The Binance Smart Chain (BSC) is a blockchain protocol built by one of the largest centralized exchanges in crypto, Binance, that operates in parallel with the Binance Chain.

It’s important to note, right out the gate, that the Binance Smart Chain is not an off-chain or layer-2 protocol running on top of the Binance Chain.

Instead, it is an entirely independent blockchain that operates side-by-side with the Binance Chain and supports smart contract functionalities and compatibility with the Ethereum Virtual Machine (EVM).

That’s why we emphasized “DeFi” in the title– the Binance Smart Chain is centralized to Binance as a company.

Unlike Ethereum, which is still a Proof-of-Work-based protocol, BSC uses a hybrid consensus algorithm called Proof of Staked Authority (PoSA), which allows BSC to achieve significantly higher transaction throughput without sacrificing security.

Another critical difference between the two competing blockchains is that, unlike Ethereum, whose native token ETH is inflationary, BSC’s native token BNB is deflationary (burned by Binance on a regular schedule). This means that BSC validators aren’t rewarded with newly minted BNB for securing the network, but rather solely by racking up transaction fees.

That being said, Binance’s flagship smart contract platform for “decentralized” applications is a bit of an oxymoron because the blockchain itself is highly centralized. Namely, the Binance Smart Chain has only 21 validating nodes in its PoSA network, compared to Ethereum, which has about 10,000 PoW mining nodes. To further exacerbate things, most of these nodes on BSC are operated by Binance itself.

Becoming a validator on BSC involves being approved by Binance and staking BNB to secure the network, and Binance still holds a vast majority portion of the total BNB supply.

Centralization concerns, however, aren’t that bad considering that Binance is transparent about their vision — the Binance Smart Chain optimizes for speed, scalability, cross-chain interoperability, or more specifically, Ethereum-compatibility, and not decentralization.

The Binance Smart Chain’s primary mission is to provide a full-fledged environment for building high-performance “decentralized” applications. For this reason, Binance designed the BSC protocol to be compatible with Ethereum, allowing for most of Ethereum’s dApps, tools, and ecosystem components to be ported or simply copied on BSC with zero or minimum effort.

