There are plenty of ways to make money with Bitcoin outside of the traditional investment routes that you’ve probably had promoted to you ad nauseam by now.

As the old saying from the gold rush goes, “You can either mine for gold or you can sell pickaxes.” In this article, we’ll outline how to make money off Bitcoin using 4 different pickaxe strategies:

- Writing

- Bitcoin websites

- Lending

- Products & Services

Writing

The cryptocurrency industry is still relatively young, and there aren’t many resources online to learn more about it. As interest in Bitcoin continues to grow, the demand for cryptocurrency writers and content creators will increase with it.

As a cryptocurrency writer, you may be able to charge a premium for your services because of the complexity of the topics and the recent boom in popularity.

Beyond writing informational content, several blockchain product companies pay active forum contributors to promote their product across popular platforms like Reddit and Facebook.

Bitcoin websites

Another strategy to make money from Bitcoin is by starting a Bitcoin website. Once again, you can provide relevant content to visitors on your site that focuses on anything from market trends and coin performance to explanations of advanced trading strategies.

There’s an endless amount of possible website subjects.

With enough visitors to your site, you can monetize the traffic through referral links and advertisements.

Lending

Although not as popular as normal trading, some exchanges let you loan out your Bitcoin to other users. On Bitfinex and Poloniex, you can make money from your Bitcoin through margin funding.

When you margin fund, you provide Bitcoin to other traders who are making leveraged margin calls.

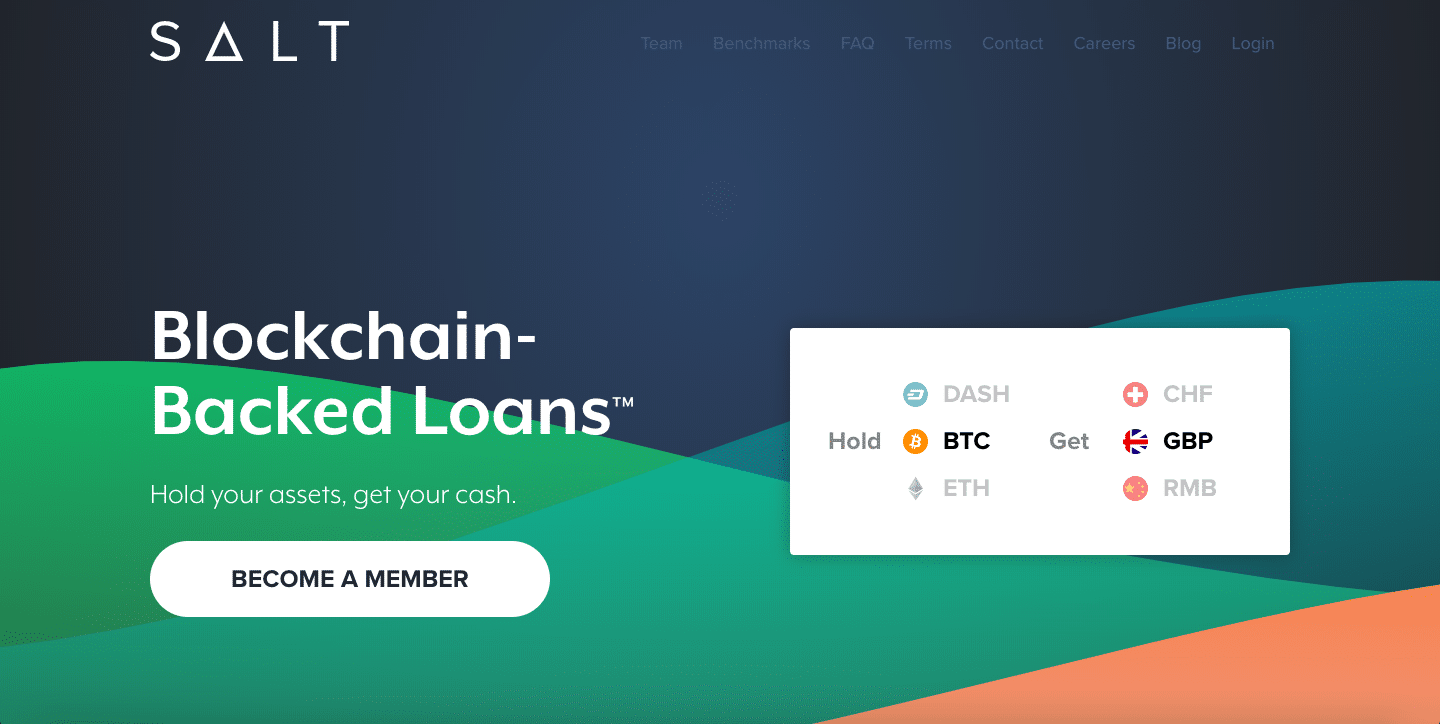

If you have a higher risk tolerance, you can take advantage of a program like SALT. SALT is a relatively new platform that provides cash loans when you give your cryptocurrency assets as collateral.

Using the lending program, you can take your cash loan and re-invest it into the crypto market with the goal of increasing your position before your loan expires. Once again, this is a risky strategy that may result in you losing both your loan and blockchain assets if the market does poorly.

Products & Services

As with any new industry, there’s ample opportunity to create products and services that fill a gap in the market. Whether it’s a portfolio tracking app, a new cryptocurrency, or even a blockchain-based game about cats, there’s plenty of options for you to choose.

The key to coming up with a great idea is by keeping your eyes and ears open to the pain points people (including yourself) are experiencing, and finding a way to address or circumvent them.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.