Metaplanet’s Bitcoin acquisition strategy is paying off as the company’s income generation from digital assets is rising. This comes amid Bitcoin’s return to $120,000. With rising market bullishness, many traders are seeking tokens that can take them into profits in 2026.

One rising contender is DeepSnitch AI, an ecosystem that aims to level the playing field between crypto whales and retail traders. Additionally, its high market appeal has attracted 300x projections. Here’s why investors say DeepSnitch AI could become the best crypto to buy now.

MetaPlanet Bitcoin revenue jumps in Q3 2025

MetaPlanet has unveiled a record increase in its Bitcoin Income Generation revenues for Q3 2025. The company’s Bitcoin Income Generation segment drew in $16.56 million in Q3 2025. This was an over 100% increase from its Q2 revenue of $7.69 million.

Following the increase, Metaplanet has also doubled its revenue forecast to $46 million for the year 2025. The company has also adjusted its operating profit guidance to $32 million.

One possible driver of Metaplanet’s growth could be its recent leaning towards cryptocurrency assets. The company has announced that it has completed its 2025 target of accumulating 30,000 BTC tokens.

As of early October, the company’s total BTC stock stands at 30,823 tokens. Its most recent purchase was a $615 million acquisition of 5,268 BTC tokens that pushed the company into 4th place on the list of largest public Bitcoin holders.

Despite MetaPlanet’s Bitcoin bullishness, its stock fell sharply in Q3. Its stock price fell by 67.5% between July and September. Still, the company’s Bitcoin acquisition goals are likely to continue. Already, the company has set a target of holding 210,000 BTC tokens, which is roughly 1% of Bitcoin’s total supply.

FOMO rises as investors name DeepSnitch AI the best crypto to buy now

Crypto is overflowing with information: charts, feeds, wallets, contracts. Most retail investors don’t have the time or tools to process it all. DeepSnitch is being built to bridge that gap with AI-driven clarity.

Its architecture features five AI agents that track blockchain flows in real time. Whales, liquidity moves, and suspicious deployments are all flagged within seconds. What normally takes hours of manual analysis becomes instant, reliable signals.

Security is another cornerstone of the DeepSnitch ecosystem. Rug pulls and pump-and-dumps still plague the market. DeepSnitch AI is trained to detect these threats ahead of time, reducing the chance of costly mistakes.

One standout feature of the DeepSnitch AI ecosystem is how accessible it makes its signals. Instead of bulky information, DeepSnitch compresses data into actionable insights that can be fed straight to your Telegram or X account. This allows traders to turn market analytics into real-time investing decisions, helping them keep up with whale traders.

Additionally, DeepSnitch AI offers an interesting mix of low market cap, solid fundamentals, and strong market appeal. These factors position DeepSnitch AI to become one of the best cryptos to buy now.

Many investors are already securing positions in its ongoing presale. One token is now going as low as $0.01735. Yeet, not for long, as stage two of DeepSnitch AI’s presale is fast approaching. With DeepSnitch AI set to reshape retail trading, joining its ecosystem could be a gateway to parabolic growth.

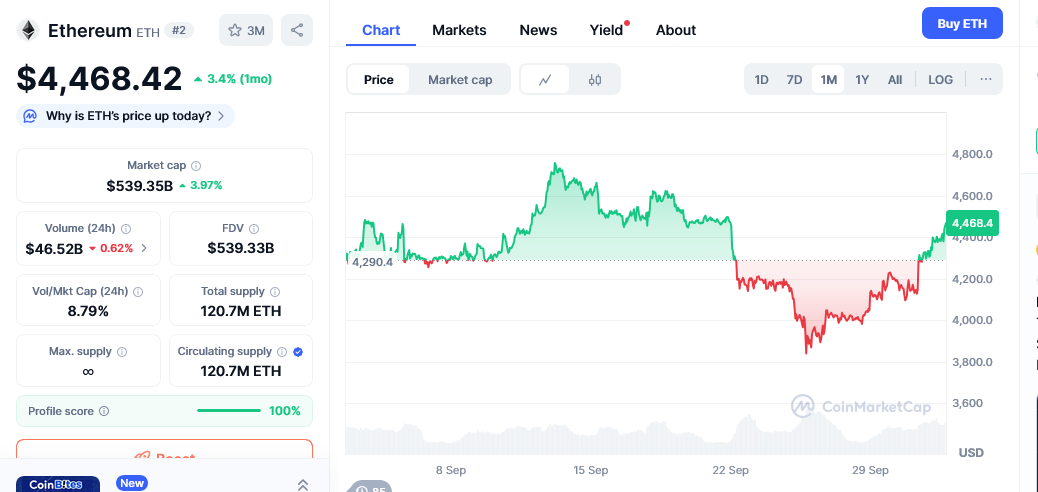

Ethereum surges amid bullish Uptober sentiment

The crypto market has turned around its recent slump, with many tokens now returning to their early September highs. Ethereum is now back to $4,400 despite hitting a four-week low in the aftermath of the recent $1.8 billion market liquidation. Bitcoin is leading the charge after nearing the $120,000 region.

