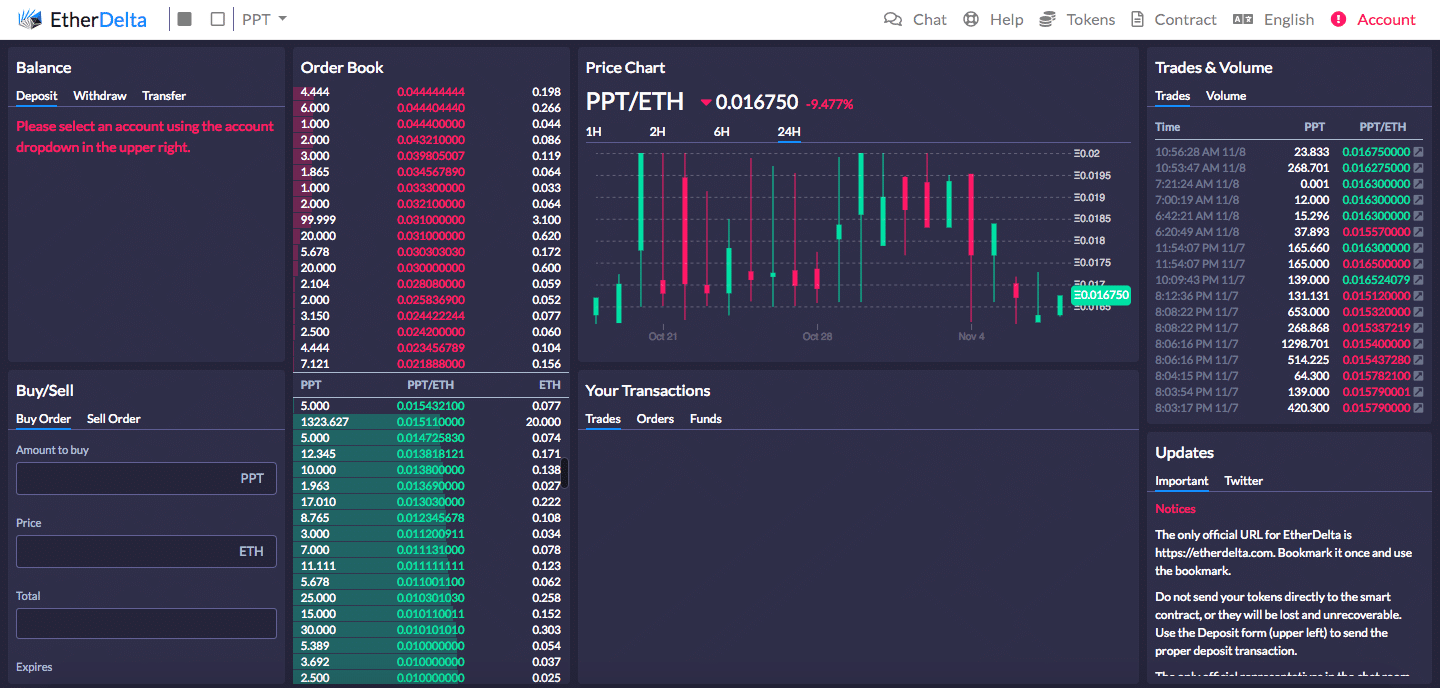

This morning, the United States Security and Exchange Commission (SEC) announced formal charges against EtherDelta founder Zachary Coburn for operating an unregistered national securities exchange. The SEC order explains that EtherDelta facilitates the trading of ERC20 tokens, many of which they deem to be securities.

The charge comes on the heels of the 2017 DAO Report. This report outlines certain types of digital assets that the SEC considers to be securities, including DAO tokens. It’s implied that at least some of the tokens being traded on EtherDelta fell into this category. Over the last 18 months, users on EtherDelta performed more than 3.6 million trades, with many involving security-classified tokens.

Although EtherDelta executes trades automatically through smart contracts and stays non-custodial regarding user funds, the SEC still argues that the exchange (and the founder behind it) is at fault. Co-director of the SEC’s Enforcement Division Steven Peiken explains, “EtherDelta had both the user interface and underlying functionality of an online national securities exchange and was required to register with the SEC or qualify for an exemption.”

On news of the charges, Coburn agreed to pay the nearly $400,000 in fines and penalties. The investigation is still ongoing.

The Implication

Previously, it was thought that decentralized exchanges (DEXs) like EtherDelta were out of reach of any jurisdiction. Well, this now appears to be false. Although the decentralized nature of certain exchanges may prevent them from getting shut down, any type of known figurehead runs the risk of getting in some serious trouble.

Additionally, a charge of this magnitude (EtherDelta was at one point the largest DEX around), shows that the SEC means business. They’ve moved beyond going after the most obvious scams now to companies/projects that the majority of the cryptocurrency industry has considered legitimate.

With this EtherDelta charge, it’s clear that the entire cryptocurrency industry is going to have to start taking the SEC’s threats seriously – whether they want to or not.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.