There are a few different factors that influence whether or not Bitcoin mining will be worth it for you. Even with the rising Bitcoin price, the set-up fees and electricity costs may outweigh the revenue that you’d earn through mining.

The primary factors that affect your Bitcoin mining profitable are:

- Mining difficulty and rewards

- Hash rate

- Operational costs

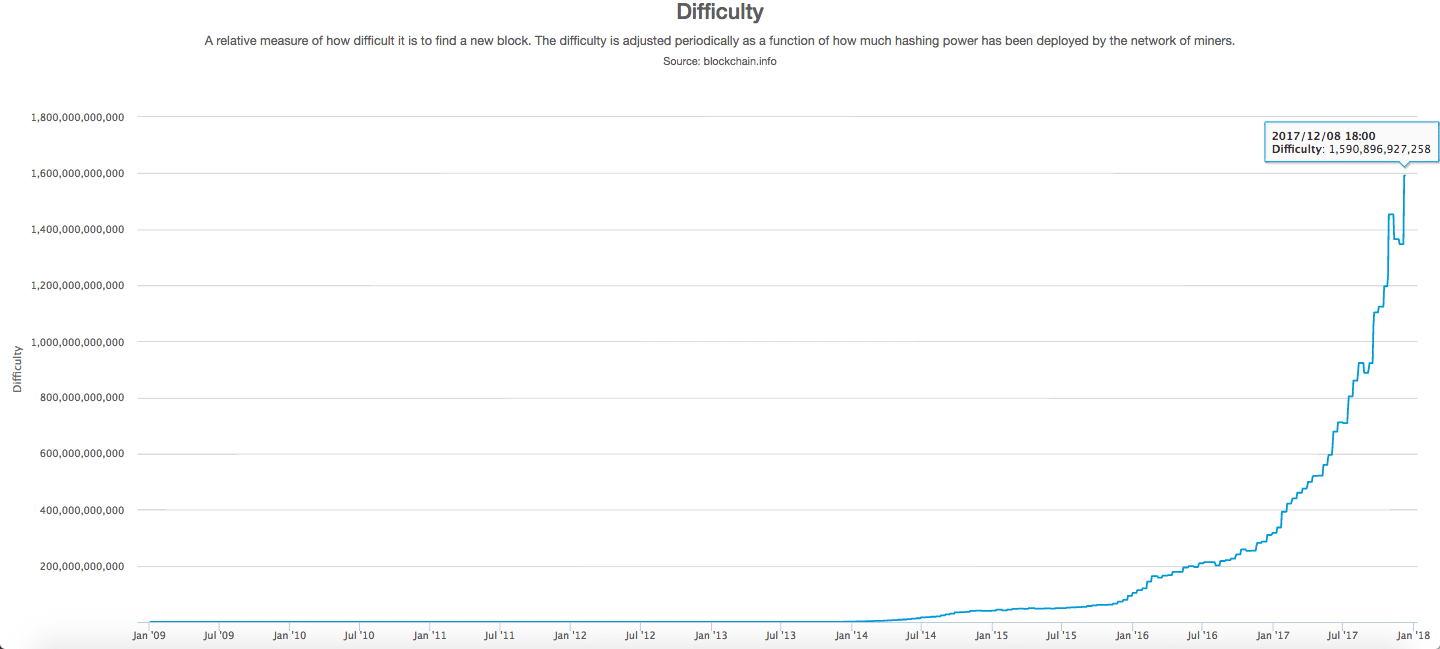

Mining difficulty and rewards

The mining difficulty determines the complexity of the algorithm you need to solve when creating a new block of transactions. As more miners join the network, the difficulty increases making Bitcoin harder to mine.

The reward for mining a block is currently 12.5 Bitcoin. This reward is cut in half every 210,000 blocks with the next “halving” set to occur in 2020. Ideally, the price of Bitcoin will increase enough to outweigh the continuing decline of the mining reward.

You should also factor in the conversion rate of Bitcoin to fiat if you plan on cashing out at any time. With the volatility of Bitcoin’s price, this could greatly affect your profitability.

The biggest unknown when calculating your projected Bitcoin mining profitable is the amount of yearly profitability decline. No one knows how many miners will continue to join the network, so it’s nearly impossible to calculate just how much your revenue will decrease each year.

Hash rate

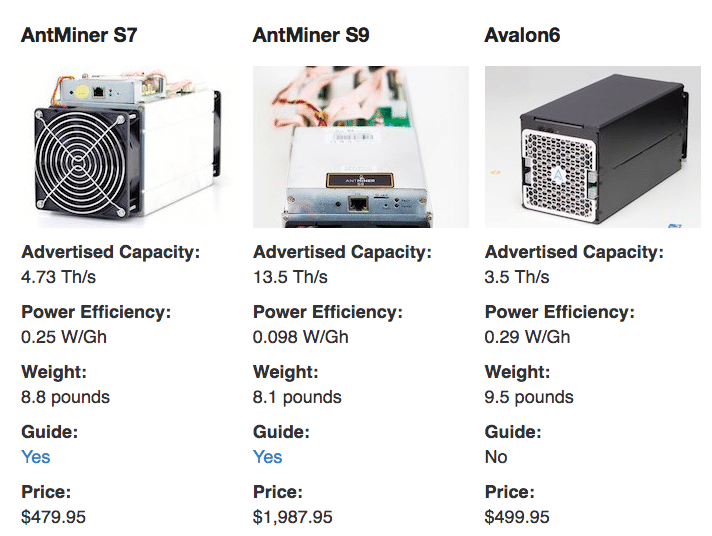

The hash rate is the speed at which your mining rig can solve the algorithm needed to mine new blocks. Although a mining rig with a high hash rate may seem nice, they usually cost significantly more to purchase and operate.

When choosing a miner, you should first figure out how long you’d like to mine for. If you’re only planning on mining Bitcoin for a short amount of time, it could be advantageous to pick up a less expensive miner. Even though the hash rate may be lower, you may be able to pay off the initial purchase cost at a faster rate.

Operational costs

There are a few different costs you need to consider when calculating your Bitcoin mining profitability.

The electrical costs differ based on your electricity rates and the power consumption of your mining rig. Mining rigs are usually listed with their typical power consumption, and you can find your electricity rate on your power bills.

To mine effectively, you’ll need to join a mining pool and pay the associated pool fees. A mining pool is a group of miners that work together to mine blocks at an increased rate. The reward of each block is then split amongst the miners enabling you to get paid more regularly. These fees range anywhere from 0% – 5%.

You should also include the upfront cost of buying a mining rig when calculating your potential profitability.

Bitcoin mining profitability calculators

Once you’ve figured out some of your costs and mining rig options, you can use a calculator to determine whether or not Bitcoin mining is worth it for you.

If you find that you won’t be profitable mining Bitcoin, don’t fret. There’s plenty of other coins like Monero or Litecoin that you may find more profitable for yourself.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.