GDAX vs Gemini

If you have an intermediate understanding of investing, GDAX and Gemini are good platforms to begin trading cryptocurrency. These platforms provide a simplified exchange experience with enough bells and whistles to keep the average user happy. Both platforms are also a good next step if you’re looking to move beyond the more simple and limited features of exchanges such as Coinbase.

In this “GDAX vs Gemini” review, we’ll show you the differences between the two exchanges, so that you can make an informed decision of which is best for you.

We’ll go over:

- Funding Methods

- Interface

- Trading Fees

- Available Cryptocurrencies

- Transfer Limits

- Company Trust

- Fund Security

- Customer Support

GDAX vs Gemini: Key Information

| Exchange |  |

|

|---|---|---|

| Reviews | GDAX Review | Gemini Review |

| Deposit Methods | Bank Transfer (ACH), Bank Wires, Crypto Deposits |

Bank Transfer (ACH), Bank Wires, Crypto Deposits |

| Available Cryptocurrencies | BTC, ETH, LTC | BTC, ETH |

| Company Launch | 2012 (Coinbase) | 2015 |

| Location | California, USA | New York, USA |

| Community Trust | Great | Great |

| Security | Great | Great |

| Customer Support | Good | Good |

| Fees | Very Low | Very Low |

| Website | Visit GDAX | Visit Gemini |

Funding Methods

Both Gemini and GDAX allow you to fund your account in three primary ways – bank transfers (ACH), wire transfers, and cryptocurrency deposits.

Additionally, GDAX accepts fund transfers from Coinbase accounts instantly and without fees. This makes for a smooth transition if you had previously been using Coinbase but want to switch to an exchange with more robust features.

On the other hand, Gemini is a solid option if you’re trying to invest as soon as possible. Gemini allows you to buy and trade before your funds are approved in your account. Although you won’t be able to withdraw until your initial funds are approved, you can lock in coins at a certain price without worrying about their price going up in the meantime.