As of October 2, ETH stood at $4,393 following a 10% surge over the past week. ETH’s 30-day chart also shows a 2.51% rally.

Ethereum’s surge comes days after its worst-ever weekly spot ETF outflows. For the week ending on September 26, Spot Ethereum ETFs recorded $795.6 million in outflows, its highest ever. Some investors say the strength of Ethereum’s current bull sentiment depends on whether ETF demand rises. If that happens, Ethereum could be on its way to another ATH.

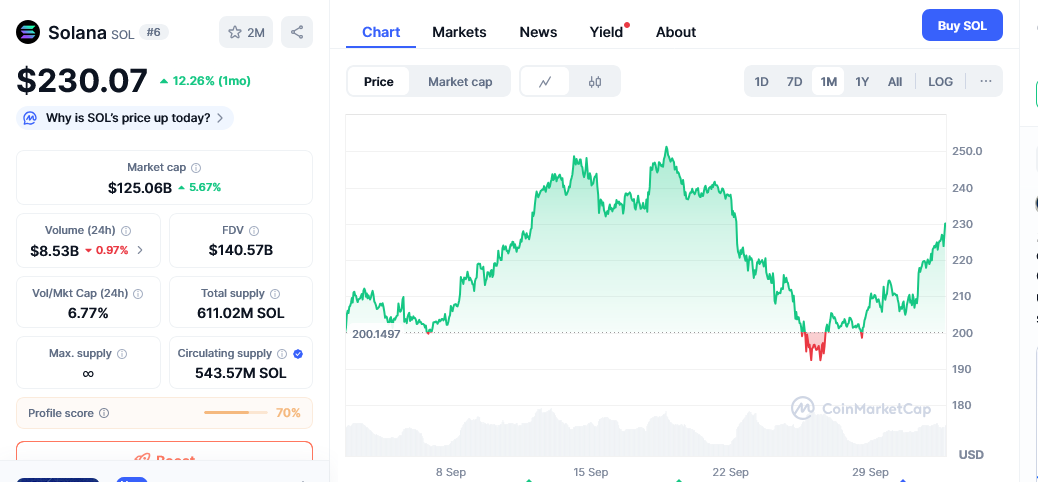

Solana nears $230 as developers mull block limit cuts

Solana has turned around its bearish momentum, rising by double digits in the past seven days. Like other altcoins, Solana has been buoyed by the recent market rally. This has spurred a strong return to Solana’s October 2 price of $227.37.

Solana’s weekly chart shows a 14.52% jump, similar to its 30-day chart, which shows a 15% rise. As Solana’s bullish sentiments rise, there is also growing discussion over a block limit cut that could bring unmatched network scalability.

This new change would allow dynamic block size adjustments, thus enabling validators to process as many transactions as they can handle. If passed, the upgrade could make a new era in Solana’s DeFi dominance.

Conclusion

Continued BTC accumulation by companies like Metaplanet will likely boost the current bull rally. Traders seeking blue-chip crypto are moving to DeepSnitch AI. Over $295,000 has been raised from DSNT sales already.

Stage one is nearly over, meaning the opportunity to buy DSNT is closing fast. Additionally, DSNT’s strong market appeal and its 300x growth potential could make it the best crypto to buy now.

The best time to secure early-stage gains is now. Head to the official presale site today and secure your DSNT before the next price jump.

Frequently asked questions

What crypto will explode in 2025?

Many investors say AI crypto like DeepSnitch will likely outshine their competitors in 2025.

Can Solana overtake Ethereum?

While Solana’s DeFi ecosystem is growing rapidly, it is nowhere close to overtaking Ethereum, especially as the latter continues to expand.

What is the best crypto to buy now?

Many investors are stacking DSNT tokens following predictions that DeepSnitch is poised for 300x gains in 2026.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.