- What is Bitcoin Atom?

- A Hybrid Consensus Model:

- Lightning Network Swaps

- Enter Bitcoin Atom

- The Bitcoin Atom Team

- Where Can I Get Bitcoin Atom?

- Final Thoughts

What is Bitcoin Atom?

Bitcoin Atom (BCA) is a SegWit enabled Bitcoin fork that is working on on-chain atomic swaps and a hybrid consensus model. One of the most attractive components of Bitcoin Atom is its mission of creating a decentralized digital asset exchange through the use of hash time-locked contracts (HTLCs), which would allow for a true peer-to-peer exchange minus any centralized intermediaries.

A Hybrid Consensus Model:

While many cryptocurrencies choose between a PoW (Proof of Work) and a PoS (Proof of Stake), Bitcoin Atom uses a hybrid mix of both with the aim of increasing network stability and decreasing the influence of miners.

Referred to as a 51% attack, this hypothetical attack is when a single group of miners controls more than 50% of the network’s mining hashrate. These miners would be able to prevent new transactions from gaining confirmations, essentially immobilizing the network. Additionally, they would be able to reverse completed transactions or double-spend coins. As you can imagine, this would suck for all parties involved (except the saboteurs).

Lightning Network Swaps

A focal point of the Bitcoin Atom project, and where it likely gets its name, is its LN implementation that will allow for instant off-chain atomic swaps, also referred to as “cross-chain atomic swaps”.

If you’re not familiar with what an “off-chain atomic swap” is, you’re not alone. An atomic swap is simply a cryptographically powered smart contract that focuses on creating a trustless and direct exchange.

An atomic swap makes it possible for two parties to exchange different tokens without the need for a third-party intermediary such as an exchange while also eliminating the risk of default.

“Atomic” gets its name from computer programming as a reference to something that is indivisible, like atoms. In this case, it’s the trades that are indivisible. Instead of a centralized exchange or escrow managing the transaction, an atomic swap is a simple, direct transaction.

For example, if Mike and Ike want to trade via atomic swap, either the trade will happen and both Mike and Ike will get their respective tokens, or the trade will not go through. There is no possible situation where one party can bail on the transaction and leave the funds in escrow purgatory.

Cross-chain atomic swaps, as you may have reasoned, are swaps between two different cryptocurrencies running on different chains that use the same hash algorithm. These swaps can be done without a third party intermediary or any exchange and transaction fees.

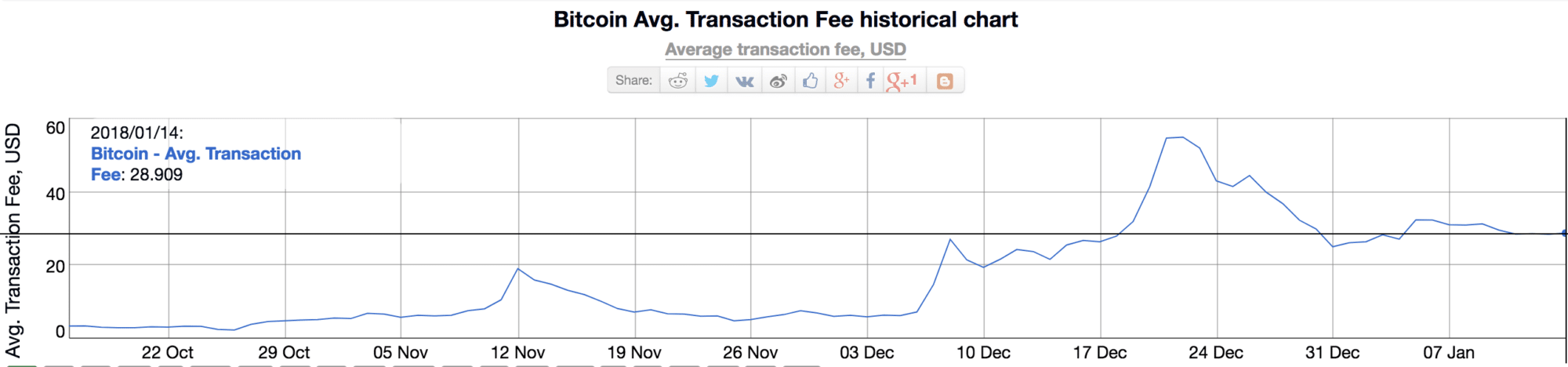

In a cryptocurrency world where exchange fees hover around 0.1% and 0.25% and transaction fees hovering around $30 USD for Bitcoin, atomic swaps are a big deal.

If popularized, Bitcoin Atom could potentially solve many of the issues preventing many cryptocurrencies from being used for daily transactions.

Atomic swaps, however, are not all sunshine and rainbows. They aren’t the most user-friendly of things. The lack of a third party intermediary comes at a cost. In order to perform one, you’ll need to do it via command line and this requires some programming knowledge.

As you can imagine, this is a huge barrier to adoption for the vast majority of people. Atomic swaps are still a very new technology that is being refined and tested at both a fundamental level, and for mainstream adoption.

Enter Bitcoin Atom

Bitcoin Atom has been able to attract relatively positive attention as one of the fairly legitimate potential Bitcoin forks with a novel and practical purpose. Looking at the slew of recent and upcoming Bitcoin forks, this is a breath of fresh air.

The reason many looks at Bitcoin Atom with optimism is because of its potential to solve a huge problem in the cryptocurrency world. The implementation of Lightning Network Swaps would essentially eliminate the need for centralized exchanges, the risk of exchange hacks, as well as allow users to truly utilize a free peer-to-peer digital currency.

Bitcoin Atom isn’t the only project working on utilizing some form of atomic swaps. Komodo, for example, performs atomic swaps instead of proxy tokens within its ecosystem.

Bitcoin Atom plans to utilize Atomic Swaps via Hashed Timelock Contracts (HTLC) on-chain and it plans to potentially use Lightning Network (LN) off-chain once it is further developed.

The processes of exchanging cryptocurrencies through Atomic Swaps is pretty straightforward and quick compared to centralized exchanges:

- Place your order inside your node.

- Receive your exchange cryptocurrency.

That’s it. The process also performs faster trades, eliminates delays, retains your private keys, keeps your identity private, and reduces trading fees to a minimum.

The Bitcoin Atom Team

There is currently no available public information about the Bitcoin Atom team. If you represent the Bitcoin Atom project and have information you’d like us to include here, email [email protected].

Here are some additional channels for the Bitcoin Atom’s community:

Where Can I Get Bitcoin Atom?

Prior to the fork, your best bet for getting some Bitcoin Atom is to have your Bitcoin on an exchange or wallet that has partnered with BCA. The current list of partnering organizations includes: Okex, YObit.net, Exrates (exchanges) and Coinomi, Atom Wallet, and ESR (wallets).

Final Thoughts

Is Bitcoin Atom the next Bitcoin? Probably not. However, it is an interesting implementation of a hybrid PoW/PoS consensus model that could potentially solve many of Bitcoin’s potential shortfalls.

If Bitcoin Atom is even able to address one or some of Bitcoin’s shortfalls, it will still need significant adoption to really give its peer-to-peer transactions some steam. Until then, it will be an interesting cryptocurrency case study of a developing technology that could play a huge role in advancing cryptocurrency adoption on a grand scale.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.