Interface

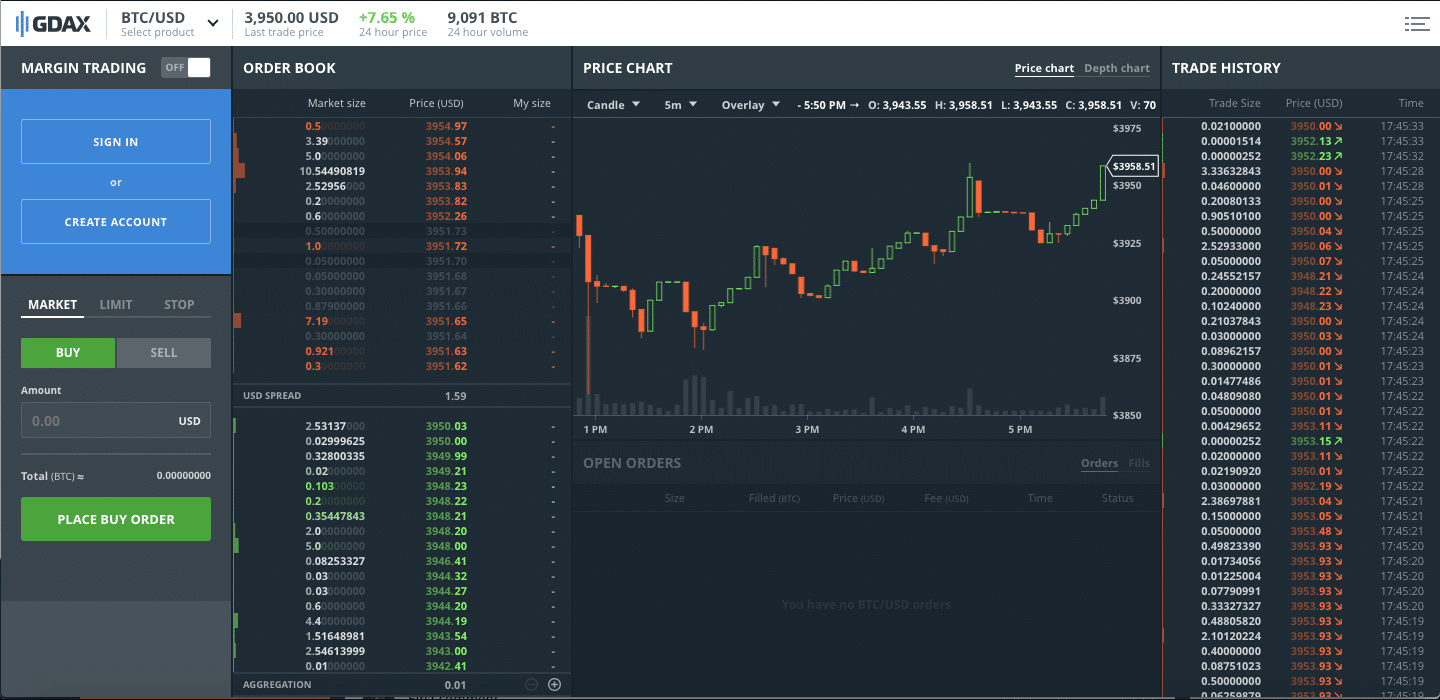

GDAX offers a slightly more advanced trading experience than Gemini with options such as margin trading and stop orders. At first glance, the exchange may look intimidating to new investors because of the constant movement of buy/sell orders across the screen. However, after the first use, I found this to be one of the best-designed layouts of the exchanges I’ve used.

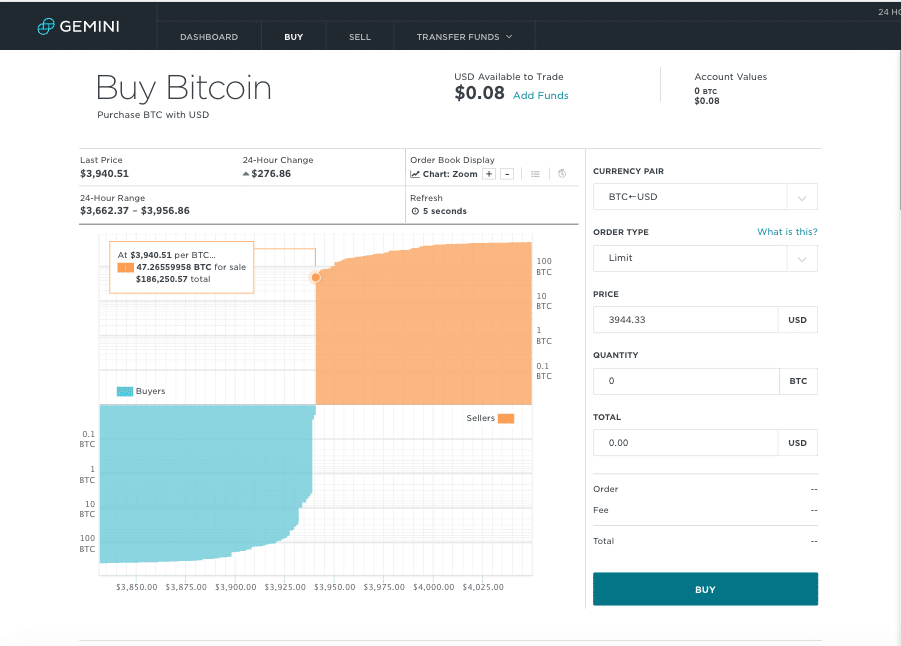

Subjectively, the Gemini platform is aesthetically pleasing but difficult for analysis. The order book table is hidden behind a small button and the order book chart follows an unorthodox design putting buy orders under the x-axis. A unique feature in Gemini is the ability to order coins in an auction format, although I’ve never tried this myself.

For experienced traders, GDAX is a better platform for analysis and advanced trading options. If your goal is to simply make a purchase and hold it for a while, Gemini is a good choice.

Trading Fees

Gemini and GDAX are similar in fee structures with a maximum trading fee of 0.25% for BTC trades on both platforms.

However, if you’re looking to trade ETH, Gemini could be a better option for you. On Gemini, the maximum trading fee for ETH is 0.25% – slightly less than the 0.3% fee on GDAX.

Both exchanges use a fairly complex system to calculate your trading fees. These calculations are primarily determined by your 30-day trading volume. The important thing to note, though, is that GDAX has no trading fees for makers (users who put an order on the books).

