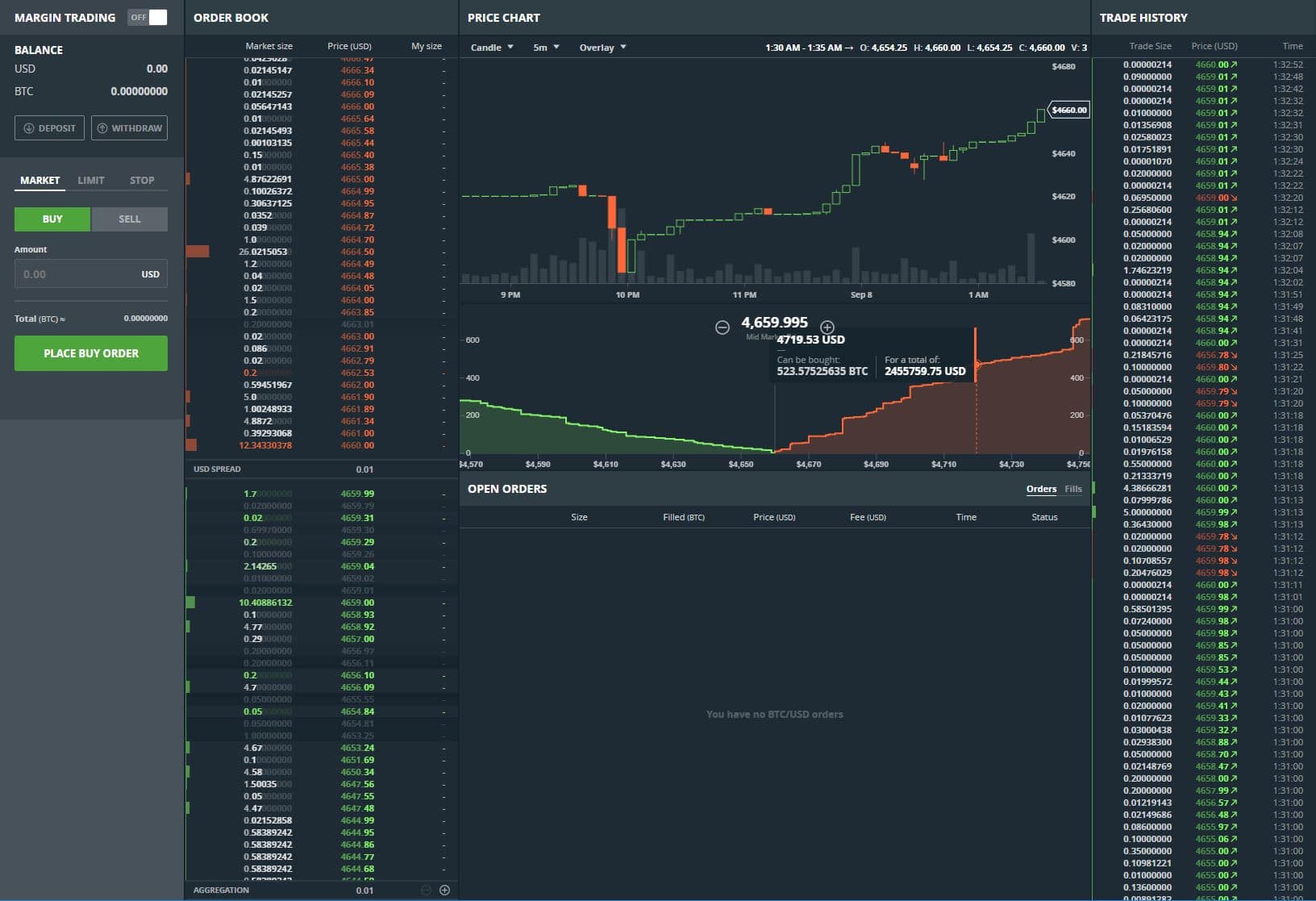

GDAX Review: Exploring the Platform

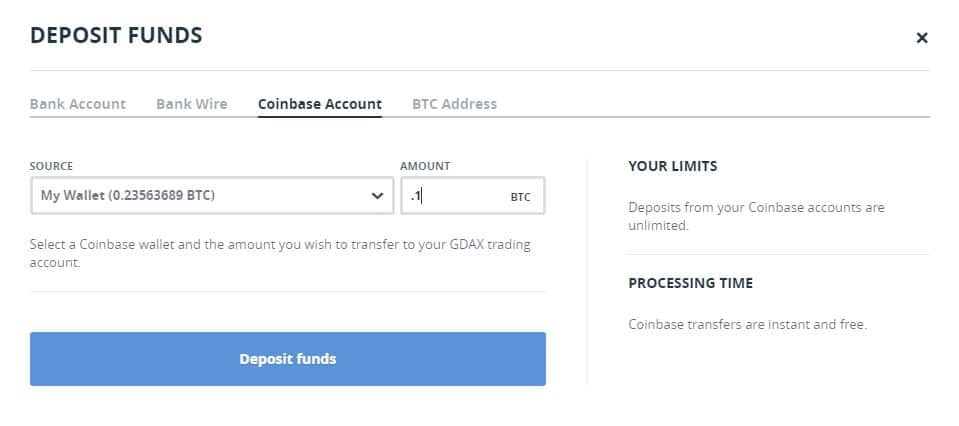

In order to use GDAX, all you have to do is have a Coinbase account.

You can transfer funds from your Coinbase account to your GDAX instantly with no fees.

Overall, what I like most about GDAX is that it has extremely low fees, with no fees charged on maker trades. Taker fees start at a mere .25%, and volume-based discounts can drop these fees down to .1%.

This is a stark difference from its brother Coinbase, which charges 1.49% per transaction.

Keep in mind that they both use the same back-end and are both insured and backed by some of the biggest players in the finance world such as the New York Stock Exchange, Union Square Ventures, and Andreessen Horowitz.

GDAX comes with a very intuitive interface, provided you have an intermediate understanding of how these exchanges operate. It also provides users with charting tools and a trade history. A few more GDAX features include:

- Real-time market data. See the most up-to-date crypto prices.

- Flexible API allows for secure and programmatic trading bots. This is a big reason many institutional and professional investors prefer GDAX. Regular IT security checks and financial audits. It’s important to note that the Coinbase team places a monumental amount of value on keeping their platforms safe.

- Regular IT security checks and financial audits. It’s important to note that the Coinbase team places a monumental amount of value on keeping their platforms safe.

- Secure storage. GDAX keeps 98% of their users’ funds off the Internet in cold storage.

- FDIC insured USD balances up to $250,000.

- Wide variety of fiat and cryptocurrency pairs. Trade between BTC/USD, ETH/USD, ETH/BTC, LTC/BTC, LTC/EUR, LTC/USD, BTC/GBP, BTC/EUR, and others.

