- Impact on Real Estate Agents and Other Third Parties

- How Does Blockchain Transform the Real Estate Industry?

- Examples of Real Estate Blockchain Projects

- Conclusion

A variety of industries are beginning to see the impact of blockchain as a disruptive technology. Real estate is one such industry that could soon realize a massive transformation. In fact, this change is already underway. There are some notable real estate startups that have begun making progress in the development and/or adoption of blockchain solutions.

Impact on Real Estate Agents and Other Third Parties

Property listing websites have already reduced the demand for real estate agencies. However, many buyers still utilize agents when shopping for properties. Traditional real estate typical involves quite a few middlemen. You’ve got brokerages, lawyers, bankers, and real estate agents to name a few. From both the buyer and seller side, the use of blockchain technology could easily result in reduced fees – two to three percent less in some instances. Fewer middlemen due to blockchain equate to fewer fees.

For example, if a home costs $1,000,000 with the use of third parties, this same home might only cost $970,000 with the elimination of these extra fees. Although this will certainly have an impact on the people that rely upon real estate employment, implementing blockchain solutions could improve the overall accessibility of home ownership.

How Does Blockchain Transform the Real Estate Industry?

Smart Contracts

One of the ways that blockchain can transform the real estate industry is through the utilization of smart contracts. Utilizing smart contracts, two parties can skip the traditional, slow paperwork process. All conditions on a smart contract (an electronic contract written on the blockchain) can be easily verified.

Essentially, smart contracts offer one major advantage: immutability. In other words, contracts can’t be easily changed after parties have agreed upon the written terms. Smart contracts even allow you to securely store information about a particular property. This gives potential buyers an easier way to research everything about a given property. Essentially, this could be done by inputting a unique electronic identifier for each property. Important factors like previous owners, repairs, natural disaster impact, and maintenance costs are made more transparent thanks to smart contracts.

Preventing Fraud

Even though it may seem like most locations around the world have relatively secure processes for real estate transactions, this isn’t really the case. For instance, Hyderabad, India is infamous for its cases of land grabbing.

In the United States, false data, forged documents, and rental scams all plague the real estate market. This fraud leads to a number of legal battles that often take years to resolve. Moreover, some owners use data falsification and other tactics as a way of driving up property values, which makes home buyers more skeptical.

Finally, it’s possible that hackers could even access a property record database in order to claim ownership. With blockchain and other decentralized technologies, however, hacks are much more difficult to execute. As a result, real estate data can become far more secure.

Fractional Ownership

Another technical breakthrough provided by blockchain is the ability to decrease the real estate accessibility gap. Typically, ownership of large commercial properties requires investment from one wealthy individual. Oftentimes, this makes it difficult for owners to sell. As a result, it’s common for properties to be listed on the market for years without interest from buyers. Consequently, property values can depreciate over time or owners make a decision to sell for much less than appraisal values to get the property off their hands.

With blockchain, however, it’s possible to easily create a system of fractional ownership. In essence, multiple buyers can pay for a fraction of a property. Cases of this technology in real estate and a number of other industries already exist.

[thrive_leads id=’5219′]

Examples of Real Estate Blockchain Projects

436 & 442 E 13th St. in Manhattan

As mentioned in the section above, fractional ownership is starting to become an innovative way to buy and sell real estate. Blockchain real estate startups are working to make this more convenient and efficient than traditional investment. Ryan Serhant, bestselling author of Sell It Like Serhant and star of Bravo’s Million Dollar Listing New York, is the listing broker on a unique luxury Manhattan condo development. This building, appraised at greater than $30 million, has become the first major asset in Manhattan to be tokenized on Ethereum. Through tokenization, multiple owners can invest in this property.

Propy

Numerous blockchain projects have their own native cryptocurrencies and platforms for buying and selling real estate. Propy provides one example of this. In addition to having a Propy token (PRO), web platform, and mobile applications, this project already has properties listed in several top-tier cities located across the globe. You can find properties in San Francisco, New York, London, Barcelona, Prague, and Dubai. You can even signup as a user and register a blockchain-based property deed via the Propy platform.