Binance Smart Chain Ecosystem Overview

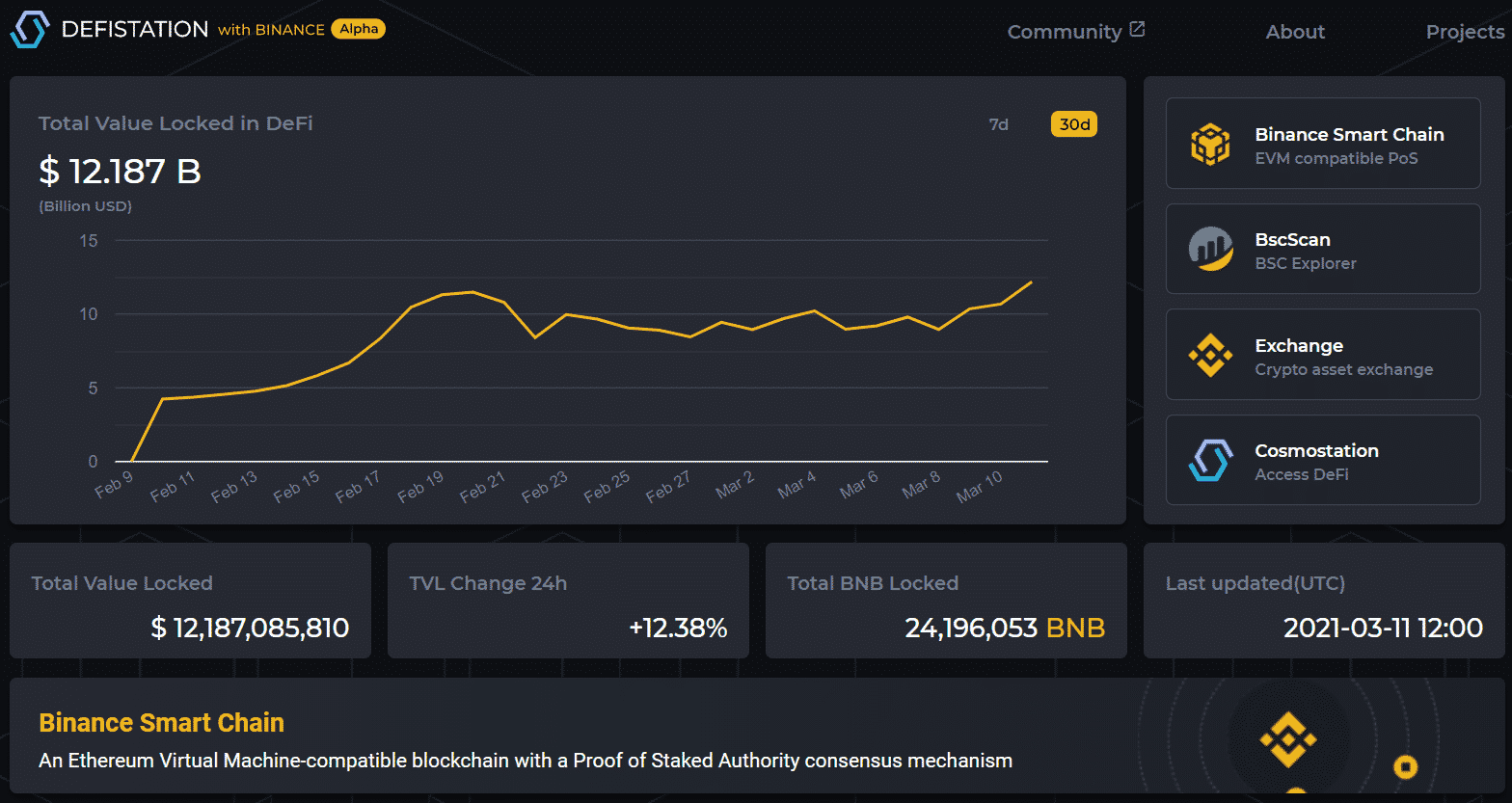

Binance launched the Binance Smart Chain in September 2020 and the ecosystem has already seen impressive growth. BSC currently has ~$8.8 billion in total value locked (TVL) across all its DeFi apps, whopping ~47 million in distinct addresses interacting with the protocol, and ~2.5 million daily blockchain transactions (though these should be taken with a grain of salt as Binance has been accused of spoofing transactions in the past.)

As a result of the surge in activity, the price of the BNB token, used to pay for transactions on BSC, grew by more than 200% in the last month: from ~$50 at the beginning of February to ~$250 at the beginning of March.

The Binance Smart Chain is growing quickly due to two reasons: fees and speed.

Ethereum gas fees are off the charts; it can cost up to $150 to execute a single peer-to-contact transaction on Ethereum-based DeFi protocols like Aave or TokenSets; it takes minutes, sometimes even hours, for transactions to confirm. By contrast, fees for interacting with BSC’s “decentralized” protocols range between 1-3 cents per transaction, and the transactions settle in as little as 5 seconds.

The second reason behind BSC’s impressive growth is the widespread proliferation of a phenomenon known as yield farming. For the uninitiated, yield farming is the process of lending and staking cryptocurrencies in Automated Market Maker or AMM-based decentralized exchanges to generate high returns in the form of fees and additional cryptocurrency tokens.

Some users have seen three or even four-figure annual percentage yields (APY) for staking on some of the yield farming protocols built on BSC. These yields are likely unsustainable because they’re primarily subsidized by staking rewards in the form of highly inflationary yield farming tokens, are high-risk, and will eventually subside.

