- Why Hardware Wallets?

- What is a Wallet?

- What is a Hardware Wallet?

- Setup & Using Your Hardware Wallet

- Recommended Hardware Wallets

- The Other Options

- Conclusion

Why Hardware Wallets?

Cryptocurrency hardware wallets are physical devices (often times, USBs) that allows you to securely generate and store your private keys offline.

The cryptocurrency world is still a very young and under-regulated world. With the amount of money flowing, and the lack of law enforcement still in the space, it’s not a world where you would particularly want to subject yourself to possible hacking. Often times, if funds are hacked and stolen, it can be near impossible for you to get them back.

There are a couple options to consider when storing your cryptocurrency, however, few offer as much security and ease of use as hardware wallets.

What is a Wallet?

A cryptocurrency wallet is a medium that allows you to store, receive, and send cryptocurrency. Most tokens come with their own wallet. However, there are a multitude of third-party wallets that allow you to store a variety of tokens as well.

Any wallet includes:

- Public and Private Keys that give you access to tokens stored on the wallet

- Algorithms that manage the keys and allow you to send and receive funds on the cryptocurrency network

Wallets can be referred to as either “hot” or “cold”. “Hot” wallets are connected to the internet in some way, making them more vulnerable to cyber attacks. “Cold” wallets are generally more secure as they are not connected to the internet and typically require some sort of compromise to the physical device in order to be hacked.

What is a Hardware Wallet?

A hardware wallet is a type of “cold” storage wallet that allows you to store your funds on a device (often a USB). Hardware wallets generate their own private key (that even you don’t see) and store it right on the device.

The beauty of hardware wallets is that, using pin access, they can connect to your computer and internet to allow you to easily exchange and manage your assets. However, when you are done managing your funds, you can disconnect your wallet from the internet and store it in a physically safe location – making your private keys off-limits to cyber hackers.

Most hardware wallets have additional features to make them more secure and easy to use such as small screens and two-factor authentication.

Setup & Using Your Hardware Wallet

The setup for most hardware wallets is quite similar. To begin, you must set up your own pin code and generate “seed” words.

Pin

The pin acts as a second layer of protection in case anyone gets their hands on your hardware wallet. You must input your pin to access your funds on any computer. On most wallets, if the pin is input incorrectly multiple times in a row, all the data on the hardware wallet will be wiped.

“Seed Words”

In the event your hardware wallet becomes wiped, damaged, or lost, you can recover your funds using your list of “seed words” that were generated when setting up your wallet. You should store these seed words in a secure location separate from your wallet. Word of caution – if you buy a hardware wallet from an unauthorized distributor (not recommended), be sure to generate your own seed words upon setup to protect your funds.

Recommended Hardware Wallets

There are a variety of hardware wallets out on the market, however, two of the most popular and trusted are the Trezor and Ledger Nano S.

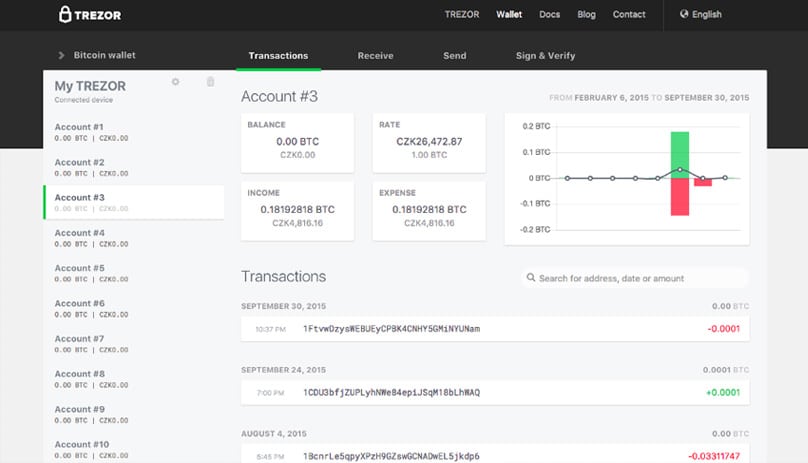

Trezor

The Trezor was the original hardware Bitcoin wallet on the market. It sports a small screen and generally goes for $110. The device is compatible with both desktop and mobile devices and comes with its own software interface to manage and trade your funds. The USB has physical buttons that allow you to scroll through their menus and authorize transactions.

