TLDR

- The SEC has officially moved Canary Capital’s SUI ETF application into the institution of proceedings phase.

- This advancement marks a significant step toward the potential launch of the first spot SUI ETF in the United States.

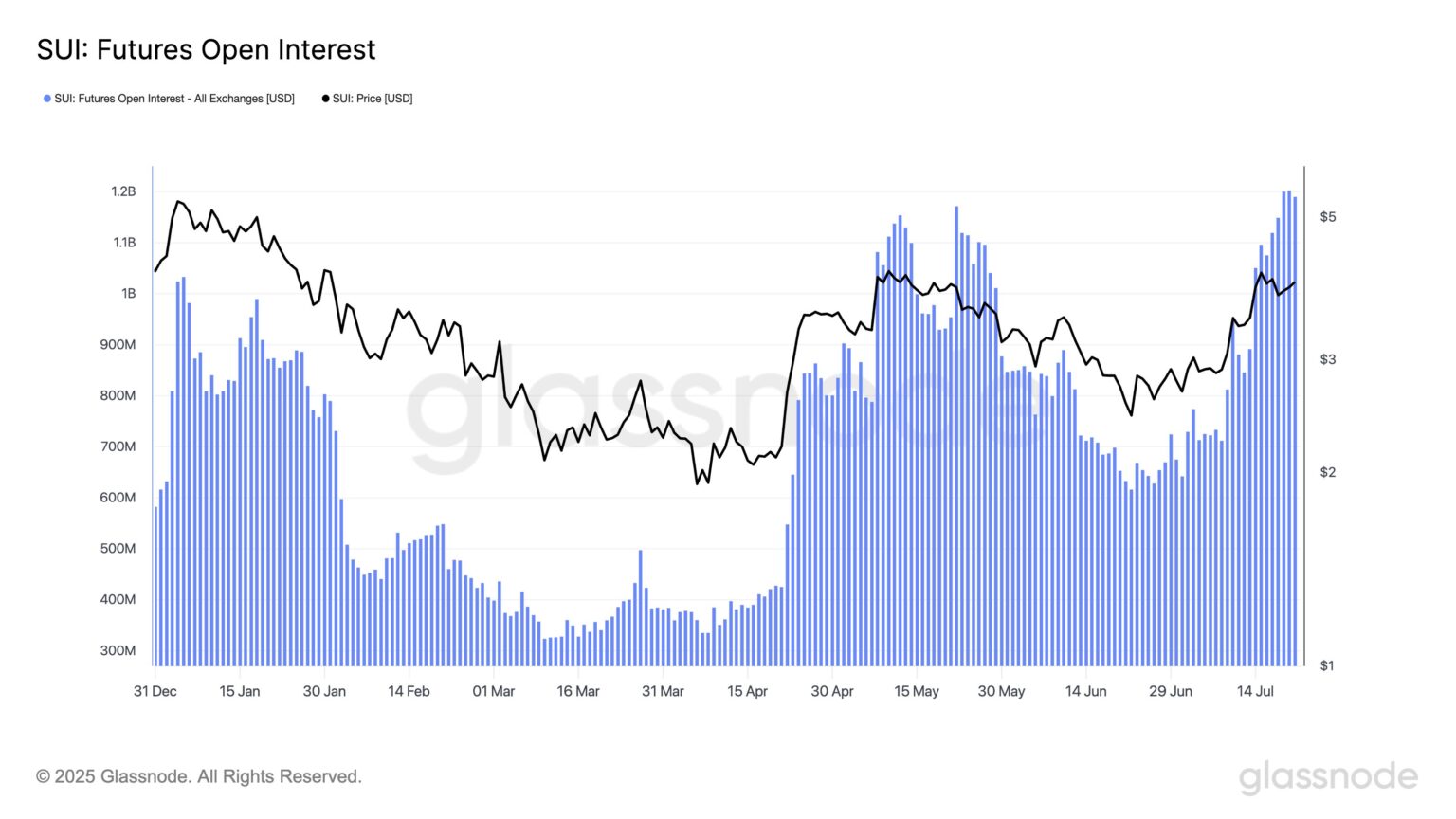

- Open interest in SUI futures has reached a record $1.2 billion, ranking it sixth among all cryptocurrencies.

- Asset manager 21Shares also filed for a SUI ETF and partnered with the Sui Network to expand institutional access.

- The Bitwise Crypto Index ETF, which includes SUI, received SEC approval but remains on operational hold.

The U.S. Securities and Exchange Commission has officially advanced Canary Capital’s SUI ETF application into its formal proceedings stage. This development marks a critical milestone in the race to launch the first spot SUI ETF in the United States. Market participants now anticipate a potential surge in SUI price momentum as institutional focus intensifies.

Canary Capital initially filed for the SUI ETF in March, following a registration process in the state of Delaware. The SEC delayed its initial decision, but it has now moved the proposal forward into the official review process. This move signals that the application has entered a key phase, opening the door for possible regulatory approval.

The SEC’s action reflects growing institutional interest in blockchain-based investment products, particularly in the Layer-1 category. As Canary’s proposal progresses, traders are watching SUI’s price movements and volume trends for further confirmation. The approval process remains ongoing, yet market expectations are clearly rising in response to these regulatory developments.

SUI ETF Open Interest and Institutional Demand Surge

The SUI ETF narrative gained strength as data shows rising open interest across major futures markets, reaching a historic $1.2 billion. SUI now ranks sixth in total futures open interest, following Bitcoin, Ethereum, Solana, XRP, and DOGE. This surge in futures positioning indicates heightened expectations surrounding a potential SUI ETF approval.

In parallel, asset manager 21Shares also filed its own SUI ETF application, further intensifying the competitive landscape. The company also formed a strategic partnership with the Sui Network to broaden market access and product offerings. This second filing reinforces the significant interest from institutional players in supporting SUI-focused investment vehicles.

The SEC also approved the Bitwise Crypto Index ETF, which includes SUI among top cryptocurrencies such as Bitcoin and Ethereum. Though still on operational hold, this approval reinforces SUI’s presence in institutional portfolios. These actions suggest growing regulatory momentum across the crypto ETF space, and SUI appears to be part of this trend.

SUI Price Eyes $6 As Technical Indicators Strengthen

SUI traded at $3.95 and remained well above its 200-day moving average, which currently stands at $2.73. The relative strength index stayed around 66, indicating continued bullish conditions without overbought signals. Technical analysts have identified strong consolidation, pointing toward a possible breakout in the coming weeks.

The immediate resistance lies at $4.00, and a clear move above this level could trigger a rally toward $4.20 and $5.00. Should the SEC approve any SUI ETF proposal during this phase, prices could push higher, reaching $5.50 or even $6.00. Market sentiment remains firmly positive as both volume and open interest continue to climb.

Crypto analysts expect a new base to form before SUI retests previous highs in August.

$SUI, I think we are building a base here for the next leg.

• 1D trend broken, and we are attempting a flip here above a key Supply/Demand zone.

We can go a bit higher from here, but I feel we range for here for the next week or so before making a push toward ATHs in August.… pic.twitter.com/znNB2GTt5i

— Scient (@Crypto_Scient) July 22, 2025

Increased ETF attention has pushed SUI into the spotlight and strengthened bullish projections. With institutional demand and strong technicals aligning, the SUI ETF narrative is now driving expectations of a breakout.