Amidst the widespread adoption of cryptocurrencies, regulations presented a huge roadblock. While other countries try to find a way in their favor, Germany seems to be embracing it with open arms as per the latest guidelines issued by the Federal Finance Ministry (BMF).

Germany Makes Crypto Tax-Free

The directive from BMF was released on Tuesday, covering multiple crypto-related issues, which also included the change in income tax (IT) law concerning it.

Until the announcement, Germany’s IT law mandated cryptocurrency investors/traders to hold their assets for a period of at least ten years in order to receive an exemption from tax.

However, now, a citizen will be eligible to be exempted from gains tax provided by holding their cryptocurrency for just one year. The gains generated from the sales of these cryptos after a year of not selling them will be considered tax-free across Germany.

This benefit also extends to the assets invested in lending and staking protocols as well as mining, hard forks, and token airdrops.

But while Germany is the latest country to do, it is not the only one. Across the world, many countries have made cryptocurrencies, and gains accrued from them tax-free over time. The likes of these include Belarus and Portugal, who, since 2018, have made crypto gains tax-free.

The former exempted individuals and businesses from taxes for up to 5 years, while the latter did not exempt businesses but only individual investors.

Similarly, El Salvador, the first country in the world to make Bitcoin a legal tender, also spared foreign investors from being subjected to any crypto tax in order to attract higher investments.

In addition to this, Switzerland, also known as the “Crypto Valley”, also has exemptions from the tax for crypto investors but as per certain conditions.

Firstly cryptocurrency miners and qualified day traders will incur income tax as well wealth tax as per the annual net worth. However, individual investors are free from paying capital gains taxes on their crypto income.

Furthermore, Singapore, Malaysia, Malta, Cayman Islands, and Puerto Rico also follow similar tax strategies making them a preferable spot for investors and traders.

CBDCs – Governments’ Escape From Crypto

Unlike the countries mentioned above, there are others that have crypto in their crosshair, and by subjecting their citizens to taxes, regulations, and restrictions, these governments are trying to kill crypto’s growth potential.

Also, as a backup, these countries are launching their own centrally controlled central bank digital currencies (CBDCs) that will act as a digital version of the existing fiat currencies.

This way, the financial system remains in the government’s control, removing the freedom that comes with decentralization.

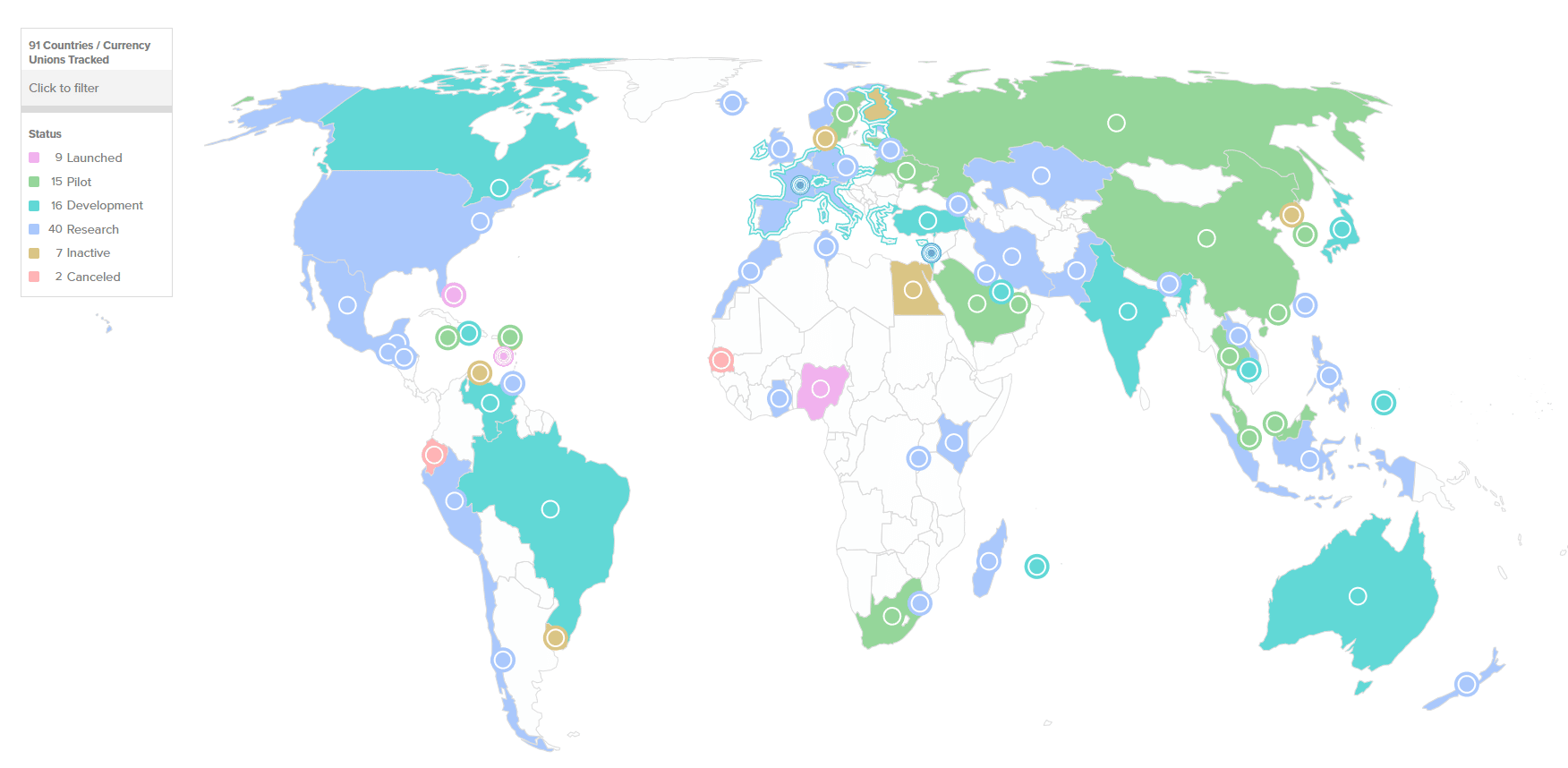

Currently, over nine countries already have a full functioning CBDC system in place, with another 15 countries running their pilot programs. China is one of the latter cohorts that tested their e-CNY during the Beijing Winter Olympics in February 2022.

Moreover, about 56 more countries are presently in the Research and Development phase, with the likes of India looking to launch its own CBDC by 2023.

The second most prominent user of cryptocurrencies, India, has been heavily taxing cryptocurrencies (30% crypto gains tax), as reported by CoinCentral which is why the decision to launch the “Digital Rupee” CBDC makes sense.

Thus, it is only a matter of time before CBDCs become a global phenomenon, making room for more countries to join, provided the currently existing systems are fruitful to the economy.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.