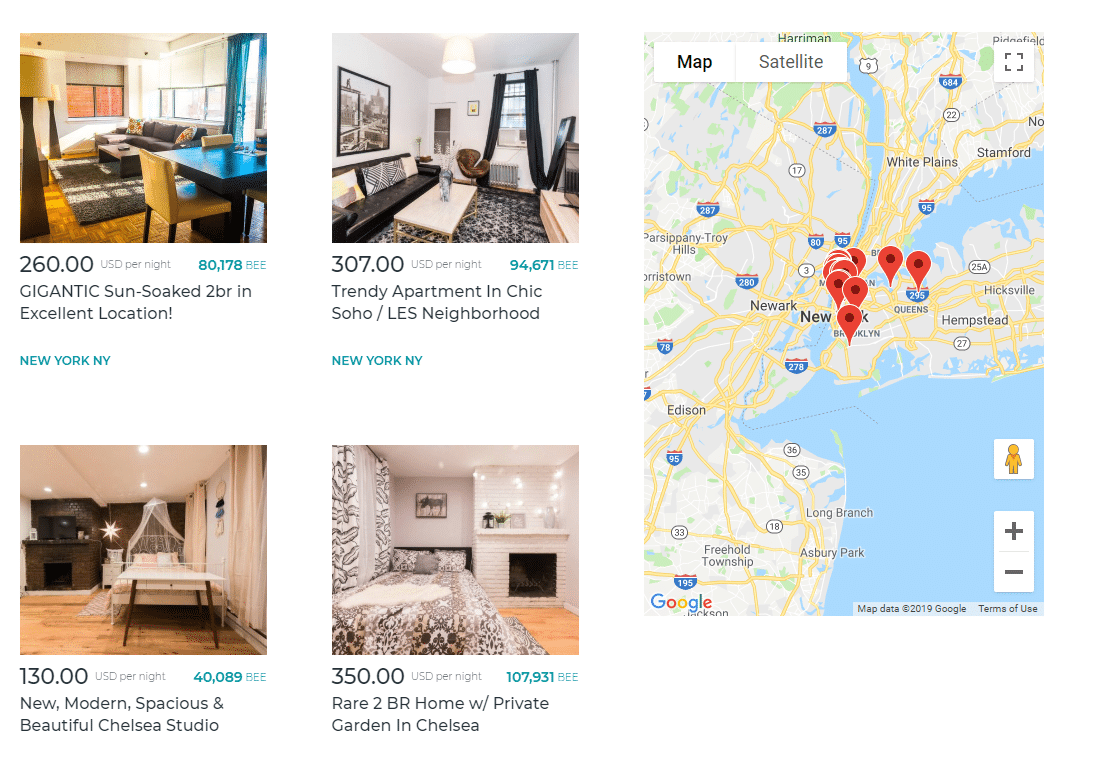

Bee Token

It’s also important to understand how other aspects of real estate have changed prior to the rise of blockchain. For instance, Airbnb created a game-changing platform for real estate owners who wanted to make money from underutilized spaces. While this company brought a lot of innovation to real estate and the sharing economy, it still needs major improvements. Poor-quality listings, customer complaints, and other issues have gone unaddressed.

Luckily, decentralized solutions are now competing in this part of the real estate economy. For example, Bee Token is creating a middleman free, peer-to-peer network of hosts and guests on a decentralized platform called Beenest. This platform features a simple payment system, dispute resolution, and reputation management via Bee Protocols. By creating a solution that provides value to both hosts and guests, this project is continuing to take the steps needed to improve the sharing economy and re-thinking the way that people think about real estate.

Conclusion

In only the past couple of years, blockchain has come a long way in its ability to disrupt the real estate industry. Still, several key improvements are required to make true disruption a reality. Platforms that use blockchain for deed signing/approval will likely need to gain legal accreditation status by various national and local governments.

Additionally, mass adoption of these platforms by end users is still far behind Web 2.0 real estate solutions. Nonetheless, there are plenty of real-world examples, such as those mentioned above, that already exist today. These give us a glimpse of what the future of blockchain-based real estate might look like in the near future.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.