The acceptance of cryptocurrencies came much easier and quicker than expected in many countries, while some others continue aiming at crypto. The United States and United Kingdom have pioneered the latter cohort with the most recent comments from critical government representatives.

US Questions While the UK Prepares

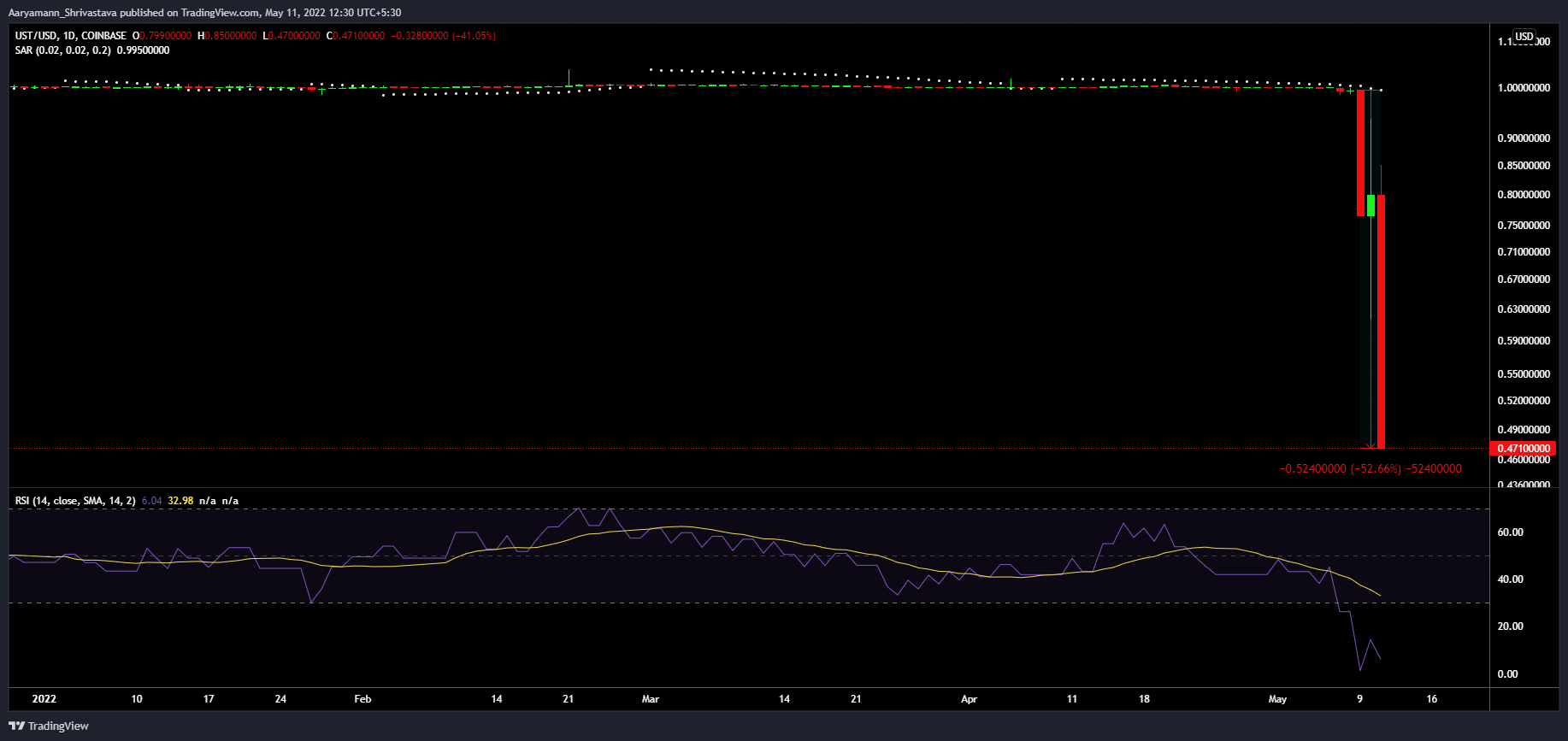

As reported by CoinCentral, Terra’s stablecoin TerraUSD (UST) depegging has been a concerning moment for investors and regulators alike. After the crash of May 9, UST lost its peg and ended up trading at a discount of 7% at $0.92.

Although yesterday, the peg was expected to recover, but after noting only a 4.4% correction, it plummeted again, and at the time of writing, UST fell by another 41.05%.

This places the total depegging at 52.66%, leaving UST with a price of $0.47.

Consequently, it triggered those who had a bone to pick with crypto, and the first in line was the US Treasury Secretary Janet Yellen. Yellen has been noted voicing concern against stablecoins in the past as well, as just in April, she stated that no one could assure if one can exchange a stablecoin for precisely a dollar every time.

Now following the UST debacle, in a congressional meeting, Yellen said,

“A stablecoin known as Terra (UST) experienced a run and declined in value…I think this simply illustrates that this is a rapidly growing product, and there are risks to financial stability and we need a framework that’s appropriate.”

While the United States is yet to bring forth any regulation or law governing crypto, the May 9 crash and the UST depegging definitely do not help the case for crypto adoption.