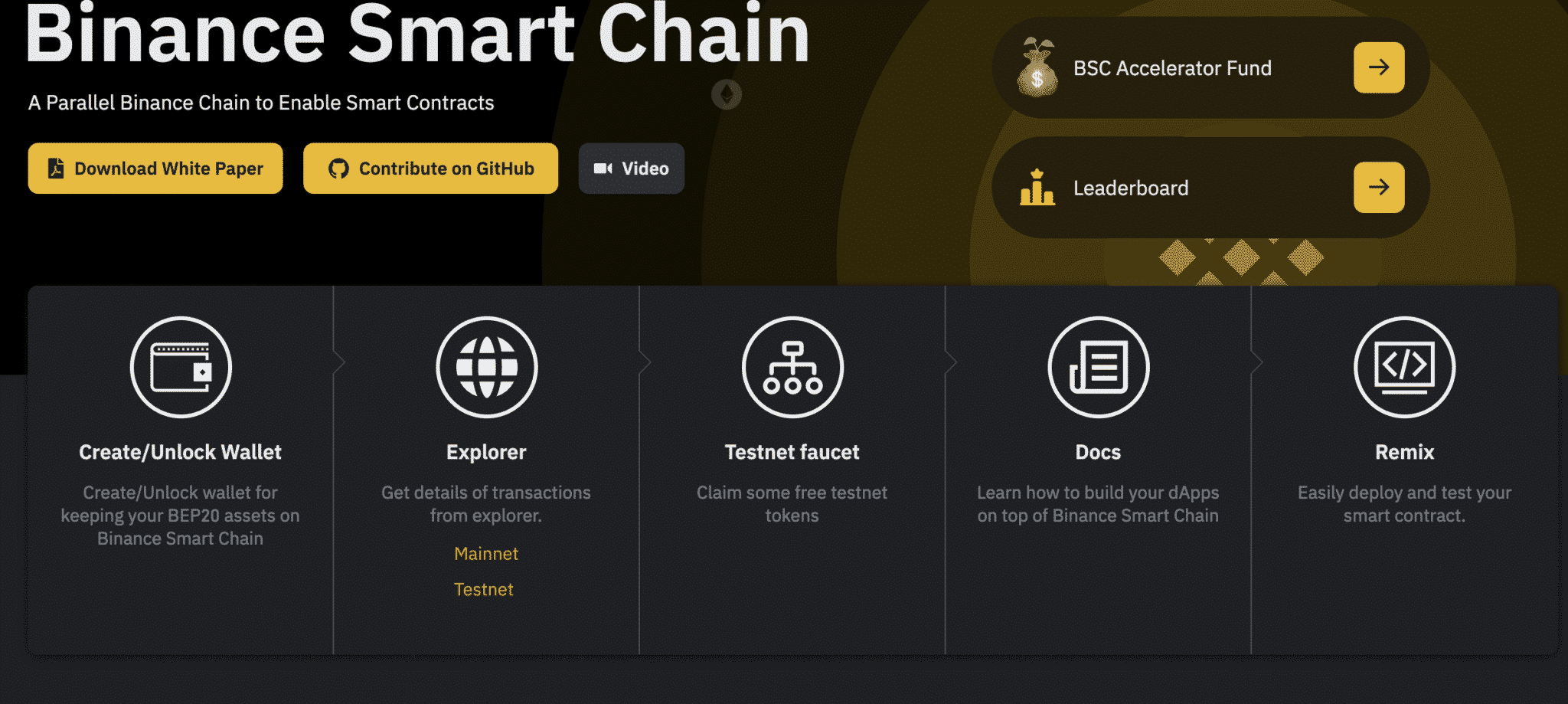

How To Get Started With Binance Smart Chain?

To get started on the Binance Smart Chain, you first need a wallet that supports Binance’s BEP20 tokens, which are modeled on Ethereum’s ERC20 tokens. Here, you have two options:

- you can either install the Binance Chain Wallet, which works as a simple Google Chrome extension,

- or you can tweak your MetaMask wallet to support the BSC Mainnet.

