Decentralized finance is becoming one of the crypto buzzwords of 2019. Beyond the hype, the DeFi movement offers up some intriguing potential. It aims to create a truly decentralized financial system, one which doesn’t need the traditional banking system. A system more closely aligned to the original intentions of Bitcoin’s elusive creator than anything we’ve seen before. So what is decentralized finance, and what does it mean for the future of crypto?

Satoshi’s Vision (Not the Bitcoin Cash one)

Before we get started, in light of recent news, let’s take a second to disambiguate the term “Satoshi’s Vision.” Long before Craig Wright reignited his war with practically the entire cryptoverse by sending cease-and-desist letters to anyone who dared to question the authenticity of his “I am Satoshi” claims, the actual Satoshi (as in, the one we know invented Bitcoin) had a simple vision. It was nothing to do with Bitcoin Cash hard forks, and it’s stated right there in the first line of the Bitcoin white paper:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Although Bitcoin largely continues true to this vision, the blockchain and crypto landscape has diverged. The financial sector in particular quickly noticed the potential of the underlying technology.

Unsurprisingly for a sector which makes its bread and butter from being the middleman, the banks, along with many governments weren’t keen on Satoshi’s original vision. However, blockchain offers vast potential to the financial sector. So the banks and financial institutions together with governments and big companies such as IBM started to investigate what blockchain can do.

Now, consortia exist to explore the potential of blockchain in almost every industry. Along with finance, blockchain is making waves in supply chain and logistics, insurance, advertising, aerospace, healthcare, and so many, many other sectors. However, many of these developments have taken place on private distributed ledgers, which don’t fully exploit the benefits of decentralization. For this reason, many crypto purists decry the departure from Satoshi’s original vision.

Enter decentralized finance.

About Decentralized Finance

The Decentralized Finance (#DeFi) movement launched towards the back end of last year, as a network of fifteen Ethereum-based projects with the unified goal of creating a more open financial system. Initial member projects included MakerDAO, Origin Protocol, and Paradigm. Later entrants included Kyber Network and Compound.

The network also solidified some guidelines for joining. These explicitly state that to participate in #DeFi, the project is building on or building a service for a decentralized blockchain, within the finance industry, adhering to common standards and pushing for interoperability, and must align with the core principles of #DeFi. The principles talk about financial inclusion, accessibility, and transparency.

Currently, members of #DeFi include decentralized exchanges, wallets, stable coins, prediction markets, liquidity protocols, and many others.

What Does #DeFi Mean for Ethereum?

Most of the first movers in the decentralized finance movement are based on Ethereum. Therefore, DeFi amounts to pretty good news for Vitalik’s baby.

