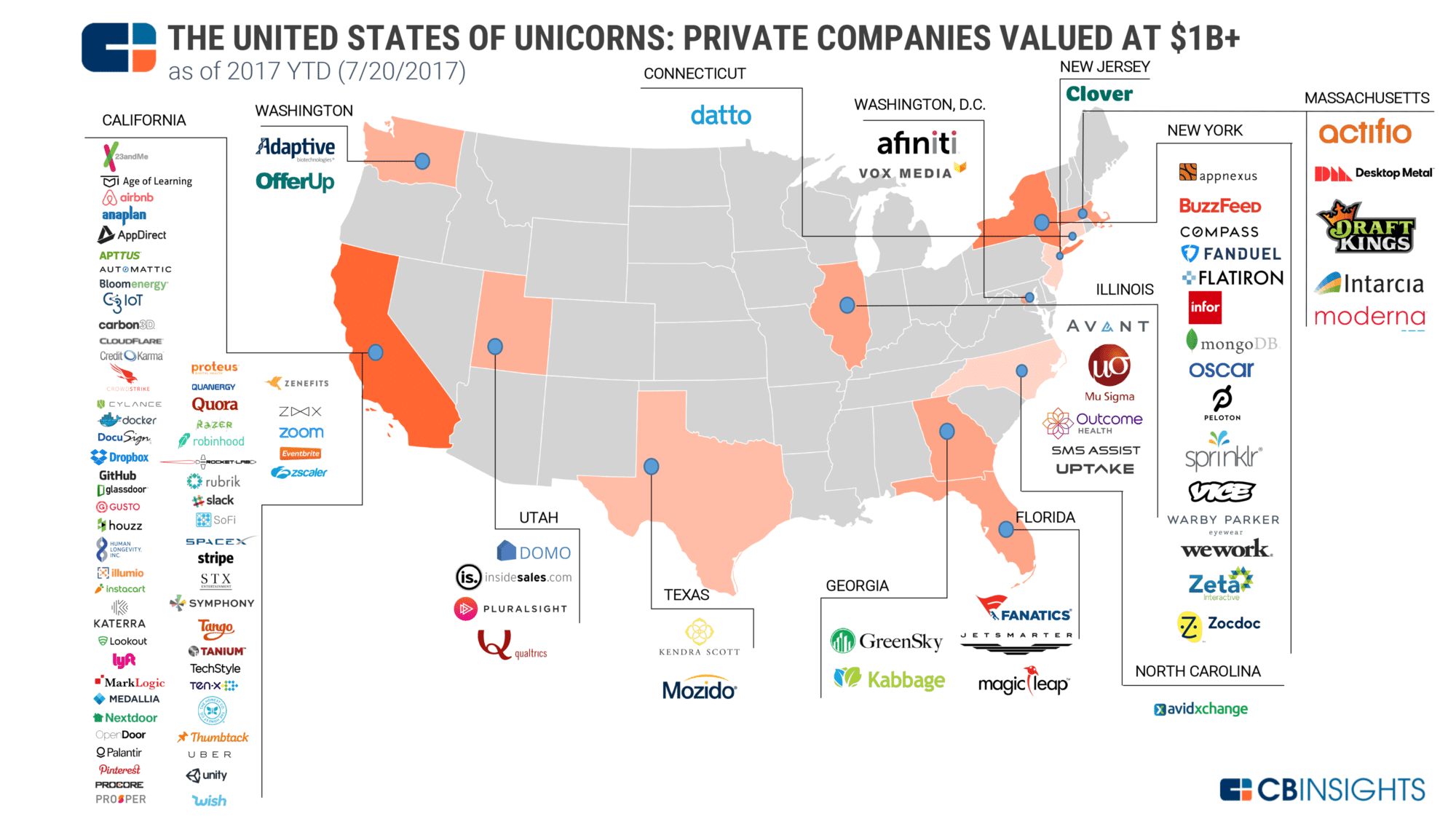

Silicon Valley has long been the de facto location for budding startups to set their roots and grow into multimillion-dollar businesses, but it may not be the capital of blockchain technology. As of July 2017, 62 out of the 105 total U.S. companies valued at over $1B are located in California. To put that into perspective, New York has the second highest amount with only 15 businesses.

However, with the power of decentralization, blockchain-based startups are proving that you can find success outside of the Silicon Valley bubble. Cities around the world, whether it be through looser regulations, strong financial ties, or some unknown factors, have started vying for the title of “capital of blockchain” and are emerging as meccas for young cryptocurrency companies. Although a forerunner hasn’t emerged yet, there are a few regions beginning to develop as hot spots for this new innovation.

Chicago, USA

Flying under the radar, Chicago is quickly building itself to be a world leader in cryptocurrency. The Chicago Mercantile Exchange (CME) and Chicago Board Options Exchange (CBOE) were two of the first U.S. financial exchanges to support Bitcoin futures trading.

