Crypto has always thrived on retail frenzy, but this cycle is different. The largest marginal buyers are not retail—this time around, it is institutions. Hedge funds, asset managers, pension allocators, and even banks are quietly accumulating crypto.

The SEC’s expected approval of on-chain stock trading will only accelerate this trend, meaning that from this point onwards, institutions will be the dominant source of capital flows. Retail investors need to understand this because it changes the game. To maximize returns in Q4, they need to mimic institutional behavior.

Projects targeting real-world adoption are what institutions like, and the most inefficient market on earth—global money transfers—is finally being disrupted. The project leading that charge is Digitap ($TAP). Here is everything investors need to know about the world’s first omni-bank, and why it trumps BlockDAG and Wall Street Pepe.

BlockDAG: Technical Innovation, Retail Disconnect

BlockDAG has long been attracting attention for its architecture, replacing traditional blockchains with directed acyclic graphs. The big breakthrough? This system can supposedly process transactions in parallel. In theory, this provides scalability that rivals Visa’s throughput.

Yet the presale has been ongoing for more than a year, starting in March 2024, and there is still no product. On top of that, institutions are not looking for exotic infrastructure unless it comes with real adoption metrics. As a result, BlockDAG, if it ever launches, will be impressive technology, but who knows when that will happen.

Wall Street Pepe—A Limited Shelf Life

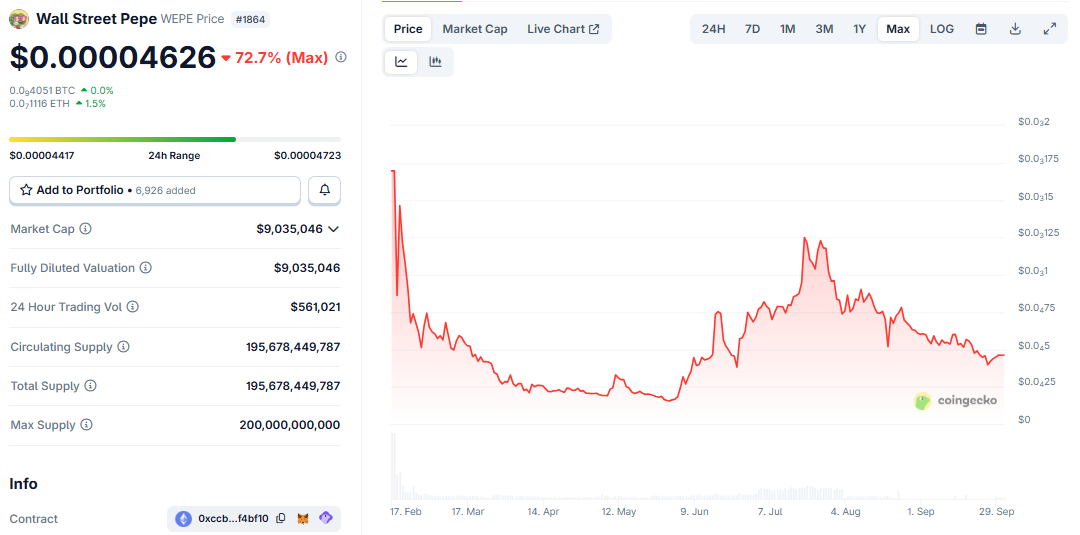

Wall Street Pepe lives on the opposite side of the spectrum. A pure memecoin with no underlying fundamentals. Aimed at retail with institutional aesthetics. This is precisely the type of project where institutions will not allocate capital. Meme tokens thrive when markets are risk on, but are structurally unattractive for large allocators.

Wall Street Pepe is down more than 72% from its all-time high at launch, and unless Musk or another celebrity starts talking about it, there is no viable path for a reversal back to these highs. Its value proposition lives and dies with social media attention.

The Omni-Bank Institutions Can Use—Digitap

Digitap is different. It solves a problem so large and so obvious that even the most conservative investors will not ignore it. Cross-border payments are on track to rise over 50% by 2030, hitting $290 trillion, yet average remittance fees are still 6.2% with settlement taking days. Digital payments should reach nearly $20 trillion by the end of the decade, and crypto payments are set for a 10X move to $9 trillion in 2030. Digitap targets all these industries at once.

This omni-bank platform—live on iOS, Android, and desktop—integrates fiat and crypto into one account. Users can deposit, transfer, and pay from a single dashboard. Under the hood, an AI-driven routing engine moves value across whichever rail is fastest and cheapest, whether that’s SWIFT, SEPA, ACH, or blockchain.

Because of this, $TAP is attractive to institutions. It addresses a real pain point. And it is a consumer-facing product that sits at the intersection of finance and technology, with clear monetization paths.

Why Professional Call $TAP the Best Crypto To Buy Now

Institutions already understand payments. They know the pain of fees, delays, and cross-border friction. Digitap positions itself directly in the flow of those inefficiencies. This makes it easier to underwrite as an investment story, and TradFi loves growth in familiar markets.

The arms race is underway. BlockDAG offers technical innovation but lacks adoption and a product. Wall Street Pepe provides entertainment but no utility. Whereas Digitap is a live omni-bank positioned squarely in the global payments boom.

Institutions are the marginal buyer this cycle, and they will not allocate to memes or unfinished infrastructure. They will allocate to products like Digitap. Still available for $0.0125 today, retail has the opportunity to frontrun the suits, and with the price increasing to $0.0159 soon, a chance to lock in a 27% gain.

Digitap is the professional’s choice this cycle and the banking utility play that could define 2025 and beyond.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://Digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.