The Rollercoaster Continues: Bitcoin, Crypto Market Correct after Uniform Bull Run

Bitcoin finally corrected after going on a bull run that put it over an $11,000 valuation, and it took the rest of the market down with it.

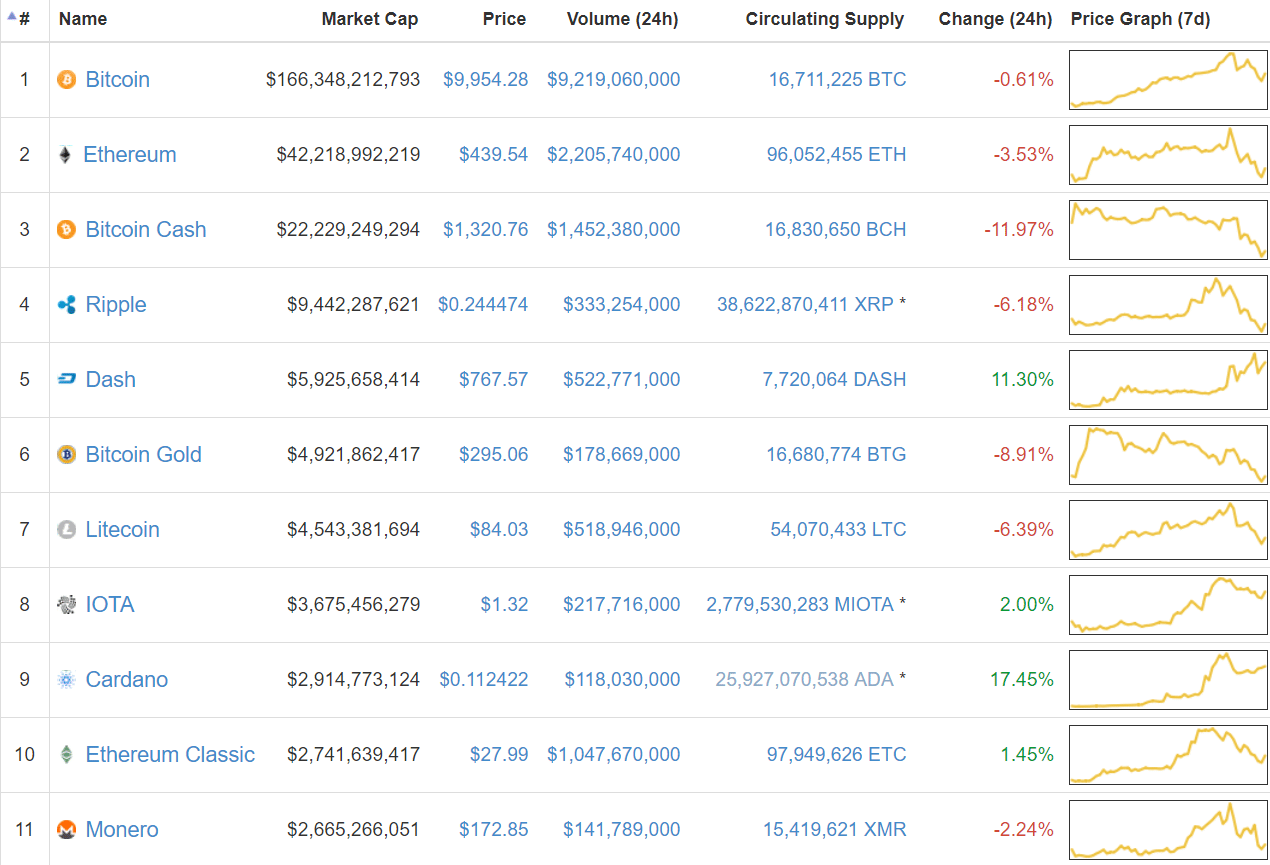

The pullback came after Bitcoin appeared to be sharing its limelight with the rest of the market, especially the marketcap top 10. Even with Bitcoin breaching the $10k and $11k marks, 6 of the market cap’s top 10 reached their own all time highs at the peak of the market’s run:

–ETH at $522.31

–DASH at $815.01

–LTC at $104.10

–IOTA at $1.56

–XMR at $214.28

–ETC at $34.60

If we look at crypto’s total November growth, these price spikes aren’t surprising. The market cap increased a staggering $100bln in under two weeks from November 16th to November 29th, and this size-able increase spread the love to the majority of the market.

Every run sees a correction, however, and at midday on November 29th, the market got its anticipated pullback. Between 11:49 and 2:49 EST, BTC’s price corrected from $11,205 to $9,601, a near $1,600 drop in three hours as buyer’s mania morphed into a massive sell-off.

https://coinmarketcap.com/currencies/bitcoin/

The rest of the market responded accordingly, as the persisting correction has dropped the overall marketcap to below $300bln. Most all of the top 10 coins experienced a relatively substantial correction from their all time highs. At the time of this writing, DASH was effected the least, down only 5.8% from its zenith. DASH sustained minimal damage, but it’s the outlier in the bunch. IOTA, for example, was the second least affected out of the top 10, but it still lost 15.3% of its value, a 9.5% differential compared to DASH. Ethereum comes in third at a 15.9% loss. Litecoin and Ethereum Classic were hit equally as hard, losing 19.2% and 19.1%, respectively. Monero is the biggest loser out of the group, being relegated to #11 in marketcap ranking after dropping 19.6%.

These trends trickled through the rest of the market, leaving most other alt-coins bleeding in price. If you were to observe Coin Market Cap in the thick of the correction, you’d noticed that only 6 out of crypto’s top 100 coins were in the green for their 24/hr change–this excludes DASH and Tether. Let’s contrasts this with just four days ago when 71 coins had a positive 24/hr change.

This correction comes after a recent influx of institutional money and fresh investment capital into crypto markets. It’s the anticipated byproduct of Bitcoin surging from $5,500 to over $11,000 in a span of 17 days. The market still appears to be reacting, as Bitcoin continues to flirt with the $10k threshold only to drop back below it. Coming off a month-long bullrun, it’s unlikely the market is at the tail-end of this pullback, so until we see substantial recovery, we’re going to sit tight and keep our eyes peeled.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.