Lesser known, the Illinois government was one of the first to embrace blockchain technology by forming the Illinois Blockchain Initiative (IBI). The IBI is a dedicated approach to:

- Create non-onerous legislation surrounding the technology,

- Perform blockchain pilot programs within government organizations, and

- Develop the blockchain ecosystem in Chicago.

The Chicago Blockchain Center (CBC) is spearheading objective number three. The CBC hosts developer workshops and meetups as well as supports local startups through incubation. All of this combined has led to the growth of a large blockchain community in the Windy City.

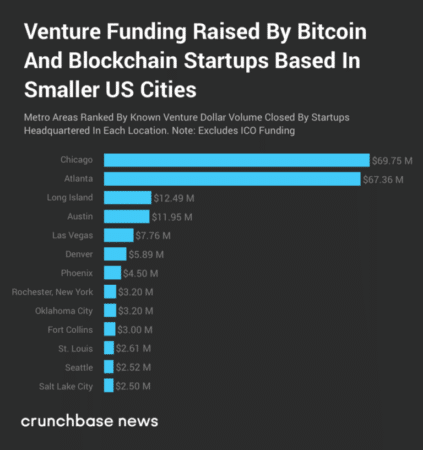

In fact, Chicago is a leader in venture-backed blockchain startups. Chicago companies have raised over $69 million to date – more than three times the amount of Austin, Denver, and Seattle combined.

Notable Companies/Projects: Bloq, CFX Markets

Austin, USA

Fielding refugees from San Francisco’s inflated housing market, Austin is carving a niche for itself with blockchain startups. Having no income tax and a natural Libertarian attitude, the state capital is primed for crypto-minded entrepreneurs.

The city has hosted the Texas Bitcoin Conference since 2014 but more famously brings in hundreds of thousands of attendees for South by Southwest (SXSW) each spring. Although not focused on cryptocurrency, SXSW this year included several speakers and panels focused on blockchain and its impact on other industries.

As one of the fastest-growing cities in the U.S., it wouldn’t be surprising to see Austin solidify itself as the place to settle down a cryptocurrency headquarters.

Notable Companies/Projects: Factom, Wanchain

New York City, USA

Although many have fled due to the implementation of its BitLicense, New York is still a hotbed for blockchain innovation. With deep roots in financial markets, it’s only natural that the Big Apple is home to some of the most well-known crypto companies and exchanges.

Beyond New York’s sheer population dominance over other cities, it also hosts one of the largest blockchain conferences in the world – Consensus. This year, the conference has even expanded to an entire “Blockchain Week”. CoinDesk and the New York City Economic Development Corporation have partnered to organize the week’s events with the goal of making NYC a global blockchain capital.

With massive amounts of investment capital and the Winklevoss twins leading the charge for self-regulation, New York City could easily become the new capital of blockchain.

Notable Companies/Projects: Gemini, Blockstack, Consensys

[thrive_leads id=’5219′]

Singapore

A country rather than a city, Singapore is a strong magnet for companies looking to ICO. The Monetary Authority of Singapore (MAS), has stated time and again that they have no plans to regulate the industry and instead provide ample support.

They’ve embraced the new tech in an experimental project, Ubin. The project is in partnership with R3, and the goal is to “explore the use of Distributed Ledger Technology (DLT) for clearing and settlement of payments and securities.” Although not directly affecting regulation, Ubin helps members of the MAS further understand blockchain and the value it can bring.

The MAS has even gone further by allocating $150 million towards FinTech projects in the country.

Singapore also is home to FinTech Festival – the largest FinTech conference in the world. Over 30 thousand people from around the globe participate in the festival, bringing loads of talent to the small nation.

Notable Companies/Projects: Digix, TenX, Zilliqa

Zug, Switzerland

Already commonly called ‘Crypto Valley’, Zug is the current leader for the capital of blockchain title, and it’s clear why. Switzerland has historically been fairly lenient when it comes to banking and financial regulations.

On top of that, Zug has some of the lowest taxes in the nation and has taken a business-friendly approach to cryptocurrency. The government supports citizens paying in Bitcoin for some services and also uses Ethereum in a digital ID system.

Bitcoin Suisse, the financial service provider behind numerous high profile ICOs (Status, OmiseGo, SingularityNET) also calls Zug home.

Entrepreneurs in the area have formed the Crypto Valley Association to help foster growth of the ecosystem. This association collaborates with partners around the world and works with the local government to create fair blockchain regulations. Even so, the canton is far from having all the answers on how to regulate this new asset class. It’s a good sign, though, that government officials are openly working with the people that it affects most.

Notable Companies/Projects: Bitcoin Suisse, Xapo, ShapeShift, Monetas, Tezos

Decentralizing the Capital of Blockchain

These are just a few of the regions making a name for themselves in the blockchain space. With the decentralized nature of the industry, it’s entirely possible that one single “capital of blockchain” never surfaces. And, that’s a good thing.

In the end, we’re all on the same team. Projects should continue to collaborate across borders to ensure the success of the entire industry. Because when blockchain wins, we all win.