- What Was Celsius Network?

- Why Did Celsius Network Fail?

- The Arrest of Alex Mashinsky

- Was Celsius a Ponzi Scheme?

- Final Thoughts: What’s Next for Celsius Network and What Can We Learn?

Celsius Network is a bankrupt cryptocurrency lending platform and crypto interest account provider; it offered depositors interest on their digital assets. Suddenly, Celsius halted all withdrawals, swaps, and transfers on June 13th, 2022. In May 2022, the company had lent out a total of $8 billion to clients, and had nearly $12 billion in assets under management.

Celsius filed for Chapter 11 bankruptcy on July 13th, 2022, and founder Alex Mashinsky was arrested in June 2023; the Department of Justice accused Mashinsky of “orchestrating a scheme to defraud customers of Celsius through a series of false claims about the fundamental safety and security of the Celsius platform.”

What Was Celsius Network?

Celsius was a cryptocurrency interest account and lending platform; storing cryptocurrency funds in Celsius would earn you interest every week.

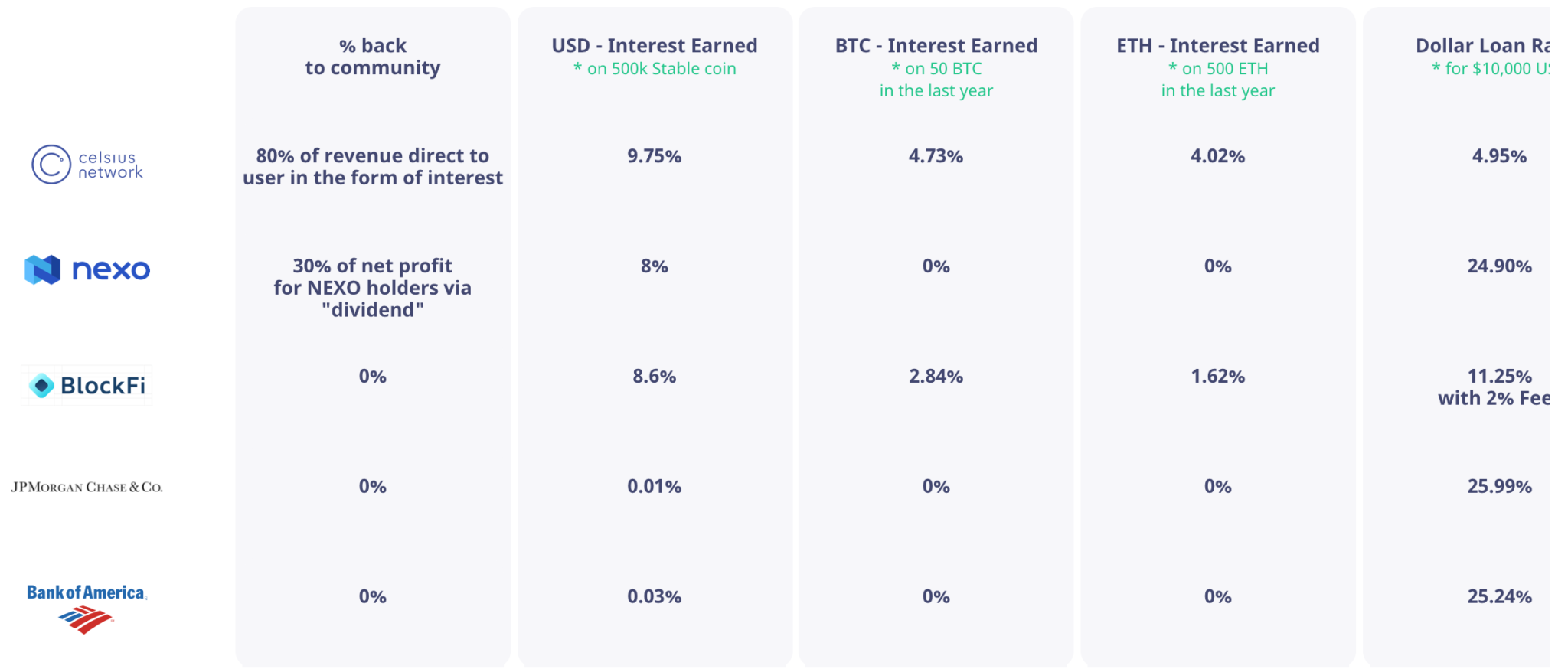

On its “About Us” page, it billed itself as “a platform of curated services that have been abandoned by big banks – things like fair yield, zero fees, and lightning-quick transactions.” Essentially, a cryptocurrency retail bank that functions similarly to traditional banks:

