The Bitcoin price prediction for October couldn’t have gone any better, with BTC touching $120k on the second day of the month. Its growth is likely to spur an increase in the DeFi sector, which has seen a sharp TVL increase in the past quarter.

Investors are now seeking the best crypto to buy in Q4 2025. Interestingly, investors say AI cryptos might dominate the market in 2025, a sentiment that is bringing the spotlight to DeepSnitch AI.

This ecosystem is providing AI-powered crypto analytics for retail traders. Yet, its surging market appeal has led to 300x growth projections for many investors. Here’s why FOMO around DeepSnitch AI is rising.

PancakeSwap’s Q3 trading volume nears $800 billion

PancakeSwap has posted a third consecutive quarterly trading volume increase. The report shows that trading volume on PancakeSwap grew to $749 billion in Q3, marking a 42% increase from the previous quarter.

PancakeSwap’s trading volume for Q2 and Q1, respectively, were $529 billion and $205.3 billion. Additionally, this would be the first time since PancakeSwap’s launch that its trading volume has grown over three consecutive quarters.

Moreover, PancakeSwap’s cumulative trading volume has now crossed $2.49 trillion across 10 supported blockchains. Additionally, its user count has now reached a new ATH of 11.8 million.

Investors say PancakeSwap’s rising trading volume reflects the growth of the DeFi sector. In Q3 alone, the Total Value Locked in the DeFi sector grew by 41% from the previous quarter, rising by $160 billion for the first time since May 2022.

This growth will likely continue due to the pro-crypto laws being introduced by governments around the world. Additionally, such laws, alongside growing corporate interest in cryptocurrencies, are likely to spur a DeFi boom.

Many traders are eager to find new projects that will capitalize on this DeFi boom. One project that can help make this search more valuable is DeepSnitch AI, a project that helps investors turn market uncertainty into actionable insights.

Best crypto to buy: DeepSnitch AI is supercharging retail trading with AI-backed market analytics

Markets move at machine speed, but retail investors are still left reacting late. DeepSnitch is being designed as an always-on AI watchtower that protects traders from risk while pointing them toward profitable opportunities.

The platform uses five AI agents to monitor on-chain activity 24/7. If a whale wallet begins accumulating, or liquidity is being drained from a pool, or a suspicious contract is deployed, DeepSnitch alerts users in real-time. By doing so, it helps make traders proactive, allowing them to respond to market changes in real time.

DeepSnitch also helps with market clarity. Instead of blasting endless data feeds, it translates blockchain scans into bite-sized, actionable steps. That compression gives everyday traders the kind of clarity that usually only insiders enjoy. Even better, traders can receive these alerts in Telegram and X, allowing them to act in real-time.

Risk management is built into its DNA. Scams like rug pulls and pump-and-dumps have stolen billions from retail wallets. By flagging unhealthy pools and shady contracts, DeepSnitch provides an extra layer of armor in a dangerous market.

DeepSnitch AI is combining strong market appeal with real-world utility, a mix that could make it the best crypto to buy. Already, many are rushing to its presale, which is about to enter its second stage. Now at $0.01735, DSNT sales are rising as investors rush to secure a share before its next price increase.

Bitcoin price prediction: ATH or pullback in November?

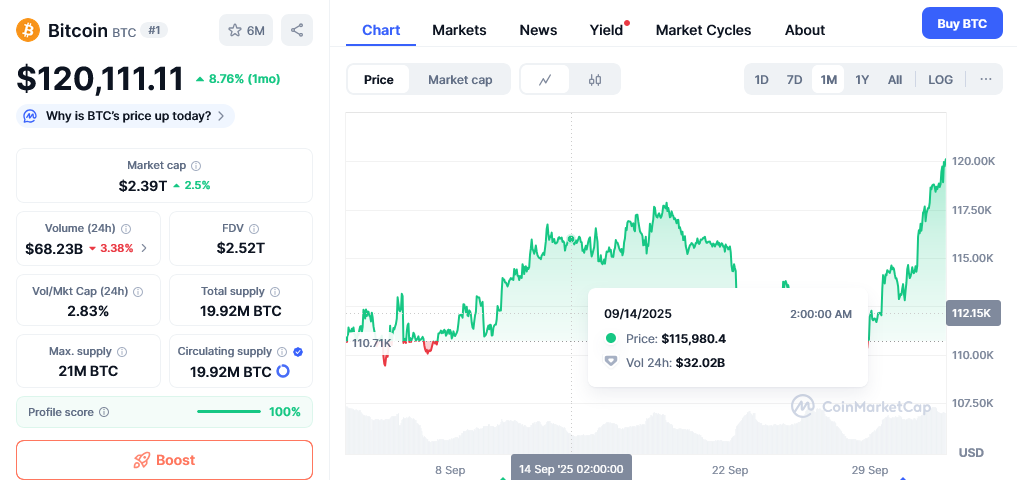

Bitcoin has shot up impressively over the past few days following widespread Uptober bullish sentiment. A few days after the September 22 market-wide liquidation, Bitcoin had gone as low as $109k, sparking fears of a bearish Q4.

