- What or who determines how many Bitcoins are left?

- When will no Bitcoins be left?

- How many unmined bitcoins are left?

There are currently close to 1,1984,000 Bitcoins left that aren’t in circulation yet. With only 21 million Bitcoins that will ever exist, this means that there are about 19 million Bitcoins currently available. Out of those 19 million, it’s estimated that 30% of those may be lost forever as a result of things like hard drive crashes and misplaced private keys.

What or who determines how many Bitcoins are left?

The remaining Bitcoins not in circulation are in a pool dedicated to rewarding miners for maintaining the integrity of the network. As miners validate transactions and create new blocks, they receive the remaining Bitcoins from this pool as a reward. The Bitcoin source code outlines how the mining rewards should be distributed and when these distributions occur.

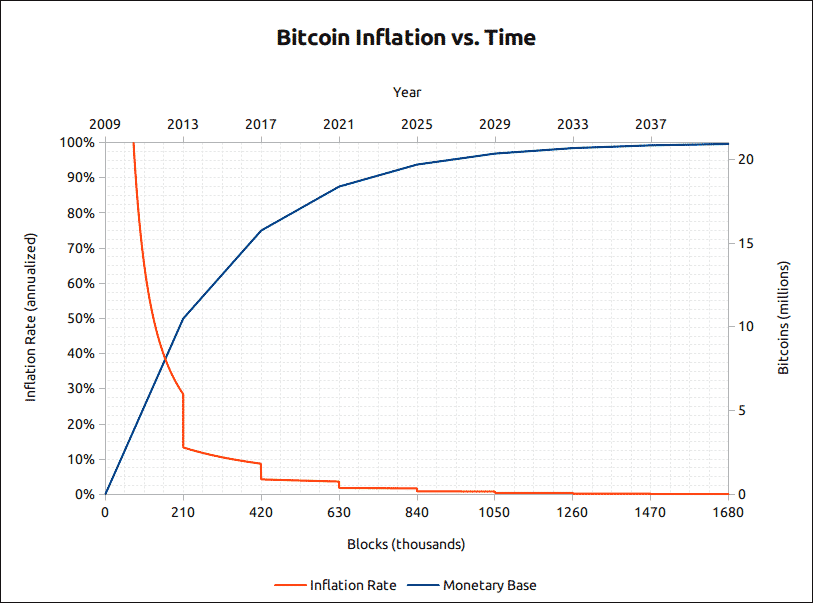

The reward for mining each block started at 50 Bitcoins and has since “halved” three times. The current reward sits at 6.25 bitcoins per block as of the May 2020 Bitcoin Halvening– which is about $250,000 in rewards per block.

When will no Bitcoins be left?

The mining reward halving occurs every 210,000 blocks. With blocks taking about 10 minutes on average to mine, halvings occur about every 4 years.

After 64 total halvings, there will be no more Bitcoins left to reward miners and all 21 million Bitcoins will be in circulation. This will occur sometime in 2140.

You may be wondering, “Without block rewards, what incentive do miners have to validate transactions?”

Miners receive more than just the block rewards when they create new blocks. They also earn the fees associated with each transaction. Transaction fees vary with the amount of network congestion and transaction size.

Miners generally prioritize transactions by the highest Satoshi/byte fee. The higher the transaction fee that you pay, the more likely a miner will process your transaction.

Once there are no Bitcoins left for mining rewards, the transaction fees should be high enough of an incentive for miners to continue running the network.

How many unmined bitcoins are left?

With just over 1.1 million bitcoins left unmined, miners have plenty of an incentive to mine the network to seek out the block reward.

Final Thoughts: What Happens to Bitcoin After All 21 Million BTC Are Mined?

Bitcoin was created to finish issuing its full supply sometime in 2140, which is plenty of runways to speculate what will happen.

Will Bitcoin’s price be greater once all BTC is mined? One line of thought advocates that yes– upon all bitcoin being mined, there will be a heavy deflationary pressure on the cryptocurrency. This is further compounded by factors external to BTC’s programming, such as people permanently losing their BTC in various ways.

It’s also important to note that we view Bitcoin’s price in terms of USD, which is an inflationary currency. If both are still around in the next century, their price parity will likely be very different.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.