- You deposit cryptocurrency into the Celsius app.

- The company then loans those funds out to retail and institutional borrowers.

- Every Monday, you receive a payment from the revenue that Celsius gains from those loans and other activities. The Celsius team boasted a return of 80% of company revenue to users.

On the other side of lending, one could get a loan from Celsius by putting up cryptocurrency as collateral. Unlike most traditional loan services, Celsius loans didn’t require a credit check and typically granted approval in minutes.

Celsius had about 300,000 active users (over $100 in wallets) and more than 1.7 million registered users at its peak.

The rates Celsius offered were reasonable– between 3% to 6% for tokens such as BTC and ETH, and upwards of 18% for other specific tokens. The model certainly didn’t seem unsustainable– Celsius claimed to just make revenue on the spread between loans and interest paid.

However, behind the scenes, Celsius was aggressively investing user deposits in a variety of higher-risk schemes. Far from just the institutional and retail lending it advertised, Celsius was also active in DeFi deployments (billions of capital in applications like Aave, Maker, Compound, and BadgerDAO), mining (purchasing expensive mining equipment and readying for an expansion of Bitcoin mining operations), and even various trading strategies.

Celsius was a private, centralized company and the majority of its balance existed off-chain, with only Celsius’s internal team having the best shot of a clear view of its operations. The public at large could only piece together a kaleidoscope of Celsius’s health from Celsius company announcements, semi-public materials (released by Celsius), Alex Mashinsky AMAs, anecdotal reports, and rumors on Twitter/Telegram/Discord with dubious credibility.

Prior to freezing all user withdrawals, Celsius was considered very trustworthy by its users– in days prior to the freeze, many users dismissed rumors (which turned out to be true) as the typical FUD that is pervasive in the crypto community.

Celsius Network made believers out of an international community, seeing their cryptocurrency assets turned into what seemed like passive investment vehicles.

Why Did Celsius Network Fail?

With billions of dollars in assets under management, it’s hard to imagine a company claiming to pursue conservative crypto lending strategies going under as quickly.

The cracks at the seams began to show at various instances in Celsius’ brief history.

In June 2021, Celsius partner and crypto custodian Prime Trust severed the relationship when Prime Trust’s risk team expressed apprehension over Celsius’s strategy of “endlessly re-hypothecating assets.”

In other words, Celsius was lending the same assets over and over to different parties. In stable markets, this could lead to better yields. Any sharp market movements, such as those linked to the collapse of LUNA & UST, would have severely negative consequences.

Celsius was advertising itself as a safe and trustworthy company, but was juicing its growth with an incredibly leveraged business model. With over 1.7 million customers around the world, Celsius was one of the largest entities in the cryptocurrency lending space.

The series of events that finally broke Celsius were as follows: the downfall of UST in May 2022 spiked the market downward, and thousands of customers rushed to pull their funds out of Celsius amid rumors that the company was severely impacted by the UST de-pegging and collapse.

The company and the very public-facing CEO Alex Mashinsky would shoot down any and all news of the company losing user funds, dismissing claims as rumors by “vocal actors” and malicious third parties spreading misinformation.

Just days before halting withdrawals, Mashinsky claimed, on one of his weekly “Ask Mashinsky Anything” sessions, “Celsius has billions in liquidity, right, and we provide immediate access to everybody.”

He made similar statements in interviews with CoinCentral, as well.

Three days later, Celsius paused all customer withdrawals to “stabilize liquidity and operations” due to “extreme market conditions.”

