The cryptocurrency market experienced a sharp pullback on Friday as concerns arose about a potential US government shutdown on October 1. Bitcoin showed significant volatility with a 2.5% decline, while popular altcoins Cardano and BNB declined by 4.8% and 2.8%, respectively.

However, it’s not all bad news; short-term volatility is common in crypto, and experts remain optimistic about both the mid and long-term prospects of leading digital assets. This is partly driven by October’s track record, which is traditionally the best-performing month for Bitcoin, hence its nickname “Uptober.”

As a result, experts feel a quiet sense of confidence right now, but instead of betting on top altcoins like Cardano and BNB, many are choosing a new alternative called Best Wallet Token (BEST). Currently in presale, BEST has raised over $16 million so far, making it one of the strongest launches on the market today.

The BEST token powers Best Wallet, a new multichain Web3 storage solution that supports Cardano and BNB, as well as other blockchains, including Bitcoin, Ethereum, XRP, and Solana. This combination of early-stage momentum and strong use case is why BEST is considered one of the best altcoins for Uptober.

Cardano, BNB Predicted to Surge This Q4

Though Cardano and BNB have experienced price declines today, respected industry analysts remain undeterred by short-term volatility. Starting with Cardano, analyst Deezy notes that it has recently formed a chart setup similar to those of previous downturns, which preceded swift upward moves.

He points to two previous cases where ADA’s price dropped and the relative strength index (RSI) fell into the oversold region (below 30), but then the price sharply rebounded. This same thing is happening again, which makes Deezy bullish.

But rather than making a specific forecast, Deezy simply wrote, “You know what happens to ADA when everyone is bearish, right?” implying that another upward move is imminent.

You know what happens to ADA when everyone is bearish, right?

Every. Single. Time.

Lock in 🚀 pic.twitter.com/XVjxAVDTew

— Deezy (@deezy_BTC) September 25, 2025

There are also bullish fundamentals supporting this technical outlook, with Reliance Global Group initiating a Cardano treasury reserve this week. Additionally, seasonal patterns observed in Q4 also suggest a positive outlook for ADA.

That said, it’s BNB that’s making all the noise right now, with its price reaching a new all-time high (ATH) of $1,080 this week. Despite a sharp pullback to $950 on Friday, analysts remain confident that new highs will be achieved in the coming months.

One analyst, known as Batman, highlights a long-term trendline resistance, suggesting that BNB could turn it into support by bouncing in the $900-$950 range, before resuming its upward trend.

Major coins that have rallied hard, like $BNB, are now retesting their old bearish resistance as new support.

Instead of getting scared, consider this a prime opportunity to add more. pic.twitter.com/WshKN0ky1b

