The crypto market is rebounding this week after a downturn in mid-to-late September, with Bitcoin leading the way as it hits highs of $121,000 on some exchanges. Currently trading at $119,700, its price has dropped slightly, but it remains up 1.1% for the day.

At its current level, Bitcoin is just 3.5% below its all-time high (ATH) set in August, a level close enough to be surpassed in just a few strong 4-hour candles. And with a breakout from the bearish trend, many analysts believe that new highs are on the horizon.

As Bitcoin approaches its all-time highs, whales are buying up altcoins they believe could see the biggest returns in the coming weeks. Three top performers are Bitcoin Hyper, Pump.fun, and Aptos.

Let’s explore what these three projects are about and why they might be the best altcoins to buy now. But first, it’s important to understand what’s driving Bitcoin’s recovery and how that could impact the market.

Bitcoin Surges as Government Shutdown Fears Subside

Bitcoin declined from $118,000 to below $109,000 in September amid concerns about a partial U.S. government shutdown, as lawmakers failed to reach a funding agreement.

Fear and uncertainty about the event and its potential consequences led to a drop in prices. However, since the shutdown began on Wednesday, prices have shown significant strength.

Despite the initial fears, history suggests that government shutdowns aren’t necessarily bearish for risk assets – the S&P 500 has climbed during every shutdown since 1990.

And considering the typical seasonality effects of October and Q4 for cryptocurrencies, it might have been a perfect storm hidden in plain sight, with traders selling BTC when they should have been buying.

At the current valuation of $119,700, Bitcoin trades at a 9.5% premium over the past week and an 8.2% premium over the past 30 days. Friday was also only the fifth day in history that Bitcoin surpassed the $120,000 mark.

Meanwhile, CoinMarketCap’s Fear and Greed Index has sharply increased, rising from 34 (deep in Fear) on Sunday to 57 on Friday, now bordering on Greed.

Clearly, market sentiment has shifted, and this creates an opportunity for traders to profit. So, what is the best cryptocurrency to buy? Let’s look at what whales are investing in.

Bitcoin Hyper

Bitcoin Hyper is a Bitcoin Layer 2 blockchain designed to address the network’s issues of slow speeds and limited functionality. The project is built using ZK rollups and Solana Virtual Machine tooling, creating a scalable environment that also inherits Bitcoin’s security and immutability guarantees.

Currently, Bitcoin Hyper is in a presale, having raised an impressive $20.4 million, with $700,000 of that coming in the past 24 hours alone. For reference, $20 million is more than Ethereum raised during its ICO.

Bitcoin Hyper clearly has the attention of wealthy investors, and this includes prominent trader Crypto Tech Gaming, who recently stated it could be the best altcoin to buy.

Occasionally, a project emerges with a use case so bold that it might actually succeed, as few have dared to attempt it before. Bitcoin Hyper is bringing smart contracts, DeFi, and meme coins to Bitcoin – so it definitely has the potential to be one of those anomalies.

Visit Bitcoin Hyper Presale

Pump.fun

When it comes to altcoins that have already made a significant impact on the market, few have shaken things up this cycle as much as Pump.fun. It’s the leading meme coin launchpad, enabling anyone to create their own project with just an idea, a JPEG image, and a few clicks.

The project’s virality is built on early participation; investors can buy in at the very start of new projects, when their value ranges between $10,000 and $100,000. If the meme coin they purchase reaches bonding and gains substantial traction on the open market, there’s potential for early participants to turn hundreds of dollars into millions.

