TLDR

- FGF Plunges 70% After $200M Ethereum Pivot, Rebrands to FG Nexus

- FGF Bets Big on Ethereum, Shares Tank Amid Bold Treasury Shift

- FG Nexus Emerges as FGF Drops Legacy Assets, Focuses on ETH

- $200M ETH Move Sinks FGF Stock, New Era Dawns as FG Nexus

- FGF Unveils Ethereum Strategy, Rebrand, and Market-Rattling Warrants

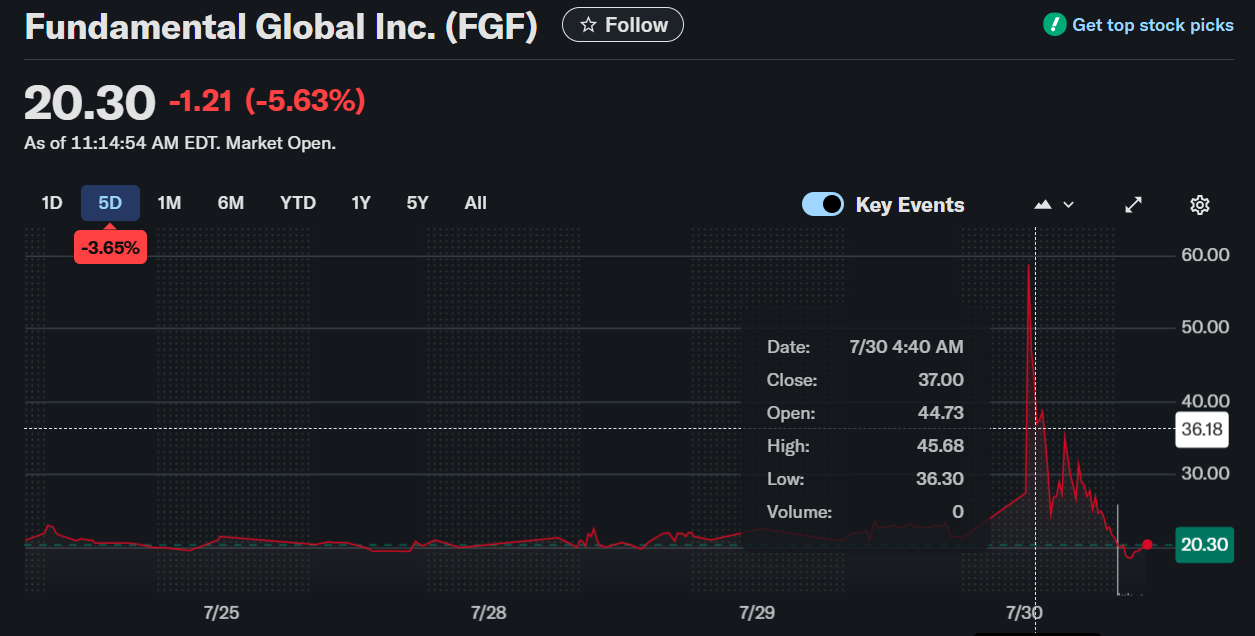

Fundamental Global Inc. (FGF) shares plunged from near $70 to about $20 early in Tuesday’s trading session. The sharp decline came as the company revealed a $200 million Ethereum treasury strategy and plans to rebrand as FG Nexus. FGF traded at $20.30 by 11:14 AM EDT, reflecting a 5.63% drop for the day.

$200 Million Ethereum Treasury Strategy Triggers Market Reaction

FGF announced a private placement deal to raise $200 million through the sale of 40 million prefunded warrants. Each warrant is priced at $5.00, including a nominal $0.001 exercise cost, to fund an Ethereum-focused treasury strategy. The transaction was structured using both cash and cryptocurrencies.

JUST IN: 🇺🇸 Publicly traded FG Nexus raises $200,000,000 for $ETH treasury strategy. pic.twitter.com/nLctNR1aHY

— Whale Insider (@WhaleInsider) July 30, 2025

This move positions FGF as a new capital markets platform designed around Ethereum’s growing role in finance and tokenized assets. The company will use net proceeds to purchase ETH, making it its primary reserve treasury asset. FGF will also pursue staking rewards and real-world tokenization opportunities linked to Ethereum.

The offering attracted strategic participants like Galaxy Digital, Kraken, and Digital Currency Group. Galaxy will manage FGF’s Ethereum treasury and provide yield execution and infrastructure. Kraken will support the company’s staking and treasury operations through FG Nexus.

Rebranding to FG Nexus with Expanded Digital Asset Focus

FGF announced it will rebrand as FG Nexus Inc., with new Nasdaq tickers FGNX and FGNXP expected to become active shortly. The rebranding highlights the company’s pivot toward blockchain-driven finance and Ethereum-based capital management. The transformation includes deploying digital asset expertise across its merchant banking and reinsurance units.

FGF formed a leadership team with backgrounds in finance, crypto and artificial intelligence. Maja Vujinovic will lead the Digital Assets division, supported by Theodore Rosenthal and Jose Vargas. The company also named Joe Moglia, former TD Ameritrade CEO, as Executive Advisor.

FG Nexus intends to operate across DeFi and traditional markets, using Ethereum as a foundation for new financial products. The team’s stated aim is to build institutional-grade infrastructure for Ethereum treasuries. The transition aligns with Ethereum’s role as the dominant platform for stablecoins and decentralized applications.

FG CVR Trust Formed for Legacy Asset Separation

FGF will establish the FG CVR Trust to manage non-core legacy assets separately from the Ethereum strategy. Shareholders on record as of August 8, 2025, will receive non-transferable Contingent Value Rights (CVRs). These CVRs will reflect any future value realized from the legacy portfolio.

FGF said the trust structure ensures continued alignment with shareholders as the company shifts toward digital assets. ThinkEquity served as the placement agent for the private offering, while Loeb & Loeb LLP acted as legal counsel to FGF. The offering was conducted under a private placement exemption from registration under U.S. securities laws.

FGF emphasized that it will register the resale of the underlying shares with the SEC following the registration rights agreement. Subject to customary conditions, the company aims to close the offering on August 1, 2025. The Ethereum strategy marks a definitive shift in FGF’s capital allocation and operational model.