— BATMAN ⚡ (@CryptosBatman) September 25, 2025

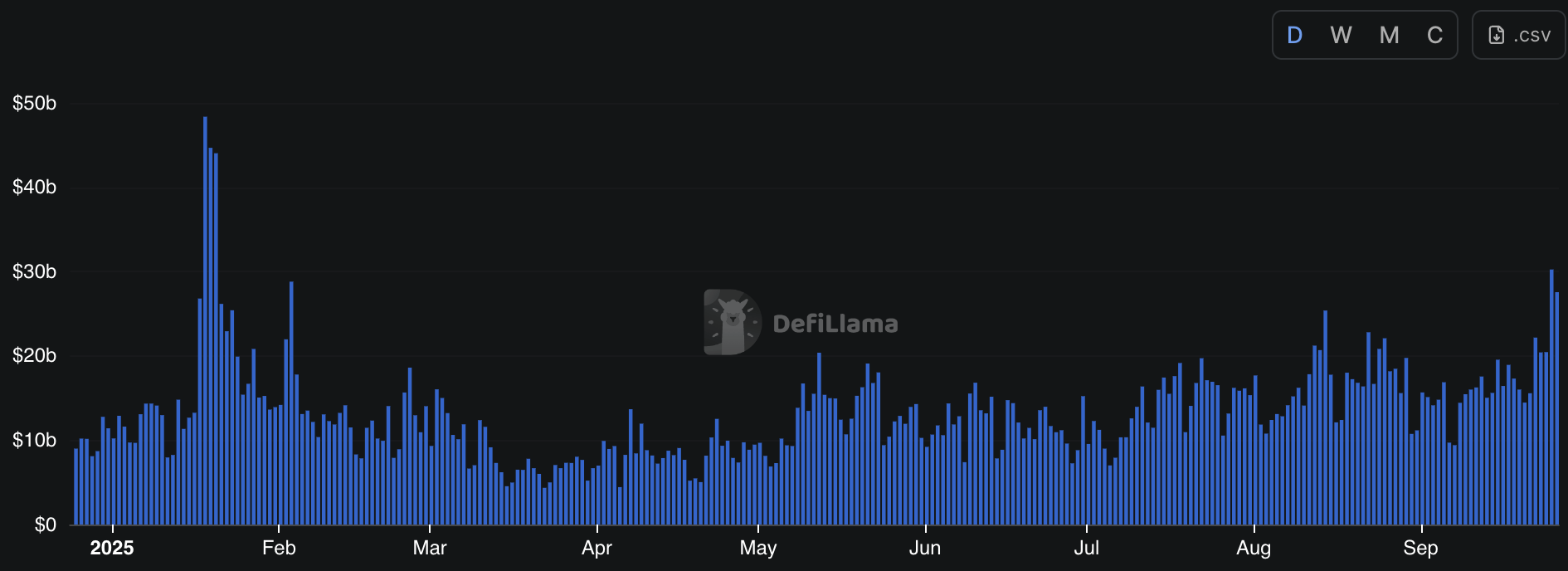

Fundamentally, a major factor behind BNB’s momentum is the surge in on-chain activity, with the launch of its new futures exchange token, Aster, causing an on-chain frenzy that resulted in a nine-month high in DEX volume and an all-time high for on-chain perpetual futures volume.

But here’s the key point: these large-cap cryptocurrencies, while appearing bullish, are unlikely to see gains as substantial as those of smaller low-cap gems in the upcoming months. And regarding which projects could generate the biggest returns, many analysts are picking Best Wallet Token. Let’s look at why that is.

But here’s the key point: these large-cap cryptocurrencies, while appearing bullish, are unlikely to see gains as substantial as those of smaller low-cap gems in the upcoming months. And regarding which projects could generate the biggest returns, many analysts are picking Best Wallet Token. Let’s look at why that is.

Expert Ranks Best Wallet Token as Top Altcoin for Uptober

Despite rapid developments in crypto adoption, with everyone from BlackRock to the United States government supporting the industry this cycle, the Web3 wallet sector, though inherently critical to blockchain operations, remains severely underdeveloped.

Wallets are not only confusing to set up; they’re slow, clunky, and, worst of all, risky. They’re fragmented, so users need different apps for different chains, which can easily lead to misplaced seed phrases and permanent account lockouts.