How to Set up Meta Mask for Binance Smart Chain

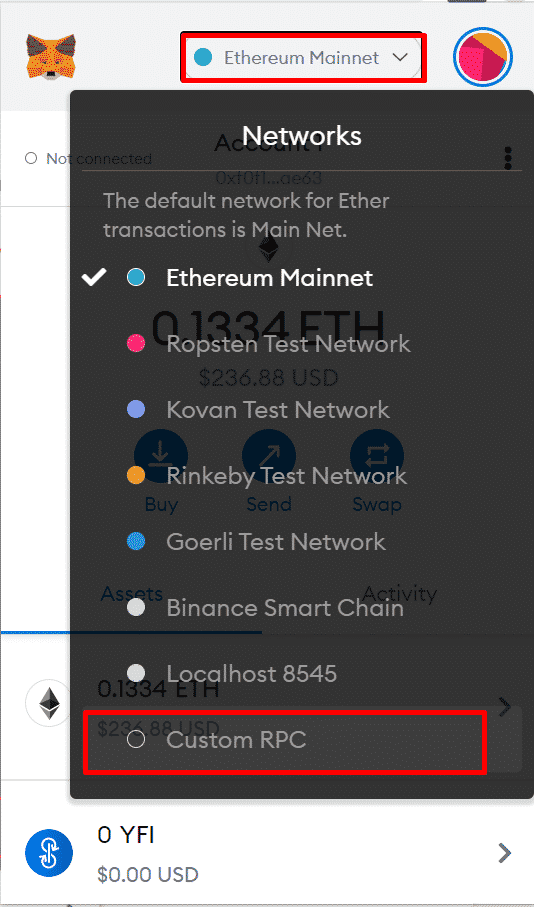

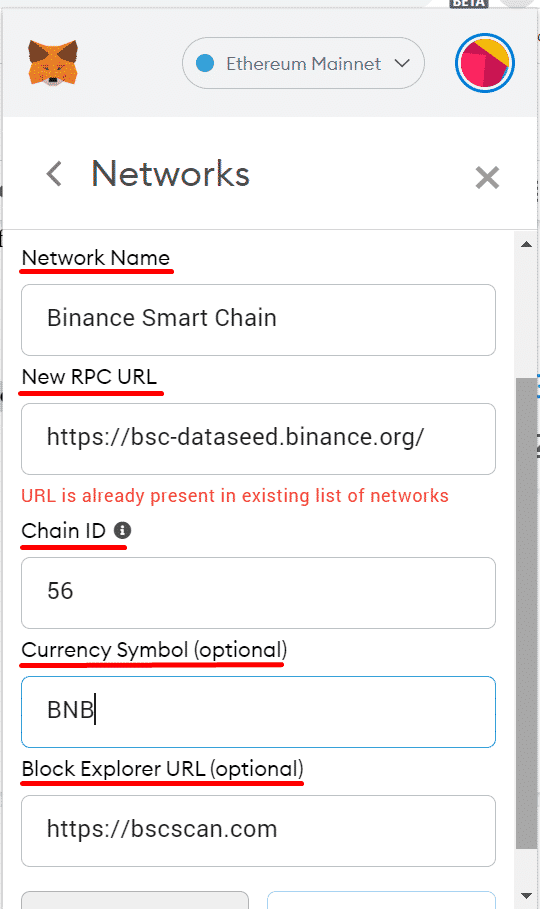

Connecting your MetaMask wallet to the BSC Mainnet is a simple 2 step process:

Step 1: Open your MetaMask browser extension.

Click the Networks tab in the top-center corner of your wallet and select Custom RPC.

Step 2: Now that you’ve opened the Network tab, fill each parameter with the following information and click Save:

- Network Name: Binance Smart Chain

- New RPC URL: https://bsc-dataseed.binance.org/

- ChainID: 56

- Symbol: BNB

- Block Explorer URL: https://bscscan.com

That’s it. Your MetaMask wallet is all set up to be used on BSC. The third and final step to get you started on the Binance Smart Chain is to acquire some BNB tokens on the Binance exchange. This step is necessary because the BNB tokens are your primary gateway to the BSC ecosystem and the only means to pay transaction fees on the network.

How to Use the Binance Smart Chain

Once you’ve set up your wallet and bought some BNB tokens, you can interact with many of the “DeFi” protocols natively built or ported from the Ethereum blockchain to Binance Smart Chain.