You can find a more detailed explanation of the Gemini trading fees here and the GDAX trading fees here. Because these fees vary based on volume, I suggest using these resources to estimate the fees on a few trades you’re thinking of doing. From there, you can decide if the difference in fees is enough for you to choose one platform over the other.

Available Cryptocurrencies

GDAX supports Bitcoin, Ethereum, and Litecoin trading. Although rumors have circulated about adding coins to this list, the company has not released an official statement saying so.

Gemini only supports Bitcoin and Ethereum trading and has yet to mention any plans on adding more in the immediate feature.

Besides the technical difficulty of adding new coins to an exchange, the regulation and process costs of getting a new coin listed may not be worth it to these exchanges at this time (personal speculation).

Transfer Limits

Gemini restricts the amount you can deposit via ACH to $500 per day. However, there is no limit for the other deposit methods such as wire transfers and cryptocurrency deposits. Gemini also sets its withdrawal limit at $10,000 per day.

Gemini ACH deposits usually take 4-5 business days to be approved. But, as I mentioned earlier, you can use the funds to trade right away.

GDAX is not as straightforward about its daily deposit limits. Their daily ACH deposit limits are determined by your account age, buying history, and account verification. These deposits typically take 3-5 business days. Wire deposits are capped at $250,000 and cryptocurrency deposits are unlimited.

Like Gemini, the GDAX withdrawal limit is $10,000 per day.

Company Trust

Operating in the U.S., both exchanges have continued to successfully navigate the strict U.S. rules and regulations.

GDAX, a branch of Coinbase, was founded in 2012 and is headquartered in Silicon Valley. Over 8 million people have used their platform, and they’ve successfully exchanged over $20 billion of digital currency. They also have the backing of several notable investors such as Andreessen Horowitz, Union Square Ventures, and the New York Stock Exchange.

Three months ago, a multi-million dollar sell order caused the price of Ethereum to drop from over $300 to 10 cents almost immediately on GDAX. This sale triggered several other automatic sales in a snowball effect on the exchange. Even though the market quickly recovered, several users lost a massive amount of money because of this bizarre incident. To regain market trust, GDAX refunded the funds lost to those who were affected by the crash.

Gemini was launched in 2015 in New York City by Tyler and Cameron Winklevoss. Although famous for their background in Facebook, the brothers have been active in the Bitcoin community since early 2013. They’ve funded several Bitcoin-related projects and are rumored to own 1 percent of all Bitcoins in circulation.

Gemini was also the first U.S. exchange licensed for bitcoin and ether trading.

Fund Security

Both GDAX and Gemini keep all U.S. dollar funds held in banks that are FDIC insured up to $250,000 per depositor.

It’s recommended to keep your assets off exchanges since there is an inherent but small risk of your account being hacked. If you do choose to keep your coins on an exchange, though, GDAX and Gemini take great measures to assure the security of those digital assets.

Less than 2% of digital assets are kept in online storage at GDAX. The rest of the funds are held in cold (offline) storage using a combination of encrypted USB drives and paper backups stored in safe deposit boxes around the world. On top of that, GDAX fully insures the few digital assets that they do keep online.

Gemini doesn’t specify the number of assets kept online but states that the majority of digital assets are held in their own cold storage system. Their system uses secure hardware security modules (HSMs) with multi-signature technology to ensure that there isn’t a single point of failure.

Customer Support

While customer support can be an issue on some lesser known exchanges, GDAX and Gemini provide you with the resources you need to navigate their platforms successfully.

Both exchanges contain a library of FAQs that not only cover common support issues but also explain investing terms. They’re perfect resources for the beginning investor.

Both companies also handle support tickets through email and have a response time of 2-3 business days. Although I’ve never had to contact support for either of these companies, I’ve heard positive reports from those who have.

Conclusion

With similar fee structures, funding options, and functionality, you couldn’t go wrong choosing either Gemini or GDAX. The decision comes down to personal preference.

Are you looking to trade Litecoin or move away from your Coinbase account? GDAX would probably be best for you. (Although, I’ve moved from Coinbase to Gemini and have had no complaints.)

Do you want to get started trading right away? Gemini is most likely your best bet.

(See CoinCentral’s Full List of Crypto Exchange Reviews)

More GDAX Comparisons

More Gemini Comparisons

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.