The market continued to drop in double digits, and Celsius’s token fell by a third to $0.21; it had traded for nearly $7 a year before. The news of Celsius stopping withdrawals even caused a 10% drop in the share price of Celsius Holdings, an unrelated energy drink company.

Celsius found itself harboring secrets of catastrophic losses and illiquid positions, such as having over 460,000 ETH locked in staking contracts.

Celsius filed for Chapter 11 bankruptcy on July 13, 2022and filed a declaration the following day reporting a $1.2 billion hole in the company’s balance sheet. Celsius had about 32% of the $5.5 billion of total crypto deposits left on the platform.

Celsius owed $4.7 billion of the $5.5 billion in total liabilities to its users, who stood as unsecured creditors. Through its Chapter 11 bankruptcy choice, repayments would be prioritized to secured creditors first, then unsecured creditors, and then equity holders– essentially leave hundreds of thousands of users with their assets locked on the platform.

Mashinsky would now claim that the company had “made what, in hindsight, proved to be certain poor asset deployment decisions”

The $167 million cash Celsius had left on hand would go to support its operations during bankruptcy.

Congratulations to Celsius lawyers and advisors who are on track to have now passed $140M in fees, at the expense of victims left behind by @Mashinsky‘s despicable $3B fraud. 🦄 pic.twitter.com/PwYJ8JLwKO

— Cam Crews (@camcrews) March 20, 2023

As of writing, Celsius has paid its lawyers and bankers over $175 million in fees, eating into the amount owed to creditors.

The Arrest of Alex Mashinsky

Mashinsky resigned as Celsius CEO on September 27, 2022. He was arrested and charged with seven counts of fraud by the US Department of Justice in July 2023. If found guilty on all counts, he could face up to 115 years in prison.

He was released from custody on a $40 million bond, pleading not guilty.

Was Celsius a Ponzi Scheme?

Celsius failed to properly disclose its business model and risks to its users, leaving many of its users’ livelihoods clinging in the throes of bankruptcy courts. Celsius has certainly been accused of being a Ponzi scheme, and some of its dealings with the CEL token are reminiscent of a Ponzi, but that doesn’t seem to be the full story.

Despite its embellishment of risk and outright lying to the public, the irresponsibly leveraged business model of seemingly endless rehypothecation, and illiquid positions, Celsius’s failings point to the inherent risks of the grey territory in which centralized companies in cryptocurrency operate.

Other crypto lenders such as BlockFi, Voyager Digital, Hodlnaut, and Genesis Global Capital were all caught in the shockwaves of the Terra Luna collapse, Three Arrows Capital losses, and the FTX fiasco.

The majority of collapses in 2022 were the result of incestuous relationships between highly leveraged centralized companies in an extremely volatile market.

Final Thoughts: What’s Next for Celsius Network and What Can We Learn?

It’s important to differentiate between true DeFi and centralized actors operating in DeFi– even Celsius, amid shuttering all withdrawals in preparation for bankruptcy, had to pay back over $500 million to its three largest DeFi lenders (Compound, Aave, and Maker) or automatically risk losing over $1 billion in collateral.

The problem is that centralized companies such as Celsius Network, Voyager Digital, and Hodlnaut could completely obfuscate what they were doing with user deposits off-chain. All users, who implicitly believed their assets were undeniably still their property once on the platform, were soon shown the opposite.

The once-active Celsius Reddit community momentarily turned into a support group, with many users claiming to have lost anywhere from a few paychecks to a few years of income to their life savings on the platform. The Reddit page is now mostly spam.

Other communities, such as the Celsius Retail Clawback Protection group on Telegram, have emerged to voice user rights and share information in the nightmarish lengthy bankruptcy process.

As of writing, Celsius users have voted on a post-bankruptcy plan presented by the Celsius legal team, where they will receive some percentage of their crypto and some percentage in equity for a new company, Fahrenheit, which won the bid to acquire Celsius’s assets.

Further Reading:

- Arkham Intelligence’s report on the Celsius Network downfall for a more comprehensive picture.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.