TLDR

- Q4 adjusted EPS of $2.26 beats estimates by 1.8% and rises 8.1% YoY

- Revenue climbs 7.5% YoY to $5.13 billion, topping consensus by 1.5%

- FY26 EPS projected to grow 8-10%; revenue growth forecast at 5-6%

- Adjusted EBIT margin expanded 50 bps; Employer Services up, PEO Services steady

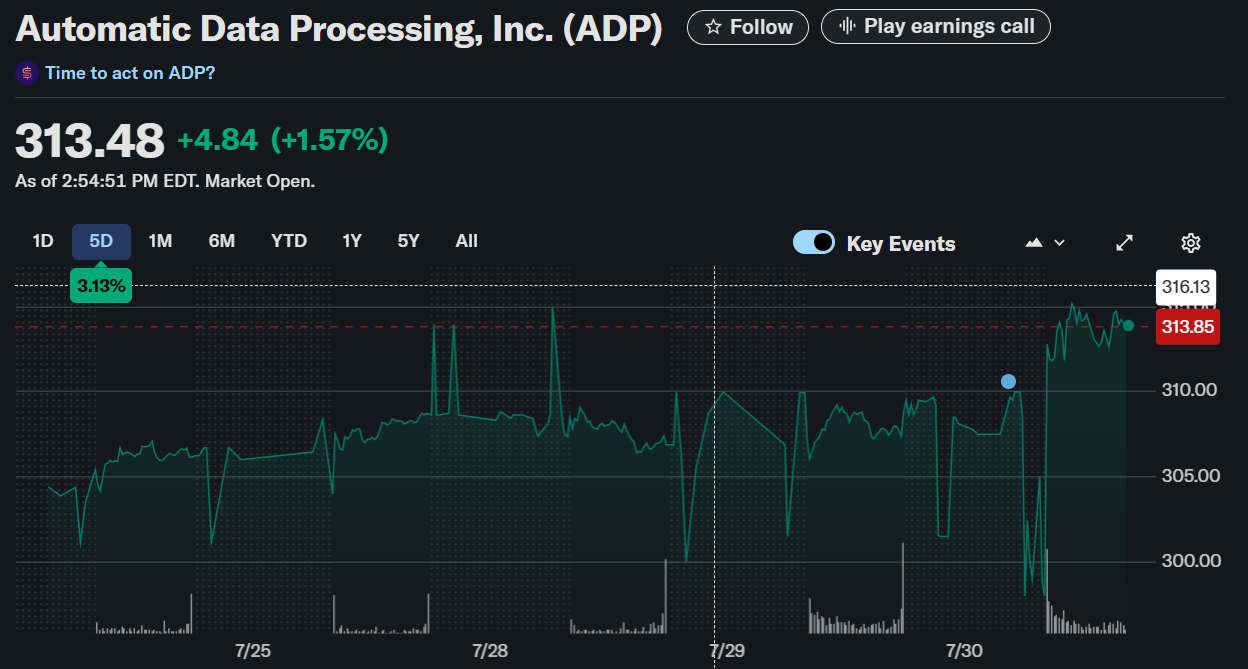

- ADP stock trades at $313.69, up 1.64% midday post-earnings

Automatic Data Processing, Inc. (NasdaqGS: ADP) reported fourth-quarter fiscal 2025 results on July 30, 2025, that beat Wall Street expectations on both earnings and revenue. The stock traded at $313.69 as of 1:28 PM EDT, reflecting a 1.64% intraday gain following the strong results and improved margin guidance.

Automatic Data Processing, Inc. (ADP)

Automatic Data Processing, Inc. (ADP)

Q4 Financial Highlights

ADP posted adjusted earnings of $2.26 per share, surpassing the Zacks Consensus Estimate of $2.22 and growing 8.1% from the $2.09 recorded a year ago. Net income came in at $910.6 million on a GAAP basis. Total revenue rose 7.5% year over year to $5.13 billion, outpacing analyst projections of $5.05 billion.

This marks the fourth consecutive quarter in which ADP has exceeded earnings and revenue estimates. Strong performances across core services contributed to the beat.

ADP, $ADP, Q4-25. Results:

📊 Adj. EPS: $2.26 🟢

💰 Revenue: $5.13B 🟢

📈 Net Income: $1.21B

🔎 Strong revenue and EPS growth driven by client funds interest and record sales in PEO segment. pic.twitter.com/93r4eXnNsj— EarningsTime (@Earnings_Time) July 30, 2025

Segment Performance

Employer Services brought in $3.5 billion in revenue, a growth of 8% YoY, though slightly below internal estimates of $3.8 billion. Pays per control rose 1% compared to last year.

PEO Services posted 9% revenue growth, reaching $1.2 billion. However, this fell short of the $1.7 billion estimate. Worksite employees under PEO Services rose 3% year over year to 761,000.

Interest on client funds climbed 11% to $308 million, as ADP benefited from a higher average client fund balance of $38.1 billion and a 20-basis point improvement in interest yield to 3.2%.

Margins and Cash Flow

Adjusted EBIT rose 9% year over year to $5.3 billion. The margin improved by 50 basis points to 26%, supported by margin expansion in Employer Services, though PEO Services experienced a slight margin contraction.

ADP ended the quarter with $3.3 billion in cash and equivalents and $4 billion in long-term debt. Operating cash flow came in at $1.4 billion.

FY26 Guidance

Management now expects FY26 earnings per share to grow between 8% and 10%. Revenue growth is forecast in the range of 5% to 6%. The adjusted EBIT margin is anticipated to increase by 50 to 70 basis points. The company also projects an effective tax rate of 23%.

Employer Services revenue growth expectations have been revised to 5-6%, down from the prior 6-7%. PEO Services guidance has also been trimmed to 5-7% from the earlier 6-7% outlook.

Performance Overview

As of July 30, 2025, ADP’s stock has returned 8.27% YTD and 24.23% over the past year. The 3-year return stands at 38.64%, and its 5-year return of 161.97% significantly outperforms the S&P 500’s 96.65% over the same period.

Despite modest underperformance versus the market YTD, ADP remains a solid performer with a strong long-term track record and reliable earnings growth. Investors will be closely watching how revised guidance translates into performance in the coming quarters.