On top of that, GDAX allows you to trade using a variety of different strategies.

- Market buy: This is pretty standard on any exchange and can be done on Coinbase, but if you do it on GDAX you will pay a lower fee.

- Limit buys: This allows you to set a price limit that you want to buy something at. For example, if you think the price of Bitcoin is going to drop overnight, you can set a limit buy for a lower price. If the price does drop, GDAX will fulfill your order at the lower price.

- Stops: This allows you to set stop losses, which means GDAX will automatically sell a specified amount of your cryptocurrency if the price drops to a certain threshold.

- Margin Trading. This means you can margin trade with a leverage between 2x and 3x depending on the crypto trading pair. This is a very risky way to go about trading, but the upside can be enormous. Tread lightly.

The only downside is that you can’t buy as many altcoins as other exchanges, and are limited to the ones provided on GDAX. It’s likely that more altcoins will eventually be added to the exchange, but for the time being you just have to stick with what’s on there currently.

Final Thoughts

Overall, GDAX is a great exchange because it provides the same security and back-end trading functionality as Coinbase but with a fraction of the fees.

If you’re a beginner, it may seem like a scary big step to jump from something as simple as Coinbase into GDAX. It looks complicated, but you’ll get the hang of it after you watch a few tutorial videos and play around with the options. In the end, you’ll be able to save a ton of money on fees, as well as enjoy the much greater functionality.

[wp-review id=”3179″]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.