The United Kingdom, on the other hand, recently introduced two new bills which, if accepted, could provide the government with more control over crypto.

Announced during the State Opening of Parliament, the government brought forth the Financial Services and Markets Bill and the economic Crime and Corporate Transparency Bill.

The former bill has been created to execute the safe adoption of cryptocurrencies into the country’s financial services.

Whereas the latter bill will be “Creating powers to more quickly and easily seize and recover crypto assets,” which, according to the government, is the principal medium for ransomware hackers.

Uk had been deliberating bringing regulations for the crypto industry, and just last month, in April, the government announced that they would be bringing stablecoins into the existing regulatory framework for payment mediums.

Around the time of this announcement, the Economic Secretary of the Treasury John Glen stated,

“If crypto technologies are going to be a big part of the future, then we, the UK, want to be in — and in on the ground floor.”

The State of the Crypto Market

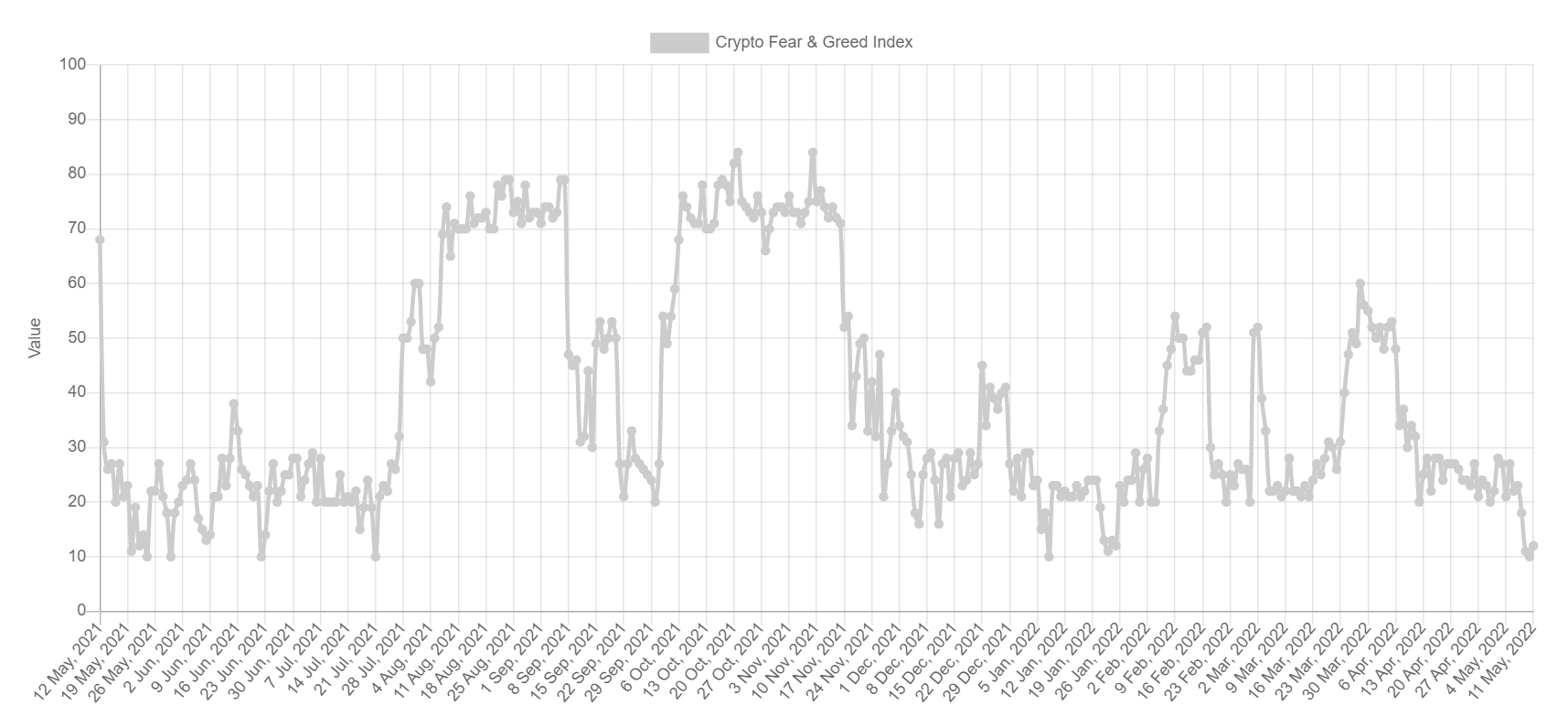

The effect of the market crash of May 9 was such that within 24 hours, over $200 billion were wiped out of the crypto space. Yesterday’s attempts at recovery failed to do much since the broader market was in absolute fear.

As a result, at the time of this report, the total value of all cryptocurrencies dropped by another $46.58 billion bringing the total market cap to just $1.36 trillion.

Right now, the persistent fear is at its worst since January 2022 and at a level only witnessed by investors five times since May 2021.

Thus as the crypto market takes heat from all directions, recovery has become crucial, which by the looks of it seems distant as the king coin, Bitcoin, itself is struggling at around $30k at the moment, falling by another 3%.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.