- What is Mining?

- Increased Difficulty

- GPU Life Expectancy - Bitcoin Mining Hardware

- Delivery Date of Your Equipment

- Electricity Costs

- Bitcoin Prices

- Future Transaction Fees

- ASIC Miners - Things to Consider

- Should I Invest in Some BTC Mining Hardware or Not?

Bitcoin Mining Hardware – Is it Still a Smart Investment?

Mining cryptocurrency has become extremely popular over the last 5 years as Bitcoin has seen a considerable price hike. This popularity has contributed to a flood of new mining rigs being developed at a record pace. The ever-changing landscape of the mining sector can leave interested parties confused as to the future value of Bitcoin mining hardware and if purchasing this equipment is still a smart move.

A quick search of mining forums and you can see that these concerns really became an issue in 2013 when CPU (Central Processing Unit) miners were superseded by GPU (Graphic Processing Units) mining rigs and then later eclipsed by ASIC (Application Specific Integrated Circuit) models. Manufacturers are reaping huge bounties from these products. Hence, the continued development of more powerful mining equipment.

What is Mining?

Mining is the process in which a network computer (node) adds the next block to the blockchain after completing a difficult math equation known as the Proof-of-Work. In the early stages of mining, this could be accomplished with nothing more than your home PC’s CPU.

It wasn’t long before miners realized that GPUs were far more efficient at handling the repetitive nature of the Proof-of-Work algorithms and by the end of 2013, GPUs were the mining standard. This had some serious ramifications as it increased both the cost of obtaining mining equipment, as well as the overall difficulty of the mining sector.

Increased Difficulty

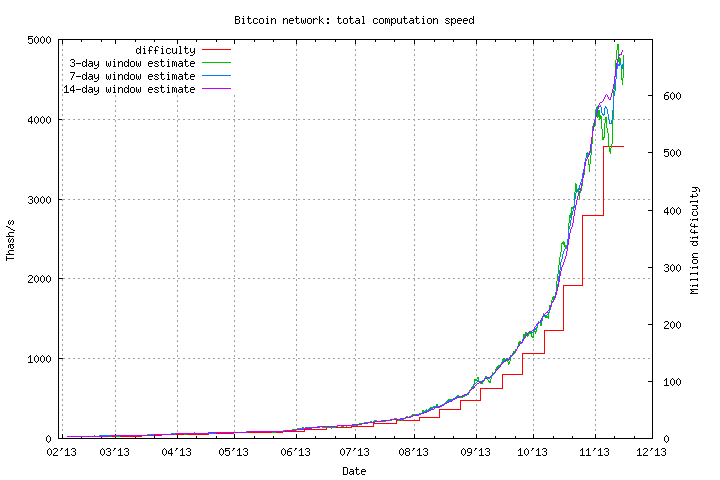

Part of the proof-of-work algorithm is a difficulty adjustment. As more computing resources enter the mining pool, the proof-of-work algorithm makes the mining math problem more difficult to solve. In 2016, the mining sector saw an explosion in both the value of cryptocurrencies and the difficulty of mining. Up until this time, the majority of mining was still GPU-based but the introduction of far more efficient ASIC mining rigs quickly made mining BTC an expensive endeavor to begin.

GPU Life Expectancy – Bitcoin Mining Hardware

The chart below indicates just how quickly GPU Bitcoin mining hardware has suffered since the introduction of ASIC rigs. In 2011, an average GPU miner could expect anywhere from 100-200 BTC for their efforts. Only one year later, these results were reduced to around 30 BTC and by 2013, you would have been lucky to mine 3 BTC using this hardware. This data reveals that by 2014, the number of BTC you could expect to mine using a GPU dropped below 1 BTC; making GPU miners practically obsolete when used alone.

Delivery Date of Your Equipment

Due to the overwhelming demand for BTC mining hardware, there is now a wait associated with purchasing these products. ASIC miners can have waiting periods that can extend for months. It is important to consider difficulty fluctuations during this time. Basically, if you have to wait too long for your mining equipment, it may not be worth it by the time it arrives.

Electricity Costs

Electricity costs should be one of your main concerns when deciding on what type of mining rig to purchase. You may find that you are losing money if you go with a high-powered mining rig in an area where electricity is expensive. Today’s mining equipment is focused on efficiency as older mining rigs are unable to produce a profit in today’s difficult mining ecosystem.

Bitcoin Prices

The overall price of BTC (or any other mineable crypto) is another determining factor to consider when deciding on purchasing a mining rig that will stand the test of time. When the value of BTC goes up, so does the profitability of mining this crypto. As was stated before, a single GPU miner could produce over 100 BTC in 2011. While the number of coins that a single GPU can mine has reduced, the value of BTC has appreciated nearly 1000% since those days.

Future Transaction Fees

The reward for mining a block is scheduled to half every 210,000 blocks. This means that around May 2020, BTC mining rewards will drop from 12.5 BTC down to 6.25 BTC. While this seems like it could crush the mining industry, you must consider that there will only ever be 21,000,000 BTC mined and of that 17,048,151 have already been mined. This means you can expect to see some serious price increases as the number of BTC that are available to be mined diminishes in the coming years.

ASIC Miners – Things to Consider

While ASIC mining rigs are far more efficient at mining than their GPU counterparts, you should remember that these chips are only able to mine SHA-256 cryptocurrencies and therefore serve no additional purpose once these tasks are completed. This is in stark contrast to GPU chips that can still be utilized for graphically-intense applications such as gaming long after the last BTC has been mined.

Should I Invest in Some BTC Mining Hardware or Not?

There is no one-size-fits-all answer to this question. If you live in an area that is privy to low, or even free electricity, you may find that your mining hardware’s lifespan outlasts other regions of the world due to your low overhead. Mining is a crucial part of the cryptocommunity and you should expect to see manufacturers continue to produce more powerful mining rigs over the coming years.

[thrive_leads id=’5219′]

What do you guys think? Is mining worth it in your area? Let us know on Twitter and be sure to sign up for our newsletter to stay up to date on all of the latest developments in the cryptocommunity.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.