- IRS Targets Exchanges

- What is KYC?

- If Crypto Isn't Legally Money, Then Why KYC?

- KYC: Keep Your Crypto

- Reddit Activity on the Topic

- So What Now?

- Regulations on the Horizon

Bitcoin is the world’s first successful attempt at creating a decentralized economic structure. At its core, is a belief that individuals deserve a sovereign currency. Many Bitcoin enthusiasts feel that these beliefs lie beyond the scope of know your customer (KYC) laws and federal institutions. Unfortunately, crypto exchanges don’t always share these beliefs.

Crypto exchanges have seen astounding growth over the last two years which has caught the attention of government officials. Exchanges have long been a point of centralization within the crypto space. This centralization makes exchanges the obvious choice for regulators looking to impose their will on the market.

IRS Targets Exchanges

Coinbase spent the last nearly two years battling the IRS over revealing their clients’ personal information. At first, Coinbase stood tall, refusing to provide the IRS any private customer information. But it wasn’t long before Coinbase was forced to comply. It now appears that these demands include the institution of KYC protocols.

What is KYC?

KYC or know your customer laws are anti-money laundering regulations that were developed in the wake of the 9/11 attacks. The stipulations for these regulations were crammed into the USA PATRIOT Act. These regulations were designed to prevent money laundering from being used to fund terrorist organizations.

Today, KYC is used by most financial institutions around the world. In the banking sector, asking someone to provide all of their personal information is customary, but, until recently, crypto services didn’t require this information.

You see, back when BTC was only worth $100, there wasn’t a problem with a guy owning 5,000 BTC without paying any taxes. Today, a single BTC is worth more than $6,000 apiece and that same guy, he now has $500,000.00 in crypto. You better believe the tax man is interested in his cut this go-around.

If Crypto Isn’t Legally Money, Then Why KYC?

This is a question for the ages. In most countries, including the USA, cryptocurrencies are not considered legal tender but instead virtual currency. Despite the differences between fiat and digital currency, KYC laws are being implemented at breakneck speed across the entire market. Exchanges are the obvious target for regulators because they are the choke points of the marketplace.

Coinbase illustrates just how quickly an exchange can go from battling to protect your privacy, to instituting KYC procedures. Coinbase isn’t alone in their efforts either, and most major exchanges are stepping towards integrating at least some form of KYC in the future.

KYC: Keep Your Crypto

Although it is disheartening to see, you really can’t blame these exchanges for folding under the government’s pressure. In the past governments have used terrorism as the primary reasoning for their approach. Therefore, any exchange which refuses to implement KYC protocols could fall under intense scrutiny.

[thrive_leads id=’5219′]

The real issue arises with the growing number of crypto traders who are being locked out of accessing their funds because of unannounced KYC implementation. Let’s look back to Coinbase to explain this point with more clarity.

Originally, Coinbase simply required your personal information such as your name, date of birth, and social security number to open an account. This was a very easy procedure and millions of crypto investors signed up for the platform. The platform allowed fiat trading pairs, making it one of the most user-friendly options at the time. Most users were willing to share a little information in exchange for the ease of access that the platform provided.

Coinbase soon became the largest exchange in North America. Fast forward to the beginning of this year and you now see Coinbase requiring full KYC compliance, prior to allowing the withdrawal of your funds. This protocol was instituted without warning and it allowed Coinbase to confiscate a significant amount of crypto. The exact amount is unknown.

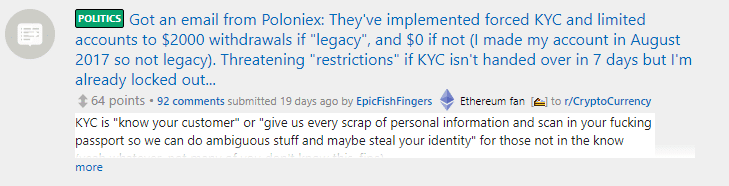

Reddit Activity on the Topic

A quick glance through the latest Reddit posts reveals many investors in the same predicament. In one post, an individual explains in depth how the exchange Bitstamp only required his driver license to sign up and load his account with funds. But when he went to withdraw, he was halted by a flurry of intrusive questions regarding the nature of his investments.

Herein is where the true problem lies. Exchanges should have to notify their clients when they are instituting new withdrawal procedures. This is especially true when the protocols are as intrusive as these. Below are just a few of the questions you may be required to answer the next time you want to withdraw your crypto.

- What are your future trading plans/intentions?

- What is the address and SWIFT code of your bank?

- Do you plan more withdrawals?

- What is the origin of your deposited BTCs?

- Please provide a verified receipt of your mining equipment and the technical specifications.

- What will you use your BTC on?

So What Now?

You can always turn to decentralized exchanges if you are looking to continue your crypto trading aspirations in private. Decentralized exchanges are becoming more popular and unlike their centralized counterparts, they are hardly a good target for hackers. Most decentralized exchange platforms don’t even handle your crypto directly. Instead, the entire process is conducted directly Peer-to-Peer.

Regulations on the Horizon

While BTC isn’t so easy to reign in, the rest of the coins in the crypto market have actual company representatives and executives that are unable, or unwilling, to stand up to the powers that be when it comes to protecting your information.

Talk of regulations continues to grow, and many crypto experts believe this to be a necessary step towards full-scale adoption. It will be interesting to see how the market develops as KYC laws continue to plague many investors in the space. For now, take this as just one more reason to never leave your coins sitting on an exchange.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.