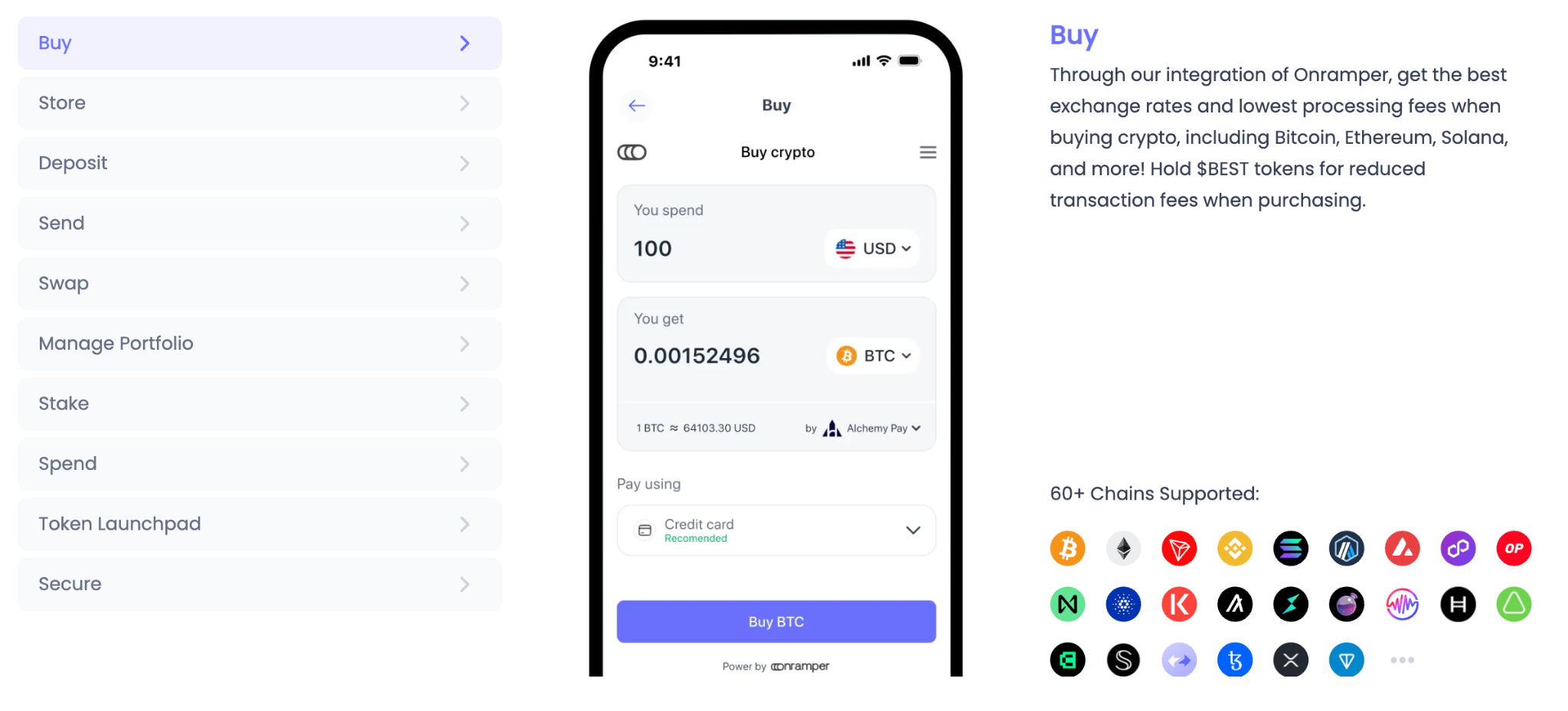

Best Wallet Token is a new cryptocurrency that analysts believe will capitalize on this opportunity. It’s the native token of Best Wallet, a multichain Web3 app supporting over 60 blockchains.

It features Fireblocks MPC security technology, allowing users to create secure cloud backups of all their accounts without seed phrases. Additionally, it offers a wide range of built-in features, including a futures exchange, a cross-chain DEX, a presale aggregator, a staking aggregator, and even a crypto debit card.

It features Fireblocks MPC security technology, allowing users to create secure cloud backups of all their accounts without seed phrases. Additionally, it offers a wide range of built-in features, including a futures exchange, a cross-chain DEX, a presale aggregator, a staking aggregator, and even a crypto debit card.

The app is powered by the BEST token, which provides trading fee discounts, higher staking yields, governance rights, and access to promotions on partner projects. This inherent utility, combined with its strong use case, is why top analysts like Borch Crypto say it’s the best altcoin to buy and suggest it could even deliver 100x gains.

Can BEST realistically outperform ADA and BNB?

Given the inherent bullishness of October and Q4 – combined with the strong fundamentals of all three cryptocurrencies – holders of ADA, BNB, and BEST tokens will likely be richer three months from now.

And although there is no guarantee that BEST will deliver 100x gains like Borch Crypto predicts, the fact remains: it’s a low-cap cryptocurrency that’s mostly flying under the radar, yet it addresses pressing industry issues. That’s a textbook setup that could easily lead to market-leading gains as word spreads, exchange listings occur, and the community grows.

Visit Best Wallet Token Presale

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.