- Coinbase vs Poloniex: Key Information

- Coinbase & Poloniex – Complimentary exchanges for different types of investors

- The Court of Public Opinion

- Customer Support

- Company History and Regulatory Compliance

- Safe and Secure

- Fees

- Available Cryptocurrencies

- Coinbase vs Poloniex: Final Thoughts

The cryptocurrency exchanges Coinbase and Poloniex share many features and market to much of the same user base, but ultimately serve two different purposes for most cryptocurrency investors.

In this Coinbase vs Poloniex comparison, we’ll discuss the major features of both exchanges and how each can be beneficial to different types of investors.

Coinbase vs Poloniex: Key Information

Exchange

Reviews

Site Type

Easy Buy/Sell Methods

Cryptocurrency Exchange

Beginner Friendly

Mobile App

Buy/Deposit Methods

Credit Card, Debit Card, Bank Transfer, Cryptocurrency

Cryptocurrency

Sell/Withdrawal Methods

PayPal, Bank Transfer, Cryptocurrency

Cryptocurrency

Available Cryptocurrencies

Bitcoin, Ethereum, Litecoin

Bitcoin, Ethereum, Litecoin,

and 68 MoreCompany Launch

2012

2014

Location

San Francisco, CA, USA

Incorporated in Wilmington, DE USA

Community Trust

Great

Fair

Security

Great

Fair

Customer Support

Good

Poor

Verification Required

Yes

Yes

Fees

Medium

Low

Site

Visit Coinbase

Coinbase & Poloniex – Complimentary exchanges for different types of investors

Coinbase is many investors’ first experience with cryptocurrency since it’s perhaps the most user-friendly way to convert fiat currency to cryptocurrency.

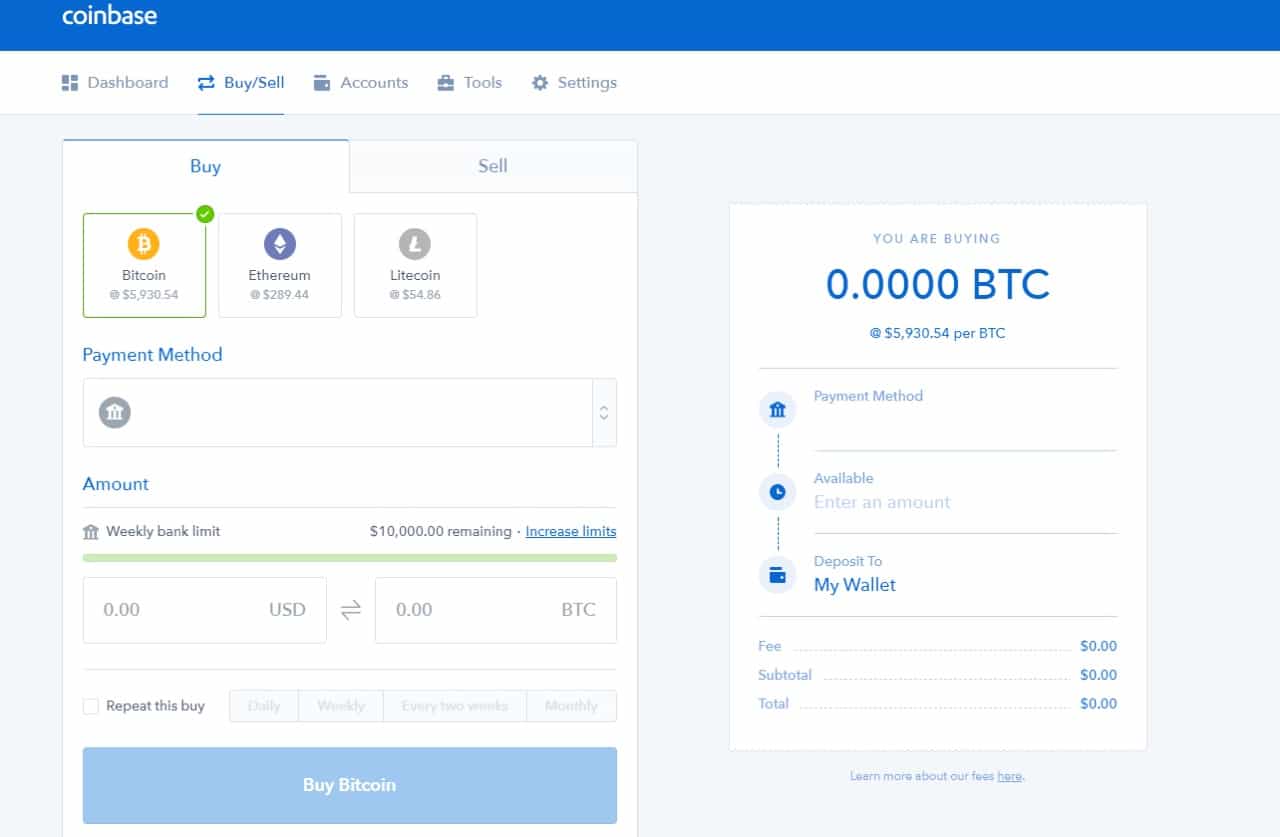

It features a simple user interface and accepts deposits in USD via ACH bank transfer, bank wire, or credit/debit card. In addition to its primary business of being a retail cryptocurrency exchange, Coinbase offers trading through its crypto trading platform, Coinbase Pro (formerly known as GDAX.)

