ICO Statistics

2017 was a breakout year for cryptocurrencies. The price hike of popular coins aside, the sector attracted an influx of new investors. According to data from ICOwatchlist.com, a total of $2.3 bln was raised in the year from various ICO crowdfunding campaigns.

Of the project’s funded, FileCoin tops the list, successfully raising a staggering $522 mln. That’s a significant amount of capital, and it reflects investor confidence in the market.

Fast forward to 2018 and $6.7 bln has been raised from crowdfunding efforts in 2018. Telegram has attracted the most funding with $1.7 billion from their ICO pre-sale. However, they canceled their much-hyped sale back in May to the dismay of public investors. Telegram didn’t specify a reason for canceling their ICO. Speculation, though, suggests that stricter regulations may have played a major role in influencing their decision.

Telegram is not alone in pulling out of its ICO. Here are a handful of other coin offerings that went bust in the midst of their fundraising.

A Sneak-Peek at Some ICO failures

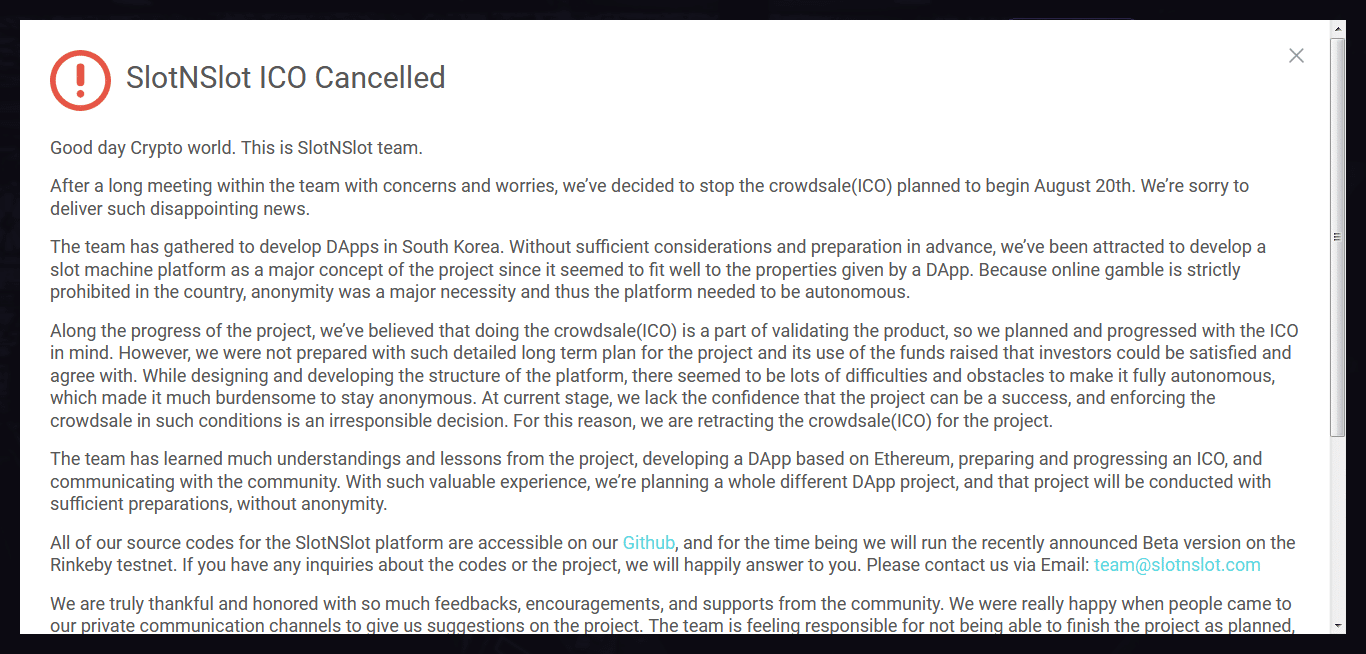

Slot N Slot

Slot N Slot wasn’t a scam, but it made our list of failed ICOs for its inability to continue with development. The project was meant to provide an extremely low-cost autonomous gambling platform accessible to anyone in the world. It was going to use Ethereum to provide its services.

The team’s idea wasn’t necessarily original. They did, however, put effort into the ICO and producing a playable beta version. During the design and development stages of the platform, developers faced a host of obstacles and difficulties. Upon this realization, they issued a press release indicating that they had failed and were altogether abandoning the project.

OneCoin

OneCoin was another huge ICO flop that many experts considered to be an international Ponzi scheme from the get-go. It had a website full of technical problems and spelling errors. They also lacked a working prototype, which is essential for an ICO project. OneCoin also accepted funding in fiat currency, unlike a majority of ICOs that used Bitcoin or Ether to raise capital. Several governments had already issued warnings to their citizens about OneCoin and the fact that it could be a possible scam. In fact, the Italian Government suspended OneCoin operations in its country.

Droplex

Droplex initially masqueraded as a legit ICO by impersonating another company. Apparently, Droplex’s whitepaper was a word for word copy of Quantum Resistant Ledger’s own. Unfortunately, a few unsuspecting investors fell for the trap and Droplex scammed roughly $25,000 out of them. Investors who were familiar with QRL raised red flags and warned other investors, so the damage was thankfully minimal.

The Issue

Previously, we looked at why so many ICOs are failing. Apart from technological issues, regional disparities, and bad project ideas, we also found out that a majority of ICOs don’t have a functional prototype for what they intend to build in the long-run. Others are even completely void of a roadmap. Some ICOs also spend a considerable amount of time perfecting their whitepapers, websites, and marketing campaigns. This, however, doesn’t justify the outrageous amounts of capital raised in initial coin offerings.

It’s up to innovators to go a step further to tell their investors the truth about their technology and what it can do to revolutionize an industry, not what they hope it might achieve someday. Giving investors the cold hard truth may be a bitter pill for some to swallow, but it will help to keep people from investing in projects that may fail.

Also, most investors nowadays don’t research projects well enough, and they end up investing in them just because others are doing so. Most ICO investors judge ICO projects based on how high the value of the token will go. An increase in token value simultaneously signals an ICO’s success which, in turn, attracts more investors.

[thrive_leads id=’5219′]

Conclusion

Some ICOs will truly create lasting change in the world with their innovative ideas. However, chances are, most won’t fulfill their promises or expectations. Only the most promising and innovative projects will remain. The rest will most likely fade out. Therefore, it’s crucial for investors to differentiate between shrewd and misleading marketing efforts and authentic product development. Establishing a clear difference between the two will help investors choose those ICOs guaranteed to succeed.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.