Choosing the best crypto to buy now is no longer about chasing hype; it’s about spotting the next breakout before everyone else does. With Fed rate cuts expected in September, liquidity is primed to flow into real utility plays, not just speculation.

That’s why investors are hunting DeFi project opportunities that deliver practical adoption and real-world impact. In this environment, established leaders show stability, but the next big altcoin 2025 narrative belongs to Defi solutions like Remittix solving everyday payment bottlenecks.

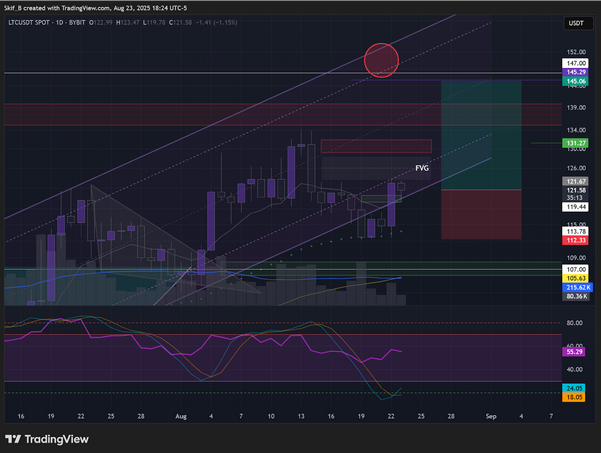

Litecoin: Stability Amid Turbulence

Litecoin sits at $121.31, up 83% year-on-year, with analysts eyeing $158.44 if current support levels hold.

Litecoin price tapped liquidity on the higher time frame before sliding back to the lower boundary of the main ascending channel. This setup looks tradable for retail participants, with the first upside target at $131.27, representing a 10% increase in the short term.

While Litecoin’s appeal lies in being a trusted low gas fee crypto for fast payments, LTC’s price action looks like steady growth, not built for explosive rallies; the kind of coin whales park capital in, not where they chase 50x moves.

Chainlink Oracles Are Driving Value As Algorand’s Strong Tech, Slower Gains

Chainlink (LINK) is trading near $25.48, supported by strong on-chain activity. Whales have been moving large amounts off exchanges, including one transaction of 1.29 million LINK worth about $31 million.

Wallets holding between 100,000 and 1 Million LINK increased their balances by 4.2% this month, adding roughly $97 million.

Even with these gains, retail participation has been more modest, keeping the growth curve steady rather than explosive.

Meanwhile, Algorand demonstrates steady progress with growing activity and liquidity, but its growth path looks more gradual. Algorand (ALGO) trades around $0.25 to $0.26 with a market cap near $2.2 billion.

Transactions rose 30% in the past week to 5.8 million, active addresses climbed 22% to nearly 79,000, and network fees increased by 25% to $3,600.

Both projects remain important, yet investors seeking rapid gains may find that Remittix outpaces both LINK’s current trajectory and Algorand’ stability.

Remittix: The Payment Rail Whales Are Circling

Here’s where the FOMO kicks in. While others consolidate, Remittix is rewriting the playbook with PayFi infrastructure designed for real-world money movement.

The Layer-2 Ethereum alternative isn’t theory, RTX already smashed through $21 Million raised, locked in BitMart as its first centralized exchanges listing, and is racing toward the $22M milestone where the next major exchange announcement drops. That leaves a narrow window for early buyers.

Why Remittix Is the Next Moonshot:

- Direct crypto-to-bank transfers in 30+ countries

- CertiK-audited for institutional-grade security

- Wallet launching Q3 with real-time FX conversion

- Support for 40+ cryptos and 30+ fiat currencies

- Deflationary token model rewarding long-term holders

Momentum is undeniable. Over 25,000 holders are already locked in, and with the fastest growing crypto 2025 narrative building, whales are positioning before the floodgates open.

Bottom line: Litecoin, Chainlink, and Algorand show strength. But for aggressive investors asking what’s the best crypto to buy now, the answer is clear: Remittix isn’t just participating in the market — it’s leading the next wave.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.