Bitcoin has had a scaling problem for years. It’s the most secure blockchain on earth, but it wasn’t designed for speed or advanced apps. That’s not great if you want developers to create anything exciting.

Ethereum went the other way. It’s a general-purpose blockchain that often needs relief valves like Optimism and Arbitrum. Bitcoin intentionally keeps its base layer lean – that means simple scripts, conservative upgrades, and a culture that values security over features.

The result? Huge parts of crypto – DeFi, NFTs, gaming – operate elsewhere while Bitcoin stays stuck. That gap has been evident for a long time, especially given the amount of idle BTC out there.

Bitcoin Hyper (HYPER), a new Layer-2 network, aims to unlock that trapped potential. It integrates with Bitcoin’s security, then adds the performance and programmability that developers want. Could HYPER be the best crypto to buy now after raising $14 million in presale?

What Makes Bitcoin Hyper Different From Other Bitcoin Layer-2s?

Bitcoin Hyper isn’t trying to make payments faster; it’s going for full programmability on top of Bitcoin. This means smart contracts, DeFi, RWAs, meme coins, and staking – features you expect from Ethereum or Solana, now for Bitcoin users.

A canonical bridge locks real BTC on the main chain and mints wrapped BTC on Bitcoin Hyper’s Layer-2, so value moves quickly and cheaply. Execution runs on the Solana Virtual Machine (SVM), enabling parallel processing and thousands of transactions per second (TPS) – far beyond what Bitcoin is capable of.

Compared to the Lightning Network, which is brilliant for micropayments but limited for apps, Bitcoin Hyper offers much more flexibility. And compared to Stacks or Rootstock, it leans on the SVM for higher throughput and faster execution.

Unsurprisingly, some big names are noticing. Content creators like Crypto Tech Gaming have already been discussing how disruptive Bitcoin Hyper could be, pointing to its speed and scalability as the missing link for Bitcoin.

The Role of the HYPER Token and Its $14M Presale Raise

HYPER is the network’s utility token, and it actually has use cases. It pays transaction fees, funds bridge operations, unlocks staking rewards, and will power governance as the DAO comes online. In short, it’s what keeps the Layer-2 running.

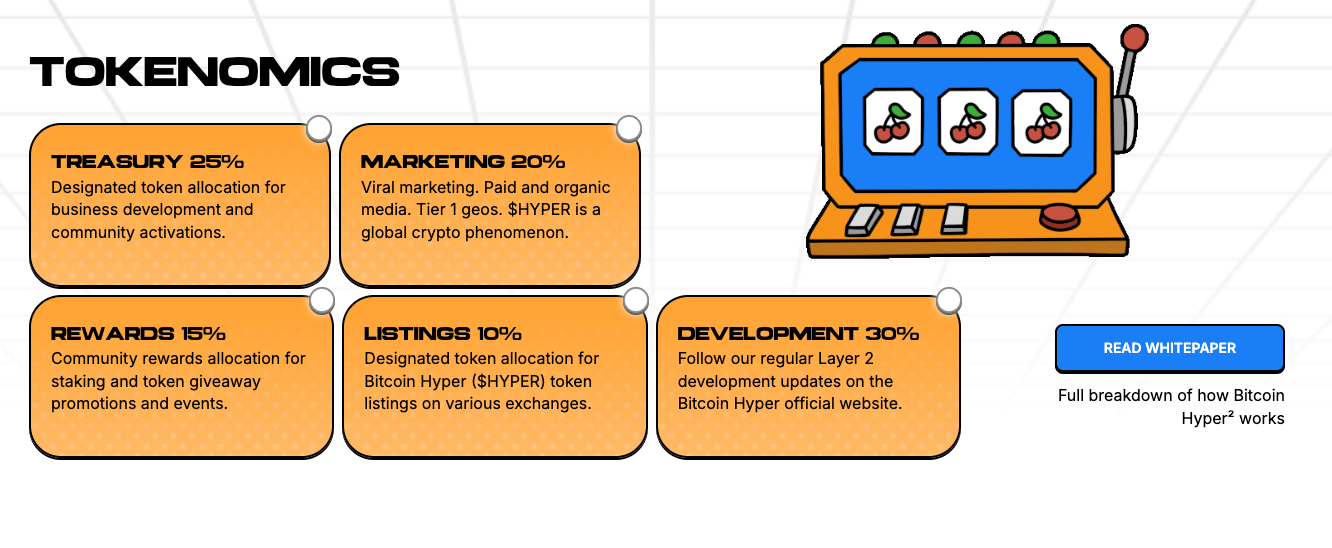

The tokenomics setup is clear. There’s a 21 billion total supply, with 30% going to the treasury, 25% to marketing, 5% to rewards, and the remainder supporting ecosystem needs.

Bitcoin Hyper’s presale just passed $14 million, with HYPER tokens priced at just $0.012865 during the current stage. It kicked off in May and will go through multiple price stages – meaning earlier investors get a lower entry point.

Bitcoin Hyper’s presale just passed $14 million, with HYPER tokens priced at just $0.012865 during the current stage. It kicked off in May and will go through multiple price stages – meaning earlier investors get a lower entry point.

And the best part? HYPER staking is already live during the presale, with yields estimated at 78% per year. More than 670 million HYPER tokens have been staked already as investors rush to secure those high yields.

Security, Roadmap, and the Bigger Picture for Bitcoin Layer-2s

Bitcoin Hyper has passed token contract audits by Coinsult and SpyWolf. That means there are no mint switches, blacklist tricks, or honeypot issues – functions work as intended, with no critical issues flagged.

Full protocol reviews are expected as the mainnet launch approaches, which is a typical rollout sequence for Layer-2s. It gives investors confidence that security is being handled in a step-by-step manner, and not rushed.

On the roadmap, we’re about to head into a key period: mainnet launch, canonical bridge activation, first dApps, and the token generation event (TGE). Q4 is all about exchange listings – Uniswap is confirmed, with CEXs potentially following – and an enhanced staking platform.

Zooming out, sector trends appear strong. Galaxy Digital estimates that by 2030, approximately $47 billion in BTC liquidity will be held on Layer-2s. Venture backing has also accelerated, and the number of Bitcoin Layer-2 projects has multiplied since 2021.

But with only a sliver of BTC active in DeFi right now, there’s plenty of room to grow. So, if Bitcoin Hyper captures a meaningful slice of that idle BTC, it could become one of the best cryptos to buy and hold for the years ahead.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.