The Coinbase web page is simple and easy to use, which is perfect for users new to crypto investing. After signing up and verifying your email address and phone number, you have the option of either depositing USD to Coinbase or making direct purchases or BTC, ETH, or LTC.

The GDAX exchange can be used for a bit more advanced trading but is limited to basic stop/market order trades for BTC, ETH, and LTC.

Poloniex is better suited for a more seasoned cryptocurrency investor. Fiat currencies can’t be deposited directly, so if you aren’t already holding cryptocurrencies you’ll need to use Coinbase or another crypto exchange before you can start trading on Poloniex.

The user interface is clean and contains a great deal of useful information for each trading pair, including candlestick charts, technical analysis overlays, and order book visualization.

Poloniex also offers more advanced trading features such as margin lending for all users and allows users to lend their cryptocurrencies on deposit.

The Court of Public Opinion

Coinbase is generally considered the most professional and reliable among crypto exchanges. This perception is firmly ingrained in both the crypto community and more mainstream investors, leading venture capitalist Fred Wilson to describe Coinbase as “a safe haven akin to Goldman Sachs or J.P. Morgan in a world of robber barons”.

You’d be hard pressed to find users speaking of Poloniex so highly. Most mentions of the exchange online tend to be focused on complaints about their lackluster handling of customer service, which we’ll discuss further below.

Customer Support

In terms of mainstream non-crypto businesses, neither Coinbase nor Poloniex are winning any awards for customer service. While complaints of Coinbase support are common, it was lauded for its recent implementation of phone customer support, a nearly unprecedented move in cryptocurrency trading.

Poloniex fares even worse in this department. Customer support consists of a FAQ section and a system to submit support tickets, which frustratingly requires a separate signup and login from your standard Poloniex login. A quick search of any cryptocurrency forum shows that Poloniex has a reputation for freezing customer accounts, delaying withdrawals, and ignoring customer service requests.

Company History and Regulatory Compliance

Coinbase was founded in San Francisco in 2012 and is backed by major VC investors like Union Square Ventures and Andreessen Horowitz. It commands significant trust in the crypto community due to its longevity, security, and regulatory compliance. Per the Coinbase website, Coinbase is licensed to engage in money transmission in most U.S. jurisdictions and is registered as a Money Services Business with FinCEN.

Poloniex has been active since 2014, but its management and ownership is much more secretive. It’s registered a Delaware LLC, but rather than a physical headquarters claims to be “a distributed company with main hub in the Boston area”. While Poloniex is not as upfront about their commitment to regulatory compliance, they have suspended operations in certain US states as required by state law, showing a willingness to operate within regulatory frameworks.

Safe and Secure

Security is an area where Coinbase shines, having never been hacked in its 5 years of existence, at least to public knowledge. 98% of the digital currency held by Coinbase is stored offline in secure vaults distributed worldwide, while the 2% held online is insured through a policy through Lloyd’s of London. Fiat currency held with Coinbase is insured up to $250K per account through the FDIC.

Unlike Coinbase, none of the digital currency held online by Poloniex is insured, though reportedly most customer funds are also stored securely offline (“cold storage”). Poloniex also suffered a security compromise in March 2014 when their accounts were hacked and 97 BTC were stolen, though to its credit Poloniex reportedly reimbursed the affected customers in full.

Neither exchange will be held liable if security is compromised on the user’s end. To that end, it’s critical to use two-factor authentication (2FA) which is offered on both Coinbase and Poloniex. Make sure to use Google Authenticator or a similar application to generate one-time 2FA codes, as text message-based 2FA leaves you vulnerable to your phone number being cloned by an unauthorized third party.

