TLDR

- Q2 revenue of $311.6M missed estimates by 4.1%, flat year over year.

- Adjusted EPS of $0.22 missed consensus by 32.5%, down 64.5% YoY.

- Q3 revenue guidance of $335.4M is 14.3% below analyst forecasts.

- Backlog rose 71.9% YoY to $1.12B despite operational disruptions.

- ERP rollout and supply chain issues impacted production in multiple facilities.

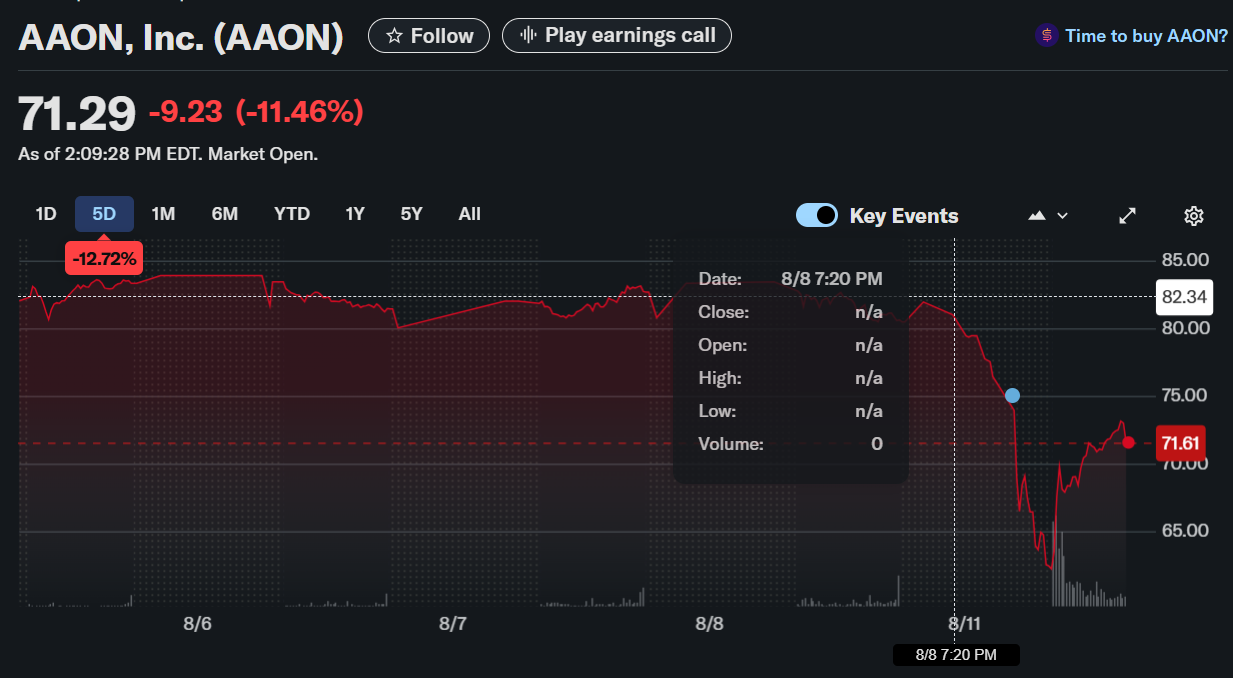

AAON, Inc. (NASDAQ: AAON) shares were down 11.68% to $71.11 in midday trading on August 11, 2025, after reporting disappointing second-quarter results and weaker guidance.

The earnings date was August 11, 2025. The heating, ventilation, and air conditioning manufacturer posted Q2 revenue of $311.6 million, missing Wall Street estimates of $325 million and falling 0.6% from the same period last year. Adjusted EPS came in at $0.22, 32.5% below expectations and down sharply from $0.62 a year earlier.

Q3 revenue guidance of $335.4 million was 14.3% under consensus estimates, raising concerns about near-term growth despite strong demand indicators.

AAON, $AAON, Q2-25. Results:

📊 Adj. EPS: $0.22 🟢

💰 Revenue: $311.6M 🟢

📈 Net Income: $15.5M

🔎 ERP rollout and supply constraints hit production and margins; backlog surged 71.9% YoY to $1.12B, signaling strong demand ahead. pic.twitter.com/wXyXKyNesM— EarningsTime (@Earnings_Time) August 11, 2025

Operational Challenges and Segment Performance

The AAON Oklahoma segment posted an 18% sales decline due to supply chain constraints and slower production ramp-up. In contrast, BASX and AAON Coil Products segments saw robust growth of 20.4% and 86.4%, respectively, driven by demand for BASX-branded data center equipment. However, ERP system implementation at the Longview, Texas facility disrupted coil and finished product production, affecting both Longview and Tulsa operations.

Gross margin fell to 26.6% from 36.1% last year, impacted by lower volumes and ERP-related inefficiencies. SG&A expenses rose to $59.1 million from $45.9 million, reflecting higher staffing, technology investments, ERP costs, and a one-time incentive fee for the Memphis facility.

Backlog Strength and Market Demand

Despite operational setbacks, AAON ended the quarter with a backlog of $1.12 billion, up 71.9% year over year. Bookings for both AAON- and BASX-branded equipment grew strongly, with data center market demand fueling BASX orders and national accounts driving AAON-branded sales. Management remains confident in the long-term potential, supported by accelerating production and backlog momentum.

Profitability and Long-Term Trends

AAON’s operating margin contracted to 7.6% from 21.7% a year ago, well below its five-year average of 16.1%. EPS growth has slowed over the past two years, with adjusted EPS down 8.3% annually in that period. For full-year 2025, Wall Street expects EPS to grow 58.1% to $1.52.

CEO Outlook

CEO Matt Tobolski acknowledged the results fell short of expectations due to ERP-related disruptions but emphasized the investment’s importance for long-term success. He noted production improvements at both Tulsa and Longview facilities, with July marking Tulsa’s best production month of the year. Management expects sequential improvement in output during the second half of 2025, though full-year guidance has been lowered to reflect ongoing inefficiencies.

Performance Snapshot

Year-to-date, AAON stock is down 39.13%, compared to the S&P 500’s 8.90% gain. One-year returns are 17.23% versus the index’s 19.85% gain, while the company has outperformed over the three- and five-year horizons.