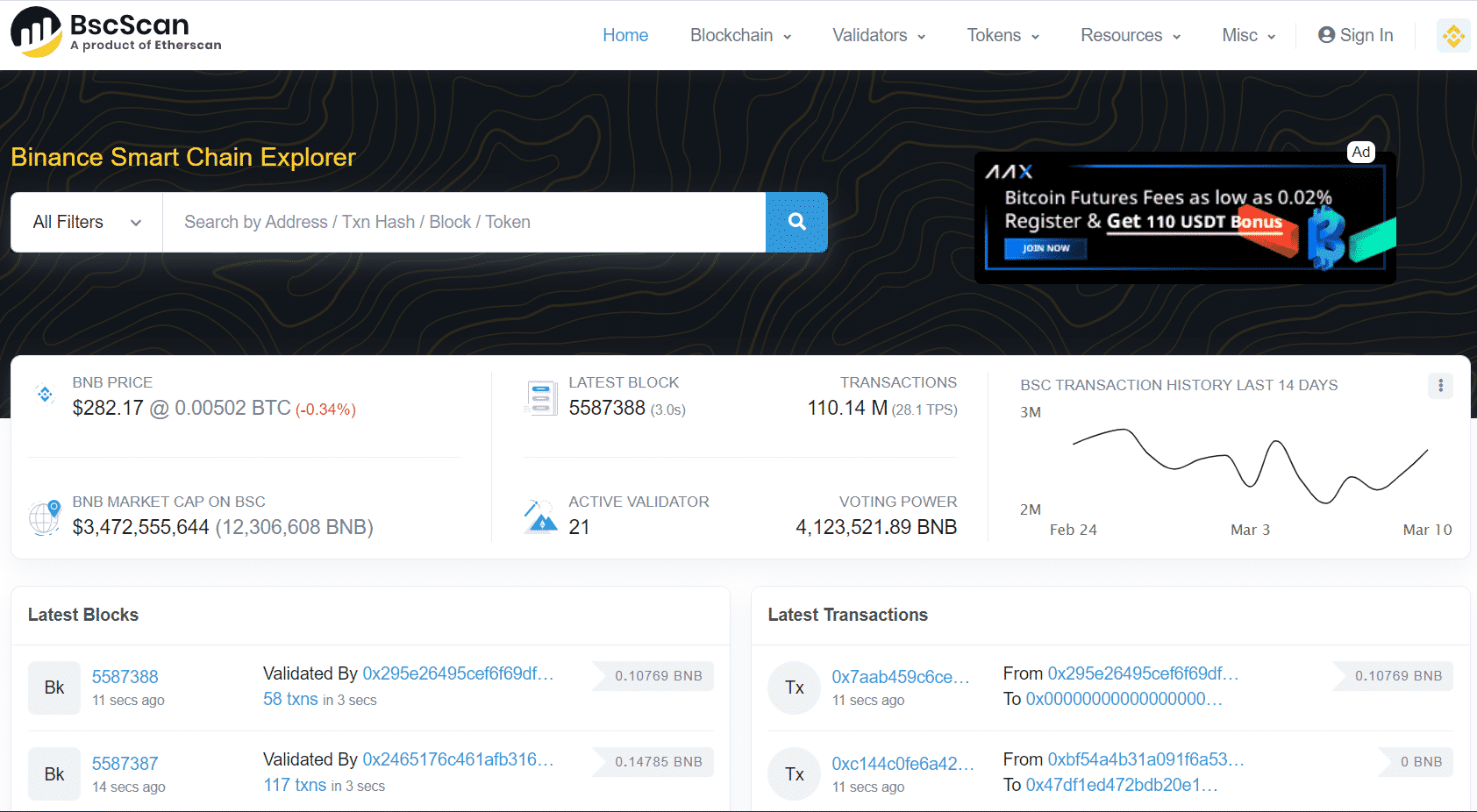

The first two places where you should begin your exploration of the BSC ecosystem are bscscan.com and www.defistation.io.

BscScan is a block explorer and analytics platform for the Binance Smart Chain, and Defistation is a leaderboard and analytics tool for DeFi projects built on top of BSC. If these sites sound and look all too familiar to you, that’s because they’re nearly identical copies of Etherscan and Defipulse, only repurposed to work for the BSC.

Another great resource to explore the Binance ecosystem is the mathdapp.store, where you can see the latest and hottest applications built on the Binance Smart Chain.

If you head over to the token section on Bscscan, you’ll quickly notice that Binance has already pegged some of the most popular Ethereum-based tokens on the BSC, like Ethereum (ETH), Cardano (ADA), Polkadot (DOT), Ripple (XRP), Litecoin (LTC) and many other. This means that you can own, stake, and trade these pegged tokens on BSC-based decentralized exchanges for a fraction of the cost you’d have to pay to do the same on Ethereum.

Then, in the Yield Farms section on Bscscan, you can explore some of the most popular DeFi projects on BSC, where you can lend or stake your crypto to earn two to five-figure yields. The most popular of these projects is the BSC alternative to Uniswap called PancakeSwap, which quickly rose through the ranks to become one of the biggest decentralized exchanges in crypto—even bigger than SushiSwap—with more than ~$1.6 billion in TVL and daily trade volumes exceeding $2.5 billion. PancakeSwap does everything Uniswap does, only multiple orders of magnitude cheaper.