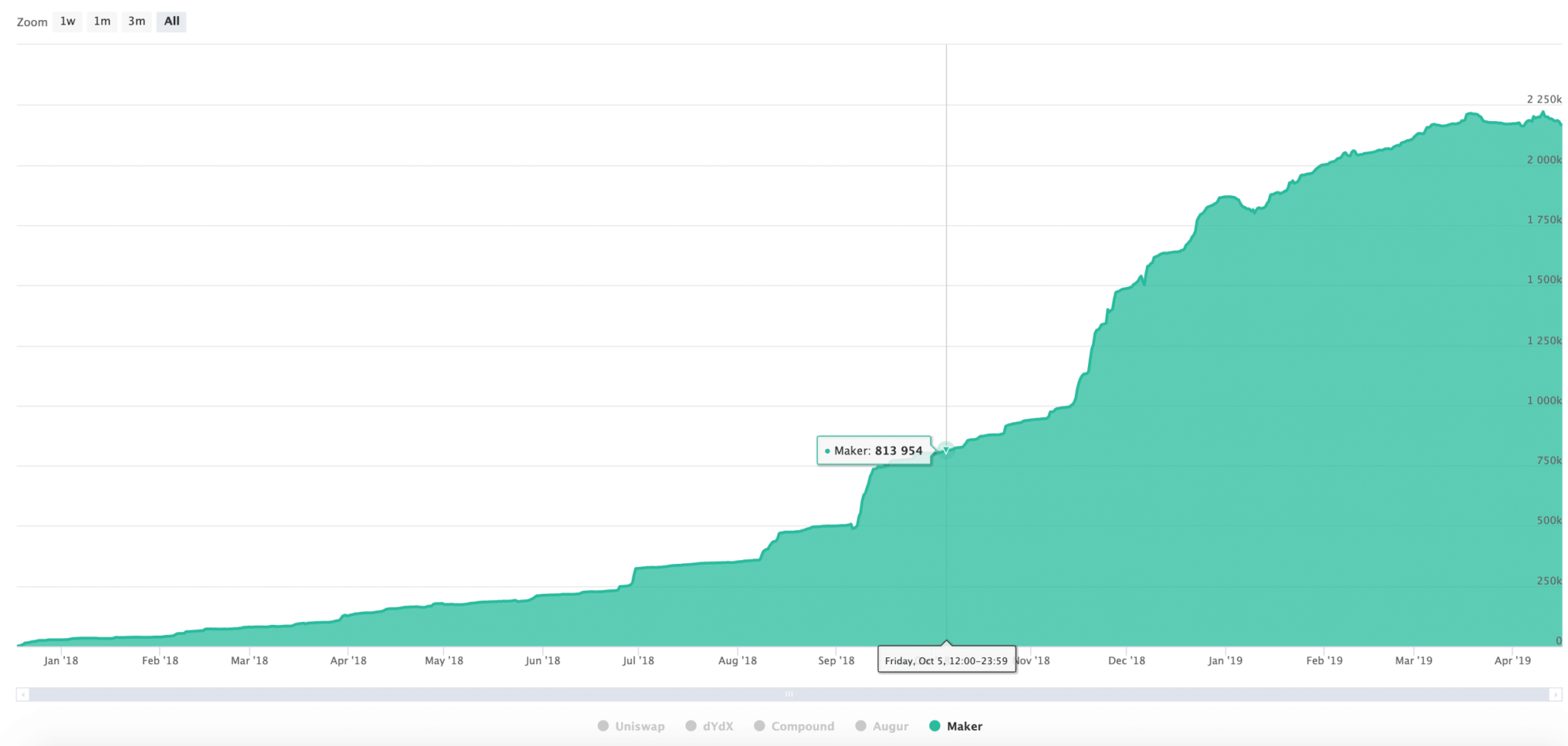

Let’s break it down. MakerDAO is far and away the biggest Ethereum project involved in #DeFi if we use staked ETH as the measure. At the time of writing, over 2 million ETH are staked in Maker.