As of January 2018, Trezor can support the following coins:

- Bitcoin (BTC)

- Litecoin (LTC)

- DASH

- Zcash

- Bitcoin Cash / Bcash (BCH)

- Bitcoin Gold (BTG)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- ERC-20 Tokens

- Expanse (EXP)

- UBIQ (UBQ)

- NEM (XEM)

- Namecoin

- Dogecoin

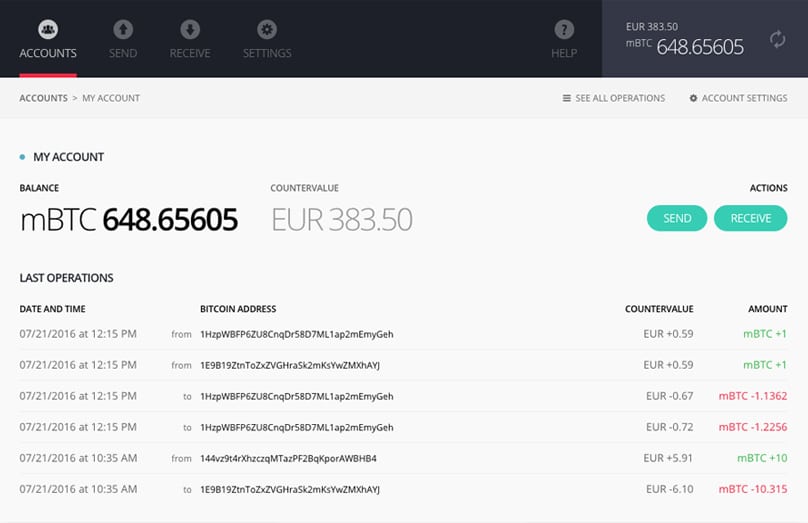

Ledger Nano S

The Ledger Nano S came after the Trezor but quickly gained popularity and was listed as 2017’s most popular Christmas gift. The Ledger goes for a slightly lower price of $95 as compared to the Trezor. It sports a sleeker design than the Trezor with stainless steel design and a built-in OLED-display. It has a chrome extension that allows you to easily view your account, and send and receive funds. The Ledger also has physical buttons that allow you to scroll through menus and authorize transactions.

The Ledger’s biggest advantage on the Trezor is that it can support substantially more coins. As of January 2018, the Ledger can support:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin Gold (BTG)

- Ethereum (ETH) + ERC20 Tokens

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Zcash (ZEC)

- Ripple (XRP)

- Dash (DASH)

- Stratis (STRAT)

- Komodo (KMD)

- Ark (ARK)

- Expanse (EXP)

- Ubiq (UBQ)

- Vertcoin (VTC)

- Viacoin (VIA)

- Neo (NEO)

- Stealthcoin (XST)

- Stellar (XLM)

- Hcash (HSR)

- Digibyte (DGB)

- Qtum (QTUM)

- PivX (PIVX)

- PosW (POSW)

Trezor & Ledger

Both devices are reliable, trusted wallets and are very comparable in most aspects. Either would be a great investment and secure place to store your funds. The biggest differentiator would be comparing to find out which wallet supports most of your coins.

[thrive_leads id=’5219′]

The Other Options

While hardware wallets are by far the most secure way to hold your funds, there are a few alternatives that may be better suited for day traders or users with very small funds.

Exchanges

Exchanges are often the easiest platforms to quickly trade your assets. While they may be more simple to trade on, they are the riskiest platform to store your funds on as they manage and store all their users’ private keys for them- making them prime targets for attack. It would not be wise to store significant amounts on them, specifically if they are long-term holds.

Desktop or Mobile Software Wallets

Desktop or mobile wallets are downloaded to your desktop or mobile device. With these, you can only access your funds from the device to which you downloaded the wallet. However, if your device gets hacked or you get a virus, you are at risk of losing all your funds.

Online Wallet

Online wallets are wallets that can be accessed from any computer using your private login. While these wallets might be the most convenient to access, they are also some of the easiest to hack since the provider stores your private keys for you.

Paper Wallet

Since paper wallets are a type of “cold storage”, they have often been regarded as an equally secure, affordable alternative to hardware wallets. While in certain use cases they can offer as much security, their UX can be challenging and if not printed and stored properly, can be vulnerable to attacks.

Because a paper wallet is completely unencrypted, malware present on your computer may be able to read your keys when you finally attempt to access your funds. To protect yourself, you must sweep (empty) your wallet and create a new key everytime you decide to access your funds.

Conclusion

While there are a variety of wallets and options out there, most serious crypto investors will tell you hardware wallets are the way to go. The rule of thumb is that if you’re investing more than a week’s worth of salary, it’s probably time to invest in a hardware wallet. Hardware wallets give you an extra layer of protection against cyber attacks, phishing sites, and malware. While it may be painful to shell out $100+ now for this small device, it would be a lot more painful to lose a couple thousand or more due to poor wallet security.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.