Bitfinex and Tether Under Fire

- Bitfinex and Tether say this is a routine “legal process” with a no comment policy

- Tether damaged relationship with auditors and failed to certify $2.3 billion in reserves

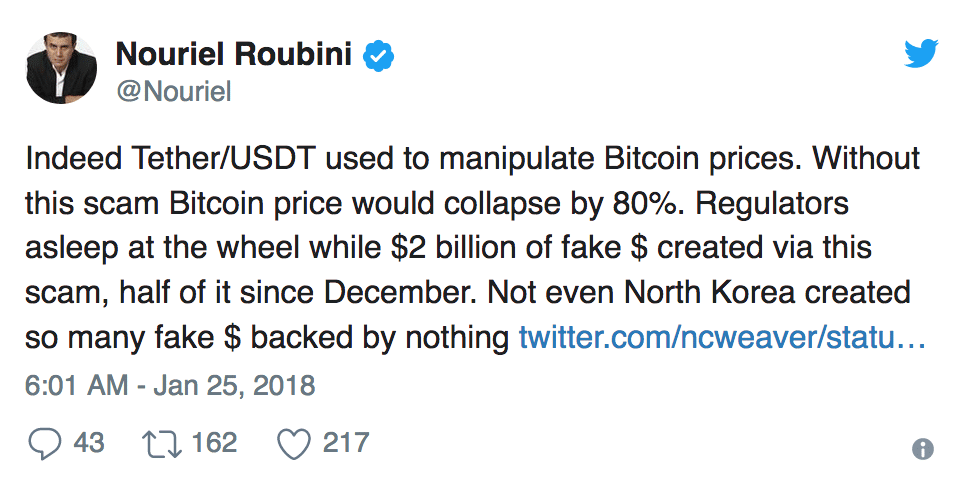

According to Bloomberg, the U.S. Commodity Futures Trading Commission delivered subpoenas on Dec. 6 to major exchange site Bitfinex and digital asset firm Tether, sister companies that share a CEO.

While the exact contents of the subpoenas are unknown at this time, regulators are questioning whether or not Tether, a broadly traded token supposedly backed by the value of the U.S. Dollar, truly has these backings in reserve.

“The company has yet to provide conclusive evidence of its holdings to the public or have its accounts audited” stated Bloomberg. In an email to the news giant, Bitfinex and Tether said: “we routinely receive legal process from law enforcement agents and regulators conducting investigations…it is our policy not to comment on any such requests.”

Effect on the Market

As allegations in the matter continue to surface in the media, the price of Bitcoin fell more than $1000 to nearly $10,000, its lowest since November. Many in the industry have been questioning the authenticity of Tethers reserve holdings for quite some time, with critics citing that unraveling the true “scam” of Tether could drive the price of Bitcoin down nearly 80%.

A “Final Tether Consulting Report” compiled by accounting firm Friedman LLP shows that Tether held roughly $443 million in various bank accounts on Sept. 15. At the time, Tether tokens were valued around $420 million, according to CoinMarketCap. However, the names of the actual banks these funds were supposedly in are concealed and Friedman LLP did not examine the accuracy of Tethers records.

Tether said in a statement “given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame.”

As of Tuesday, roughly $2.3 billion worth of Tether are outstanding, and Friedman LLP no longer works with Tether.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.