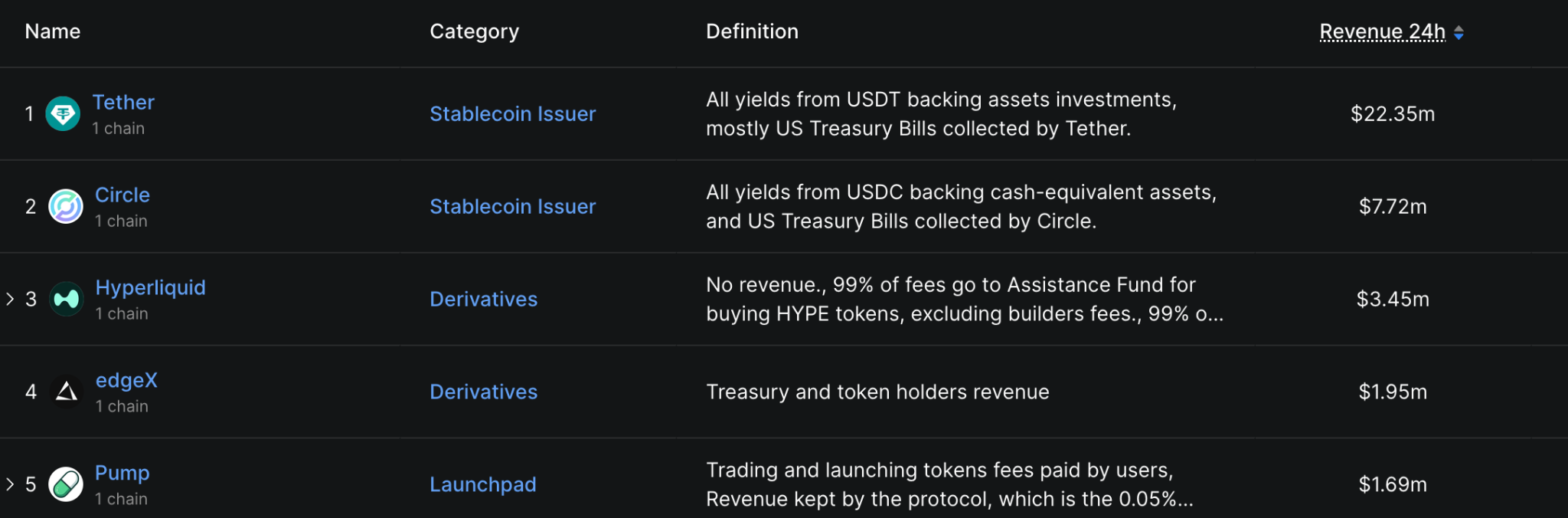

As a result, Pump.fun consistently ranks as one of the highest-revenue-generating protocols in the crypto space, currently holding fifth place over the past 24 hours, only behind Tether, Circle, Hypeliquid, and edgeX.

However, compared to those top three, Pump.fun’s valuation of $2.4 billion leaves significant room for growth. That’s partly why whales have been pouring into PUMP recently, with its price surging 31% in the past week.

Aptos

Aptos is a Layer 1 blockchain focused on speed and user experience, designed to handle thousands of transactions per second while keeping fees low and confirmation times near-instant.

One of the standout events in Aptos recently is the integration of USD1, the stablecoin launched by the DeFi project World Liberty Financial, which is associated with the Trump family. This highlights Aptos’ ability to stay current with industry trends and is one reason why whales are actively acquiring the project.

Another factor is that Aptos just announced it will be integrated with Backpack wallet, a next-generation crypto wallet focused on interoperability. This increases Aptos’ accessibility to fresh users and also allows assets from the Backpack exchange to be used on the Aptos Layer 1.

Aptos is live on @Backpack Wallet 🎒

Global brands need global rails. Global trading needs a global engine.

Backpack unlocking access to Aptos brings the peak of money movement to all with day one support from across the Aptos ecosystem.

Money Moves Better on Aptos 🌐 pic.twitter.com/Am5SjLQT1X

— Aptos (@Aptos) October 2, 2025

As a result, the Aptos price has rallied 4.4% today, outpacing the returns of Bitcoin, Pump.fun, and many other leading altcoins. Moreover, the project has also experienced similar gains to PUMP over the past week, rising by 29%.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.