- The Flippening

- But What About Now?

- An Anonymous Augur

- Bitcoin Classic’s Bail and Gavin Andersen’s Support

- Where Does This Leave Us?

Bitcoin Cash (BCH) recently went on an absolute tear.

Back in late October it tested a support of ~$320.00. In the earlier hours of November 12th, it reached a new all-time high at ~$2,400. Meanwhile, Bitcoin (BTC) has suffered a major pullback, down from highs of $7,700 a few days ago to lows of under $6,000 yesterday.

To many in the cryptocommunity, it’s beginning to look like BCH and BTC are playing king of the hill, and this arms race has invited speculation from both sides as to what’s going to come of this fluctuation.

Bitcoin fans say this is just a pump and dump, while Bitcoin Cash proponents say that BCH is set to overtake BTC as the true Bitcoin currency.

So which side is right?

Well, BCH has had a major correction since its all-time high the other night, seeing prices dip to as low as ~$1,050 yesterday. But BCH’s November 13th hashrate difficulty adjustment and BTC’s continued depreciation has us thinking this wrestling match isn’t over yet

And while we’re not crypto prophets, we can give you the arguments for why both sides of this coin think their currency will ultimately prevail. So strap in and whet those analytical appetites–it’s going to get spicy.

The Flippening

To better understand this debacle, you need to understand The Flippening and its context (note: this flippening is unrelated to Ethreum, which was another conspiracy in and of itself).

Back in August, rumors began circulating on Bitcoin forums that BCH had an opportunity to overcome BTC in value and overall market cap. The logic being that since BCH mining is more profitable, miners would begin processing BCH transaction over BTC, thus marking a shift in hashpower from one coin to the other.

In addition, BCH offers faster transaction times with an 8mb block scaling solution as opposed to BTC’s 1mb block size.

Take these two factors together and you have a strong argument for BCH’s superiority.

But the hype didn’t amount to anything and The Flippening never happened. In fact, BCH suffered more than BTC in the end. After gaining 300% in a matter of days and topping off at upwards of $900.00, BCH saw a steady decline back to $300.00 levels.

This decline only confirmed BTC defender suspicions. It seemed that The Flippening hype was an obvious pump and dump by Korean and Chinese miners whose exchanges saw the majority of the coins volume during its rise.

But What About Now?

There’s a host of Bitcoin Cash supporters that say the actual Flippening is upon us.

Skeptics and Bitcoin fans cite the August pump and dump as a reminder that Bitcoin is king and this is just another futile attack on the coin’s #1 spot. They’ve also argued that the same influx of money from East Asia is driving the price spike, with a substantial amount of the coin’s volume being transacted through the Korean exchange Bithumb.

However, there are more variables at play this go-round that deserve our attention before we make an informed decision on Bitcoin’s future. So what makes the threat of this Flippening different from the last? Here are the arguments in defense of BCH’s right to the throne:

An Anonymous Augur

Recently, links to a pastebin.com message concerning The Flippening began circulating on reddit, 4chan, and other crypto forums. The message dates back to July 30th and is eerily accurate with its foresight. It predicts the pump of BCH in August from smaller mining pools, the failure and suspension of Segwit2x, and the eventual adoption of BCH by the big name mining pools in China.

Its final prediction, though, is the most damning to BTC and the most important for BCH to see dominant adoption: namely, the majority of mining power shifting from BTC to BCH. Essentially, this would mean that more miners are processing BCH transactions than BTC, giving BCH the majority of mining power on the Bitcoin blockchain.

And as of Sunday, this prophecy seems to be fulfilling itself, as BCH’s hashrate has overcome BTC’s own. Now, this is not to say that The Flippening is guaranteed at this point in time – hashrates are constantly in flux, and now that BCH’s hashrate difficulty has increased, BTC proponents argue miners will revert back to BTC.

But these circumstances illustrate that miner adoption is crucial for the survival of either coin in this contest, and understanding this logic is essential to understanding mining power’s influence on market evaluation.

Bitcoin Classic’s Bail and Gavin Andersen’s Support

Last Friday, the developers at Bitcoin Classic announced that they would be dropping code support for Bitcoin in wake of the Segwit2x failure. A blog post written by Tim Zander, Bitcoin Classic’s release manager, implores anyone who runs Bitcoin Classic to relocate to an alternative node before Bitcoin Classic shuts down. He urges users to flock to BCH, stating, “In at most 6 months I’m sure we’ll just drop the ‘Cash’ and call it ‘Bitcoin.’”

Bitcoin Classic should not be confused with Bitcoin Core, the reference client that currently runs BTC. Regardless, many BCH supporters saw the Bitcoin Classic news as further confirmation that BCH is more in line with the vision Satoshi Nakamoto had for Bitcoin when he invented it in 2009.