However, this is fast changing following Bitcoin’s recent surge. As of October 2, BTC stood at $119,754 following a 7.76% jump over the past week. BTC’s 30-day chart shows a similar 7.6% rise.

Although Bitcoin is bullish, some fear that a correction could be on the way. This Bitcoin price prediction is based on expected short-term profit-taking.

Others argue that Bitcoin could be poised for a bigger rally, citing recent corporate BTC acquisitions as a sign of whale positioning. Now all eyes are on the market and how Bitcoin will perform in the final quarter of the year.

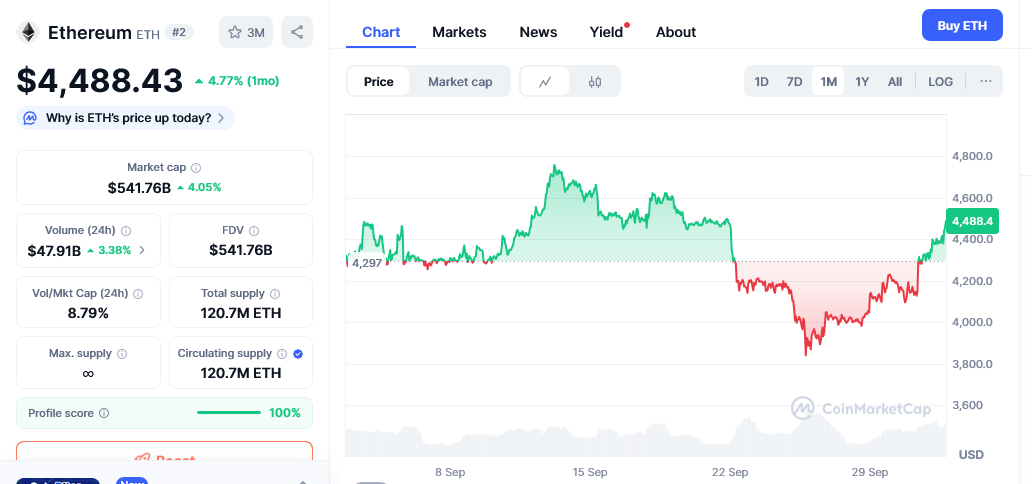

Ethereum price prediction: Can ETH hit $5,000 in January?

Ethereum bulls have maintained confidence in predictions that ETH is set for a new ATH. Their confidence has grown following the token’s October turnaround. Only a few days ago, ETH was around the $3,800 mark. However, it has followed the rest of the market, rising sharply over the past few days.

As of October 2, ETH was trading at $4,409 following a 10.4% jump over the past week. The 30-day ETH price chart shows a 1.16% jump over the past month.

Many investors say ETF demand could be the catalyst that further cements Ethereum’s rally. If ETF demand returns to its Q3 highs or even surpasses that, ETH might rise to $5,000 in early 2026.

Conclusion

The general Bitcoin price prediction has turned bullish, with many saying a new ATH might be close. The resulting bullishness is shining the spotlight on new tokens like DeepSnitch AI, which investors say is poised for 300x gains.

Over $295,000 has been raised in stage one of DSNT’s presale, which is now drawing to a close. The best time to buy DSNT at such a low price again is right now. DSNT’s low market cap and strong market appeal could make it the next crypto to explode

Visit the official presale site today and secure your DSNT allocation before stage one closes.

Frequently asked questions

Which crypto will explode in 2025?

Many investors expect AI cryptocurrencies to outshine their competitors in 2025.

Will Bitcoin hit $150k in 2025?

While Bitcoin is poised to finish the year strong, investors don’t expect its price to go as high as $150k before 2026.

Is Bitcoin a good investment for the long term?

Bitcoin is the largest and most trusted cryptocurrency with a market capitalization of over $2.3 trillion.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.