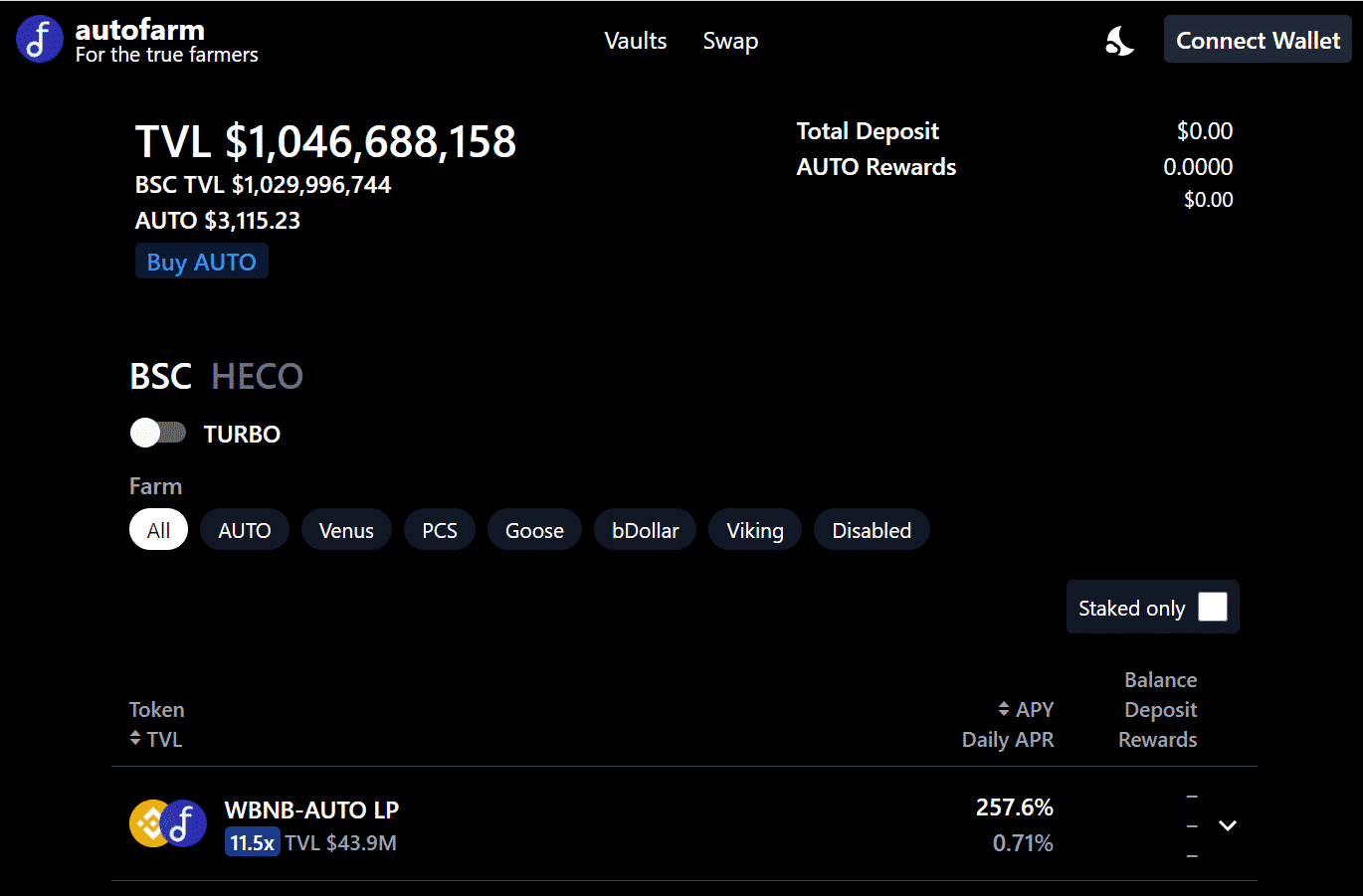

Another popular project on the Binance Smart Chain is AutoFarm, which is essentially a BSC alternative to one of Ethereum’s most popular yield aggregators, yEarn.

AutoFarm is a yield farming aggregator running on both Binance Smart Chain (BSC) and Huobi ECO chain (HECO). Like yEarn, AutoFarm’s Vaults auto-compound yields across platforms while pooling the gas costs to optimize yield farming strategies.

If you wish to track your entire BSC portfolio from a single platform, you can use the BSC alternative to Ethereum’s Zapper platform called YieldWatch.

As you must’ve already noticed, we’re not dealing with much innovation here. YieldWatch is effectively a through and through fork of Zapper, only made to track yields on the BSC.

Closing Thoughts: Is the Binance Smart Chain (BSC) Legit?

The Binance Smart Chain can arguably be considered the hottest new thing in the cryptocurrency DeFi space at the moment.

Whether you decide to jump on the Binance Smart Chain hype train or watch it pass you by is entirely up to you. If you’re all too eager to join in on the action, please do so at your own risk, and always — always — do your own research.

After all, the Binance Smart Chain is a centralized blockchain where Binance plays a central role in gatekeeping the traffic and validating the transactions, which isn’t the case with Bitcoin or Ethereum. However unlikely, Binance could theoretically pull off the biggest rug-pull in the history of crypto, and you should always keep that in the back of your mind when interacting with some of its so-called “decentralized” applications.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.