TLDRs:

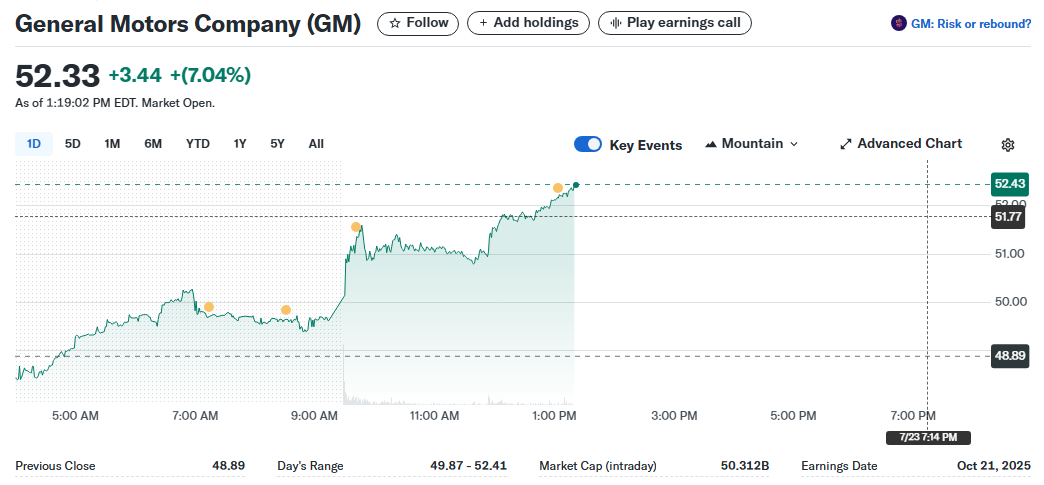

- GM stock surges 7% to $52.33 after reporting sharp rise in EV sales during Q2 2025 earnings.

- GM now ranks second in U.S. EV market, behind Tesla but ahead of Ford and other legacy automakers.

- Production flexibility allows GM to shift between EV and gas vehicles, helping mitigate policy shifts.

- Expiring tax incentives loom over Q4 outlook; GM positions for resilience amid EV demand swings.

General Motors (NYSE: GM) stock jumped 7.04% to $52.33 in intraday trading Tuesday following a robust Q2 earnings call, where the automaker announced it now holds the second-largest share of the U.S. electric vehicle (EV) market, behind Tesla.

The sharp rally came after the company revealed 46,300 EV units sold in Q2 2025, doubling year-over-year from 21,900 in 2024.

During the earnings call, CFO Paul Jacobson highlighted GM’s growing portfolio, which includes 12 electric models across its Chevrolet and Cadillac brands, more than double Tesla’s current U.S. offerings. CEO Mary Barra reiterated GM’s long-term EV commitment, calling them the company’s “North Star.”

Flexible Strategy Helps Offset Market Volatility

GM emphasized its dual-track manufacturing capability as a key differentiator. The company’s production facilities are designed to shift between internal combustion engine (ICE) and EV output based on regional and market demand. This adaptability is seen as critical with the looming expiration of federal EV tax credits on September 30, which analysts expect will cause a short-term spike in EV sales in Q3 followed by a contraction in Q4.

“Flexibility is our secret weapon,” said Jacobson. “As incentives fade and the market recalibrates, we can meet customers where they are, EV-ready or not.”

GM’s approach contrasts with Tesla’s more EV-exclusive strategy, offering GM a potential edge in managing both consumer preference shifts and regulatory headwinds.

Investments Continue Despite Demand Uncertainty

Last month, GM announced a $4 billion investment across three U.S. manufacturing sites in Michigan, Kansas, and Tennessee.

While a portion of this capital will support gas-powered SUV and pickup production, especially in light of slowing EV demand, it also includes provisions for affordable EV models, signaling GM’s long-term commitment to electrification.

The Orion Assembly Plant in Michigan, originally slated for electric trucks, will now pivot to full-size gas SUVs. However, facilities like Fairfax in Kansas are expected to produce both the Chevy Bolt EV and gas-powered Equinox, reinforcing GM’s balanced output model.

Brand Momentum Builds for Chevrolet and Cadillac

Chevrolet has now become the second-highest ranked EV brand in the U.S., while Cadillac sits at No. 5, according to internal brand tracking cited during the call. This growing brand strength has helped GM not only boost sales, but also build consumer confidence in its electrification roadmap.

As the EV landscape becomes increasingly competitive and fragmented, GM’s diversified approach and brand recognition provide it with a rare combination of scalability and resilience.

Despite short-term headwinds, GM remains bullish on the EV future. CEO Mary Barra closed the call by reaffirming that electrification remains “central to GM’s mission and future growth.” With EV tax credits phasing out and a more price-sensitive consumer base emerging, the company believes its hybridized strategy will help maintain momentum.