Fees

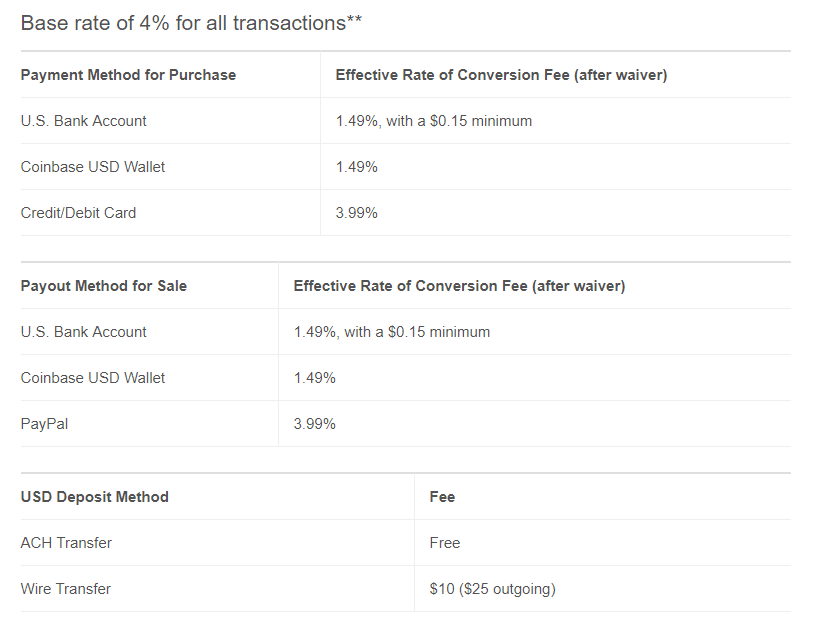

For its primary retail exchange business, Coinbase charges a 1.49% fee for all cryptocurrency purchases and withdrawals made from bank accounts or Coinbase USD wallets, and 3.99% for purchases via credit/debit cards and withdrawals via Paypal. Once your cryptocurrency is purchased, you can transfer them to other BTC/ETH/LTC addresses for no additional cost beyond the network transaction fees (ex. miner’s fees).

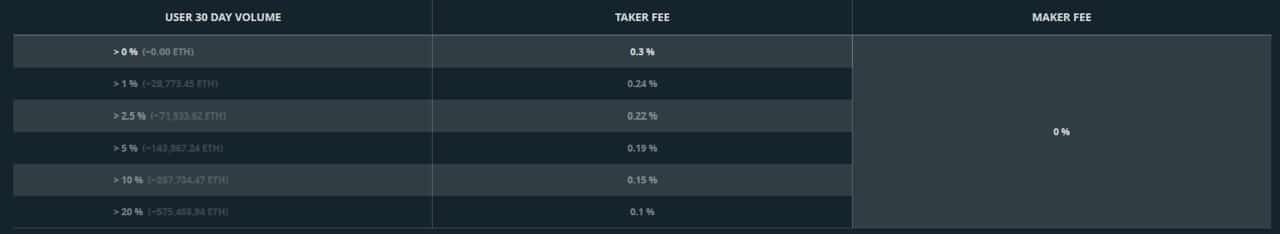

GDAX uses a maker-taker model, where users who place bids on the order book (“Makers”) receive a discount on their trading fee versus users who complete a bid already placed on the order book (“Takers”). The fees for makers are 0%, while takers pay between a range of 0.3% and 0.1% depending on their trade volume.

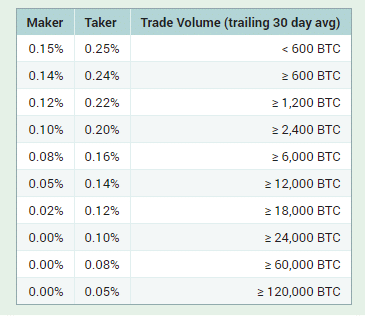

Poloniex also uses the maker-taker model for fees. For users with 30-day trailing trade volume of 600 BTC or less, this fee is 0.15% of each transaction for Makers and 0.25% for Takers.

Coinbase’s retail brokerage fees are relatively high, but it remains the simplest way for users to convert their fiat currencies into cryptocurrencies. On the exchange side, GDAX and Poloniex fees are similar.

Available Cryptocurrencies

Coinbase currently offers sales and trading of BTC, ETH, and LTC, with plans to support Bitcoin Cash (BCH) on January 1st. Earlier this year CEO Brian Armstrong also tweeted a survey asking which currency users would like to see added next, listing DASH, XMR, AUG, XRP, ETC, and ZEC as options. However, no official plans to add new currencies have been publicly announced since then.

Poloniex currently offers trading in 71 different cryptocurrencies, including virtually all major cryptocurrencies. While depositing, trading, or withdrawing in USD isn’t possible on Poloniex, you can trade in Tether (USDT), a cryptotoken designed to stay pegged to USD and which can be used as a USD proxy.

Coinbase vs Poloniex: Final Thoughts

Coinbase and Poloniex can each offer significant value to cryptocurrency investors, and whether you should use one or the other (or both) depends on your investment objectives. For new users, especially those who need to convert fiat currencies to cryptocurrencies, Coinbase is the clear choice and as trusted a name as any in the crypto world. If you are looking for basic trading functionality and only plan to trade BTC, ETH, and LTC you can then use GDAX to trade.

On the other hand, you’ll want to also use Poloniex or another cryptocurrency exchange if you plan on trading the variety of altcoin cryptocurrencies, or if you are a retail investor who wants to take advantage of margin trading.

(You Can View Our Full List of Recommended Cryptocurrency Exchanges Here)

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.