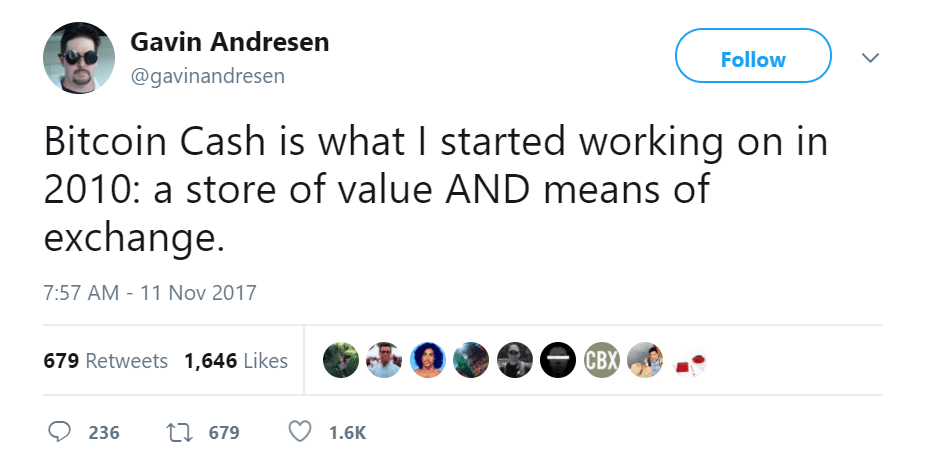

Cue Gavin Andersen. Satoshi left Andersen to be his successor as lead developer when he left Bitcoin Core in 2017. Yesterday, Andersen tweeted that Bitcoin Cash is what he had in mind when beginning his work at Bitcoin Core in 2010. With this announcement, Andersen is following Bitcoin Classic’s lead in endorsing BCH as more in-line with Satoshi’s vision for Bitcoin’s future.

As with the pastebin message and Bitcoin Classic’s blog post, many have taken Andersen’s support of BCH as a sure sign that The Flippening is for real this time, but this hasn’t stopped the naysayers from dismissing these events as a mere conspiracy.

So Why Are They Still Not Convinced?

On a basic level, BTC defenders believe that BTC is too entrenched as the dominant cryptocurrency. They argue that it’s been the gold standard for exchanging crypto, and until exchanges list more trading pairs for BCH and other currencies, it will remain the market standard.

The core of this argument lies in the first mover advantage BTC has over BCH, which essentially says that, since BTC existed first, it will always be first in people’s minds.

BTC’s market precedent is at the cornerstone of its defense, and this precedent contributes to the mindset that the influx of transactions from Korean exchanges makes BCH’s bullish streak a repeat of August – just another pump and dump. Many also see BTC’s pullback to be a healthy correction from what’s been a tremendous bull run since March this year.

The BTC community is unwavering in its loyalty and strong in its numbers. Up to now, they see the hashrate switchover and BCH bullish rise as another attack on their coin and its integrity, because to them, it’s only that–another attack that will fail and only make BTC stronger.

As of today, most of the cryptoworld would believe their logic. After a massive sell-off on Bithumb at approximately 2:00am CST, BCH has been flirting with a $1,300-$1,400 support level. It may be too early to count BCH out entirely, especially amidst rumors that market whales like Tim Draper have allocated millions worth of Bitcoins onto popular US exchanges.

Where Does This Leave Us?

November has been a tumultuous time for Bitcoin and the greater world of cryptocurrency. Between coming off the Bitcoin Gold fork in October and news of Segwit2x’s cancellation, markets are extremely volatile and Bitcoin’s future is in a tenuous balance.

In my opinion, a few outcomes that are becoming increasingly possible from this course of events.

They are as follows:

1). BCH exceeds BTC in market cap and cost, causing BTC to crumble in value and forcing exchanges and markets to recognize BCH as the true Bitcoin.

2). This really is just a pump and dump, and when those manipulating the market decide to bring it to an end, BCH price crashes, money is dumped back into BTC, and BTC sees steady gains back up to $10,000.

3). If the attempt to overtake BTC with BCH is earnest but it ultimately fails, then we will see a correction of BCH prices but not the same crash we would see with a pump and dump. As a result, BTC continues to climb again while BCH maintains a healthy support after the pullback and the two coexist.

While I believe these three scenarios are possible given the events, I’m not endorsing one outcome over the other–these are merely predictions. Nor do I endorse BCH over BTC or vice versa. This article is meant to analyze and explain the current situation and should not be taken as financial/investment advice.

All of that being said, the coming weeks will be interesting for cryptocurrency, so pop some corn and get to watching.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.