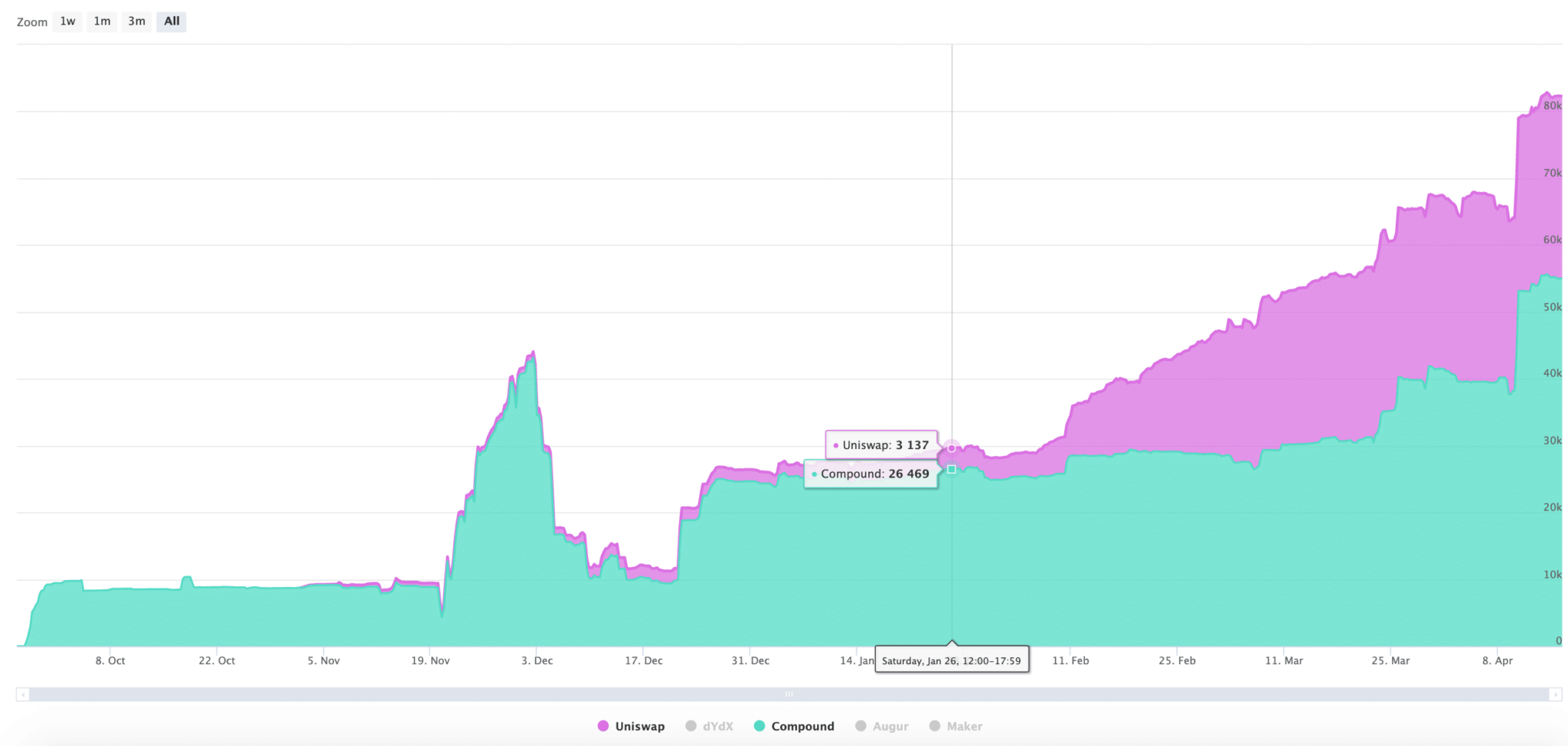

The next biggest are Compound and Uniswap, with 55k and 27k respectively.

Not to mention Bancor, which isn’t a pure Ethereum project but acts as a liquidity network for Ethereum-based tokens. A recent blog post from Bancor announced it now has $12.8m worth of Ethereum and EOS staked in its network.

The more ETH staked in these kinds of decentralized finance projects, the scarcer that ETH becomes. Increased scarcity of ETH pushes up demand from traders and investors, which increases its market value. Therefore, the growth of the #DeFi movement spells great news for anyone speculating on ETH.

What Does Decentralized Finance Mean for Blockchain?

The initial group of projects within #DeFi are mostly based on Ethereum. But this doesn’t mean that a decentralized finance ecosystem can’t flourish across all blockchains. In fact, doing so would return the convergence of blockchain and finance back to Satoshi’s original vision.

Since the prolonged bear market turned into the crypto winter, there has been plenty of criticism and naysaying directed at blockchain and cryptocurrency. Unfortunately (or perhaps, fortunately, if you’re a decentralization purist,) this is also leading many to speculate that blockchain as a technology has had its moment.

[thrive_leads id=’5219′]

Even self-styled “former believers” have used high-profile platforms to state their “we tried it, it didn’t work” position. The fact that US regulators haven’t approved a Bitcoin ETF doesn’t help sell the idea of crypto as a success in the financial world. Neither does the fact that regulated futures offering Bakkt is on indefinite hold.

This seems vastly unfair. The price of Bitcoin at its 2018 low was still four times higher than two years prior, before the boom. Furthermore, no corporate implementation of blockchain for any use case has been operational for more than a year or two at most. That’s hardly enough time to declare it a success or failure either way. Especially considering the speed at which corporate gears grind.

Making It On Our Own

In any case, decentralized finance moves away from the need for external validation of blockchain and cryptocurrencies. #DeFi doesn’t require banks and financial institutions to incorporate the technology.

Rather, it shows that the crypto world is flourishing on its own, without the need for external validation or regulation. #DeFi is creating new channels for adopting crypto. It’s encouraging a new wave of financial entrepreneurship which would be stifled in the world of traditional banking.

Furthermore, #DeFi is based on peers exchanging digital currency online. Aside from the obvious need to onboard to crypto from fiat, it doesn’t require the intermediation of a financial institution. It’s so close to Satoshi’s vision it’s as if the man himself came up with the idea. Which, when you think about it, he sort of did.

For anyone interested in exploring decentralized finance projects in more detail, some kindly souls have been curating a pretty comprehensive list on GitHub. #DeFi is also on Telegram and Reddit.

Featured image: Pixabay